BOLD Liquidity Initiative & Support Strategy

TokenBrice

TokenBrice- September 23, 2024

With the launch of BOLD approaching and the introduction of Liquidity Initiatives – allowing LQTY stakers to direct 25% of the protocol revenues to support the stablecoin’s liquidity, we want to present and detail the strategy the Collective envisions to deploy to support and grow BOLD’s liquidity. Although BOLD’s release is stated for Q4 of this year, we decided to publish our strategy ahead, to provide ample time for analyzing and implementing the community’s feedback.

This article assumes that you are familiar with this new model; if not, please refer to the official resources published on the matter.

Positioning of the Collective

Launched in October 2023, the Collective was created to support genuinely decentralized DeFi protocols, including Liquity. Stablecoins are the lifeblood of DeFi, yet maximally decentralized stablecoins are still under-represented in the ecosystem; thus the Collective is keen to provides support to innovative and resilient stablecoins projects, such as LUSD, HAI, or DYAD. It has supported LUSD-related pools since its inception, with a keen focus on layer 2, notably Optimism and Base.

- On Optimism, 1500-2500 OP has been expanded weekly for vote incentives, and most of the Collective’s 6M veVELO supports LUSD-related pools.

- On Base, 0.8 ETH have been expended weekly for vote incentives, and a growing voting power of ~400k veAERO is harnessed to support to LUSD-related pools.

- Although less consequential, various initiatives have also been implemented on mainnet, Arbitrum, Mantle, and Linea.

Onchain receipts: vote incentives are posted by the grantsfortheants.eth address (latest), veVELO & veAERO are managed on deficollective.eth. The voting activity of the Collective’s vePositions can easily be followed through our impact dashboard.

With the arrival of BOLD, the Collective will refocus its support on BOLD, starting with its top two layers 2 exclusively: Optimism and Base. Support for current LUSD-related liquidity pools will be progressively be phased out, in favor of BOLD-related pools. LUSD/BOLD pools will also be supported on both networks.

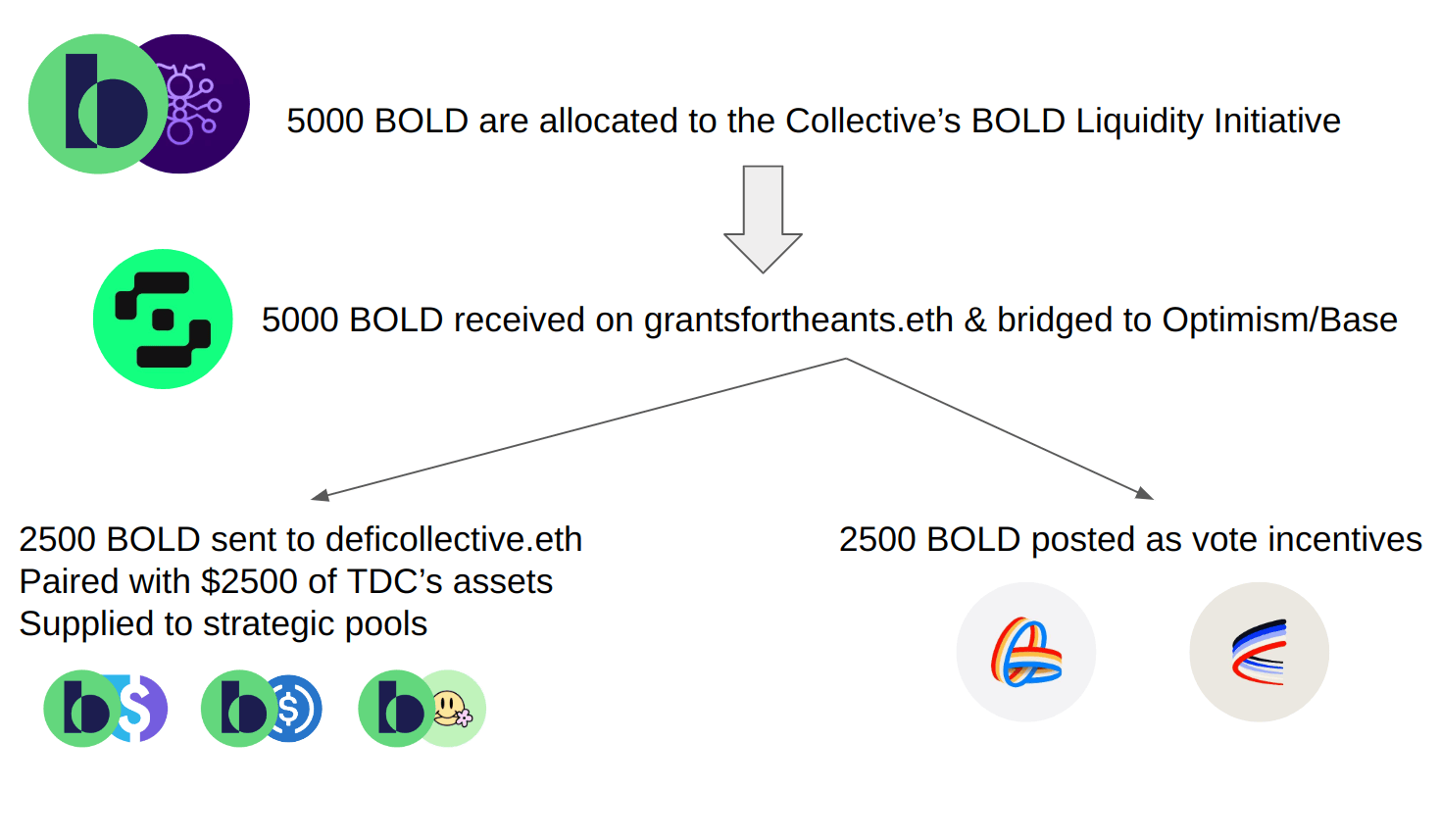

The Ants BOLD Liquidity Initiative

The Collective will present a Liquidity Initiative to the LQTY stakers, entirely focused on growing BOLD’s liquidity on Layer 2:

- 50% of the BOLD obtained will be posted as vote incentives on Aerodrome’s and Velodrome’s BOLD-related pools, directly helping to increase the emissions they receive.

- The remaining 50% of the BOLD obtained will be matched with the Collective’s assets (USDC, LUSD, etc.) and used to supply relevant pools on Optimism and Base. This enables to secure a minimal amount of liquidity supplied to each pool, and further fuels the Collective’s flywheel with additional VELO/AERO farmed and locked weekly, thus increasing the voting power.

The above will be further amplified by the Collective’s existing veAERO & veVELO position, which enables it to direct – at present prices – respectively $5100 worth of AERO and ~$4500 worth of VELO emissions weekly (excluding external votes and the impact of vote incentives). Annualized, it represents about $500 000 worth of emissions that can be directed to BOLD’s pool with the Collective’s current voting power. Accounting for external votes, the impact of incentives, and the growing vePositions, the effective figure will be higher.

Liquidity Strategy

One year of liquidity support provided to LUSD and other stablecoins, including DYAD, GRAI, GHO, and HAI, helped the Collective develop its expertise in liquidity management, especially for stablecoins. Regarding BOLD on Optimism and Base, the proposed strategy is straightforward, with the north star goal of maximizing liquidity and efficiency for the supported pools: to do so, the Collective will harness solely stableswap (sAMM) pools to begin with, as they provide the most convenient experience for LP and maximize third-party integration opportunities, helping to reduce their costs of incentivization further. Concentrated liquidity pools will also be considered if sizable trading volume is observed for BOLD on a given layer 2.

Regarding the pairing, the following will be supported:

- sAMM_BOLD/LUSD: an unstoppable stable pair, that will also enable LUSD holders to transition to BOLD from their L2 if desired directly.

- sAMM_BOLD/USDC: to provide optimized pathing to what remains the most traded stablecoin in DeFi.

- sAMM_BOLD/BOLD_local_fork: The Collective will support the pool by pairing it with the OG if a BOLD fork is present on the chain.

- sAMM_BOLD/stable_partner: if other friendly stablecoin projects are willing to co-incentivize (such as GRAI or HAI), the Collective will support such pairs.

To provide seeding for the BOLD pools on Optimism and Base, the Collective is setting aside 100 ETH to be used for BOLD minting as soon as possible after the protocol’s launch.

Fork Strategy

Liquity V2 codebase will be released under BUSL for 3 years. The source code is published openly and can be fully verified (‘source available’), but during that time, cannot be used for commercial purposes.

However, Liquity can give out additional use grants or additional commercial licenses. About 10 teams (probably more to come) are already planning to fork Liquity V2’s codebase. They will help stimulate usage of V2 on Mainnet, and they’ll also help build liquidity across DeFi, both on and off Mainnet

Forks are essential to the Bold model, and the Collective is open and willing to support them. Strategies will be devised case-by-case, depending on each fork’s specificities and chain of choice. Forks that are not yet on the Ants’ radar and wish to work together are encouraged to reach out to start the discussions.

For more context on this intended strategy as well as the recent developments at the DeFi Collective, refer to our recent community call where the topic was discussed.