The DeFi Collective - April 2024 Report

Luude

Luude- May 15, 2024

Welcome to the Collective’s April impact and treasury report. At first glance, the April revenues seem significantly down compared to March, but once we dig a little deeper we will see that there is a reason for this, and most importantly the Collective’s impact levels are at an all-time high. Without further ado, let’s dive in and see what the Collective’s been cooking in April.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

This report is also available in PDF format.

Treasury Report

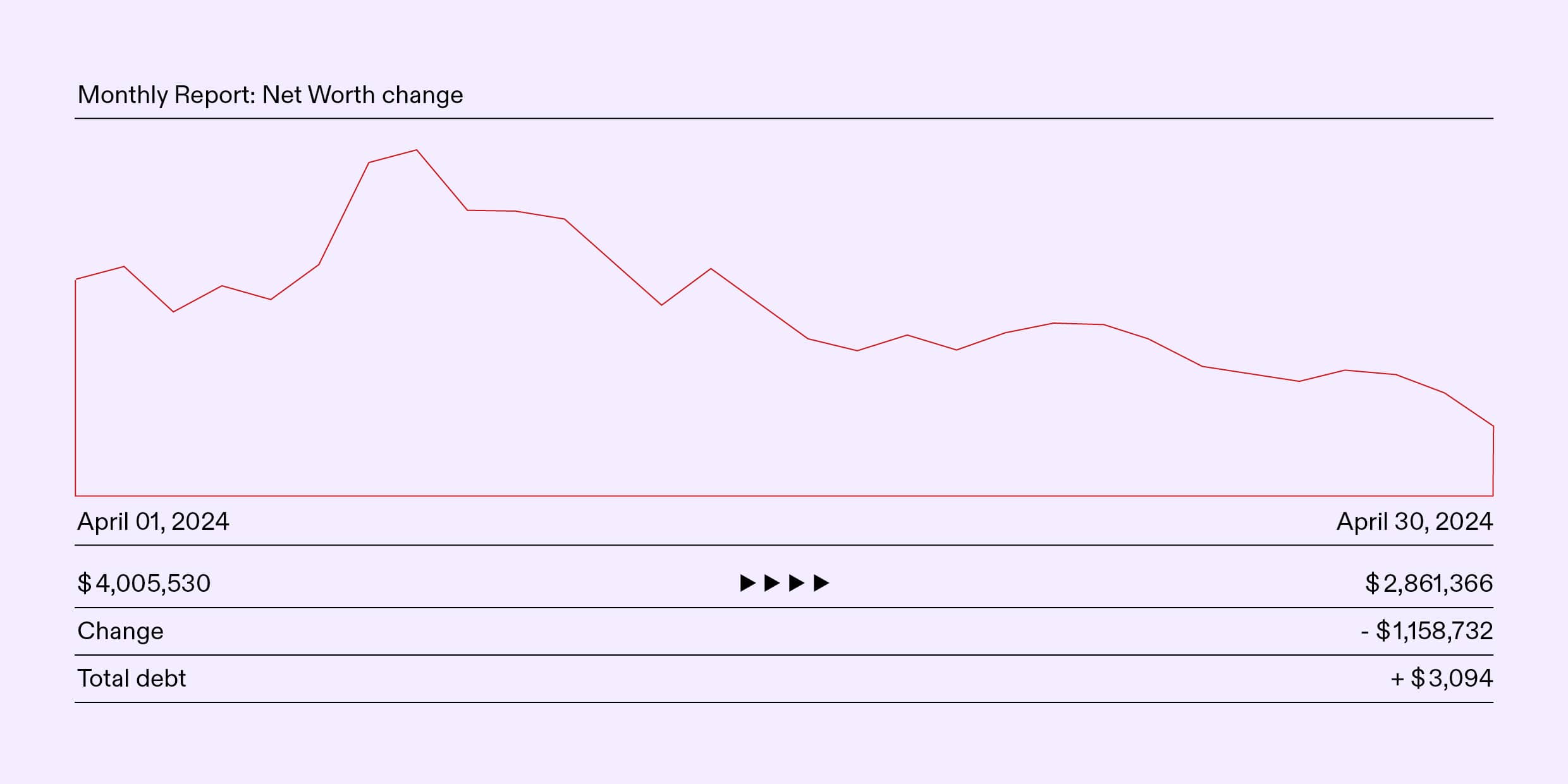

The face value of assets controlled by the Collective (excluding grants) was reduced by 28.56% in April, declining from $4,005,530 on the 1st of April to $2,861,366 by the 30th of April. The treasury decline was to be expected as the overall market cooled off during April and was mostly driven by the Collective’s previously outperforming assets, veVELO, veAERO, and veRAM all retracing after their incredible performances in February and March.

No new chains were launched in April, however, the Collective continued its support with PoolTogether, receiving a substantial POOL and USDC grant that’s destined for new LUSD/POOL positions on Arbitrum and Base. Further details of the Collective’s partnership with PoolTogether will be outlined in the Impact Report below.

Expenses Report

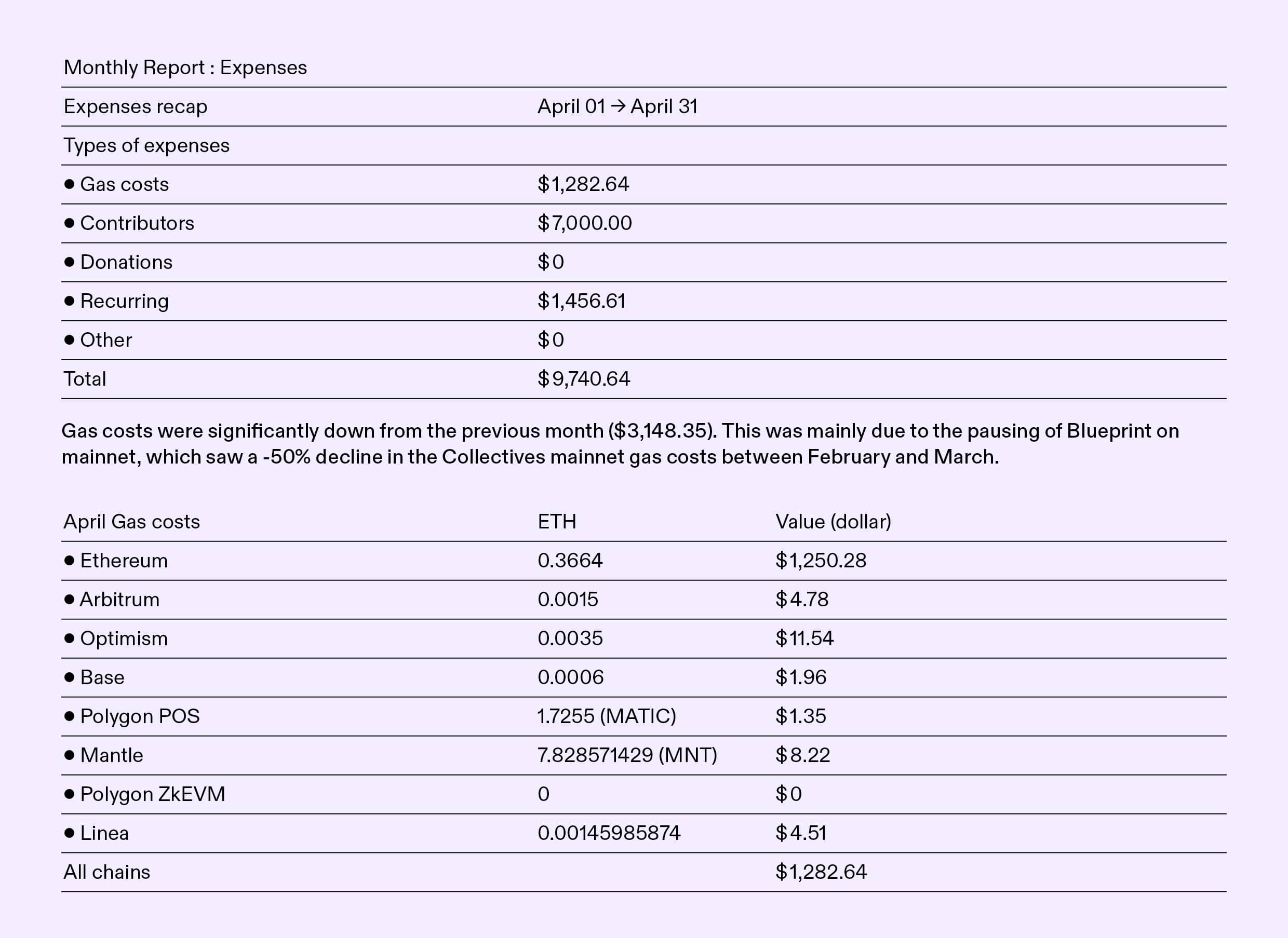

April saw the Collective’s expenses reduce back to baseline levels, hovering around the $10k mark, all while onboarding the Collective’s new Content Strategist, Cyril. With no current open roles, we see the ongoing expenses remaining steady for the next few months.

Gas costs continued their downward trajectory, with a consistently lower L1 base fee and proto-dank sharding optimizations being implemented by all L2s that the Collective operates on resulting in one of the lowest months yet in terms of gas paid. Mainnet gas fees were higher than expected due to the creation of Maverick Boosted Positions #106 and #107 which will be outlined below in the impact report.

Revenues Report

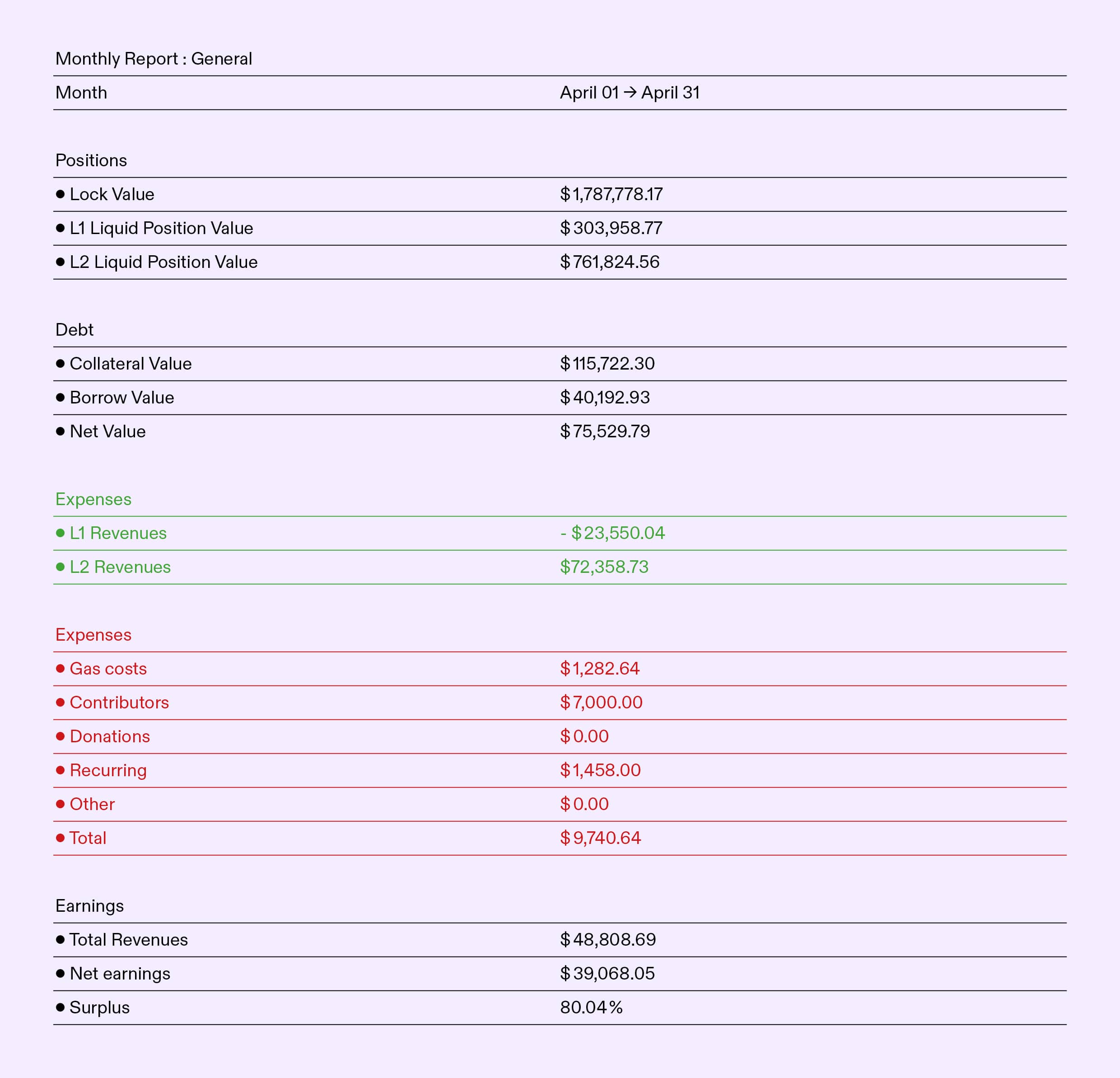

Revenues are down -43.70% compared to the previous month, setting at $48,808.69. Although it is expected that surpassing the eye-watering March all-time highs would be a difficult task, these figures alone don’t tell the full story. April saw the Collective set a new all-time high in L2 revenues, which finished up the month at $72,358.73, only to have the total revenues for our operations reduced due to a liquidity experiment in partnership with Kaskade which saw the Collective spend around $35k with the goal of growing LUSD/USDC LP APR on mainnet.

As sustainability is at the forefront of every Ants mind, we are thrilled to have our earnings providing over an 80% surplus compared to our expenses, even with another contributor onboarded.

Impact Report

Mainnet

The ants’ operations on Mainnet have reduced quite substantially over April. With ongoing farming operations remaining relatively unchanged, with support ongoing in the Uniswap DYAD/USDC pool. In addition, as mentioned above the Collective launched 2 new Maverick Boosted Positions #106 - a static LUSD/USDC position & #107 - a both-mode LUSD/USDC position. Both Boosted Positions were incentivized with 10k LUSD. The overarching strategy with these positions was to test out the impact of a volume campaign the Collective executed in partnership with Kaskade. This saw 30k LUSD (15k contributed by the Collective & 15k from Kaskade) used to incentivize volume on LUSD/USDC trading over a 3-week period.

If you would like to take a more detailed look at the Kaskade campaign, the Kaskade Campaign Report can be found here.

In addition to this, the Collective received its long-awaited 245k POOL grant from PoolTogether, which was destined for Aribtrum and Base. A small POOL surplus remained, so with the intention of making POOL easier to fast-bridge across chains it is deployed on, this surplus was provided as liquidity in Across.

Arbitrum

Although the Collective’s substantial veRAM positions price retracted during April, the ants’ activity on Ramses did not slow down. Ramses remained the home of the ants on Arbitrum, with an LUSD/LQTY CL pool and LUSD/USDC stable swap pool being created, voted for, and incentivized during April.

April also saw the Collective solidify its partnership with PoolTogether after successfully growing the POOL/ETH liquidity on Optimism; it was time to expand the POOL liquidity to Arbitrum. The Collective seeded a >$50K POOL/wETH CL LP, with a portion of the POOL that was granted to the Collective and ETH from our treasury. This LP has also been receiving substantial vote support from the Collectives veRAM position, intending to grow sustainable POOL liquidity on Arbitrum.

Optimism

Treasury operations on Optimism remained relatively consistent throughout April, with support HAI beginning with an LUSD/HAI pool Velodrome pool being created and gradually scaled up throughout the month.

In addition to this, the Collective was thrilled to see Velodrome launch their Slipstream concentrated liquidity pools and have migrated all pegged asset LP positions over to take advantage of the increased capital efficiency that CL positions offer LPs. Currently, the Collective is supporting POOL/ETH, HAI/LUSD, and GRAI/LUSD pairs with liquidity, along with vote and bribe support for LUSD/USDC, LUSD/ETH, LUSD/USDT.

Base

As mentioned previously, April saw POOL make its debut appearance on Base courtesy of the ants. A >$100k LUSD/POOL position was seeded with all LUSD being contributed from the Collectives treasury. This pool, along with the LUSD/USDC pool has been receiving substantial vote support, as well as incentives throughout the month.

With the goal of increasing firepower on Base, the ants continue to grow their veAERO position, adding another 4% of locked AERO to our position over April.

Polygon-PoS

On Retro, the strategy remains consistent with the previous months, with the veRETRO voting power allocated to support Bluechip pools like wMATIC/wETH, wBTC/wETH, or wMATIC/USDC.

Mantle

The Collective’s liquidity efforts on Mantle have not been as successful as we had hoped, with the LUSD/USDC liquidity failing to grow to any meaningful size, even with bi-weekly voting incentives. Due to this a base level of LUSD/USDC liquidity remains but a more passive vote-only strategy is in place for now.

Linea

The Collective scaled up its liquidity on Nile throughout April after a mysterious LUSD bull had been heavily incentivizing the LUSD/USDC pool out of their own pocket. This resulted in some very attractive yields on this pool that the ants could not pass up. We joined this mysterious voter in the pool with an additional $30k of liquidity and have provided vote and incentive support ourselves.

It is unknown how long this strategy will last, but for the time being it is proving to be a success.

Parting Words

Although April didn’t see the Collectives treasury continue its upward momentum, we believe that it was our most impactful month to date with significant support beginning for PoolTogether and Lets Get Hai. We plan to continue the good work from April, with support for another Arbitrum-based protocol coming in May, along with some additional exciting conversations happening in the background.

If you haven’t seen already, the Collectives’ social presence is really picking up now that Cyril has been officially onboarded, so keep an eye out for snippets of treasury alpha coming out of our socials if you want to take advantage of the treasury management support for mission-critical assets.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice, Abmis, and myself.