The DeFi Collective - April 2025 Report

Luude

Luude- May 12, 2025

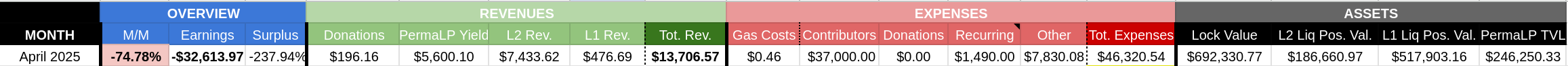

April’s treasury report continues the recent trend, with the Collective recording a revenue-to-expense deficit for the first time. This shift is driven by a sharp rise in expenses alongside a continued decline in monthly earnings.

Below, we outline our strategy to address both issues, with the goal of returning to a surplus by August 2025.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

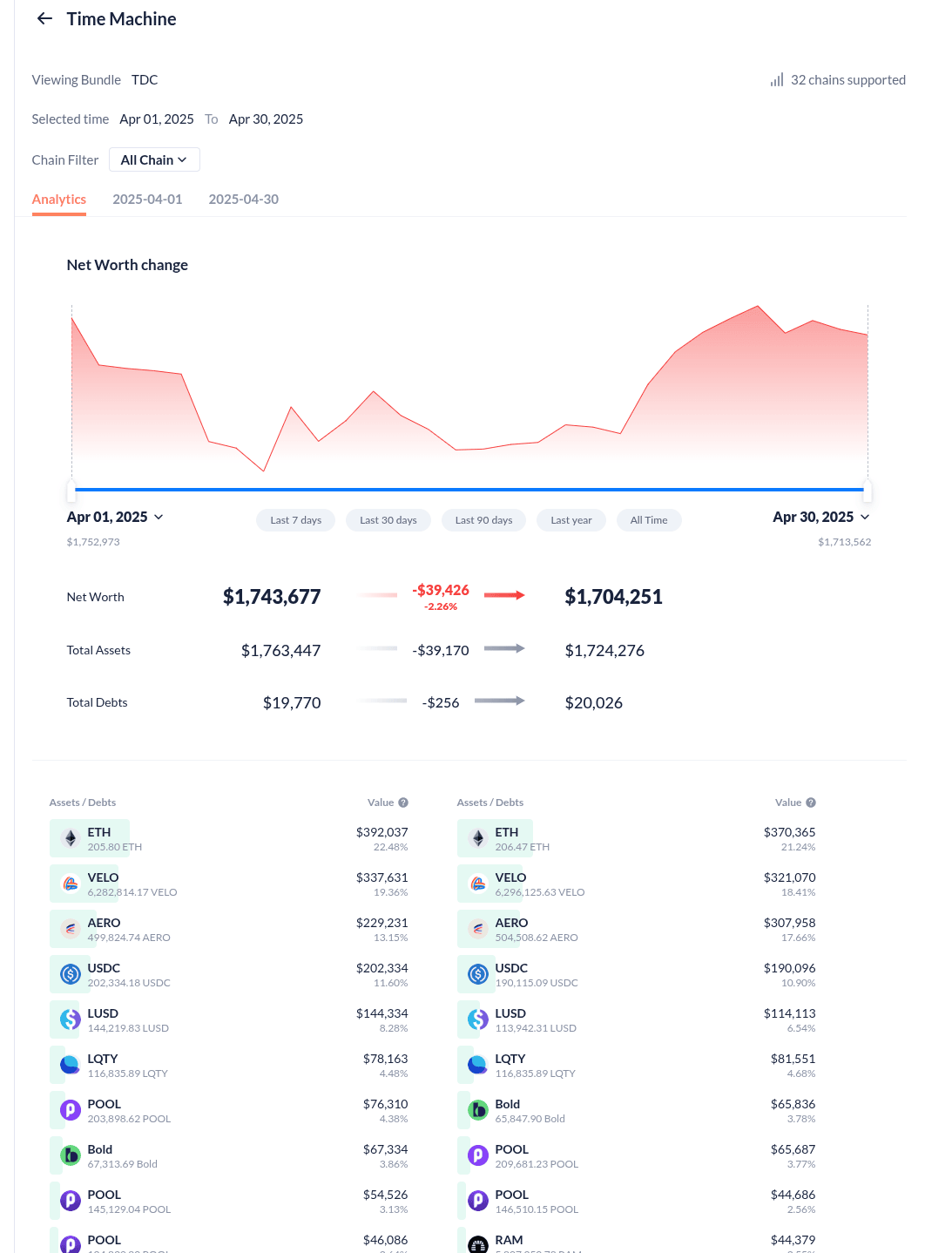

The face value of assets controlled by the Collective (excluding grants) decreased by 2.26% in February, falling from $1,743,677 on April 1 to $1,704,251 by April 30. This total comprises 42% in locked assets, 11% in L2 liquid positions, and 32% in liquid positions on mainnet. The Collective’s Perma-LP wallet holds the remaining 15% in assets. The slight decrease in treasury value was primarily driven by the ongoing decline in the Collective’s liquidity-driving positions, further compounded by broader market downturns affecting liquid asset valuations. However, the treasury has remained relatively resilient compared to the overall market, largely thanks to its substantial stablecoin holdings.

Expenses Report

April recorded the highest monthly expenses in the Collective’s history, largely due to backdated contributor invoices and annual renewals for office registration, software and infrastructure, as well as accounting and administrative services. Contributor expenses are expected to remain elevated through the second half of 2025, with monthly costs projected at $32,500.

To address this, the Collective has initiated a cost reduction plan targeting a 20% decrease in overall expenses over the coming months. Paired with a sharpened focus on revenue growth, this initiative is critical to ensuring the Collective’s long-term sustainability and ability to meet strategic goals.

The Collective is currently supported by 2 full-time and 7 part-time contributors, covering essential functions including treasury management, business development and partnerships, community and marketing, protocol research, full-stack development, and data analysis.

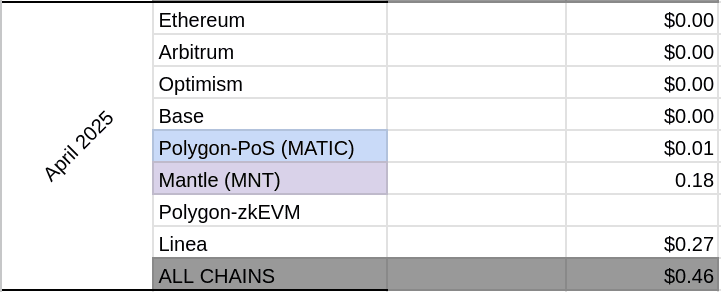

Gas expenses remain negligible due to low main net base fees, and Safe sponsoring the majority of the L2 treasury operations.

Revenues Report

Earnings fell by 74.78% in April compared to March, closing the month at -$32,613.97. As mentioned above, the decline in earnings was two-pronged, driven by both an increase in expenses and a decrease in revenues.

Looking ahead, the Collective will prioritise mobilising idle treasury assets—currently sitting in low-yield auto-compounding pools on mainnet—into higher-performing opportunities across DeFi. At the same time, we will maximise returns from liquidity-driving positions to increase weekly revenues.

All existing partnerships will continue to be fully honored, including ongoing vote and Perma-LP support for partner pools. Beyond these commitments, the Collective will focus on maximising yield from treasury assets. The treasury management team will continue to prioritise risk mitigation, limiting exposure to stablecoins and major assets such as BTC and ETH.

Impact Report

Mainnet

No treasury operations were executed on mainnet during April. The Collective’s mainnet balances remained in auto-compounding positions, awaiting the BOLD relaunch. Due to our accounting methodology, yields from these positions will only be realized when the positions are unwound.

We anticipate an increase in mainnet activity during May, as these assets are deployed across mainnet and/or L2 networks.

Arbitrum

Revenue from the Collective’s veRAM position has fallen to its lowest level on record, driven by a sharp decline in both TVL ($2.3M) and volume ($62.57M) facilitated by Ramses. While the treasury management team will continue to take a revenue-focused approach on Ramses and maintain support for the wETH/POOL pool, we do not anticipate a material recovery on Ramses in the near future.

Optimism

The treasury management team maintained steady operations on Optimism throughout April, continuing vote support for both LUSD and POOL pools on Velodrome. However, vote allocations will be fine-tuned in the coming months to better align with the Collective’s renewed focus on revenue generation.

On a brighter note, the ants continue to enjoy a consistent stream of ETH, thanks to the Collective’s LUSD and USDC positions on PoolTogether.

Base

Operations on Aerodrome remain stable, with voting support currently directed toward the BOLD/POOL and LUSD/USDC pools. Similar to the approach on Optimism, the Collective’s veAERO voting strategy will be adjusted in the coming months to place greater emphasis on revenue generation.

Polygon-PoS

April saw operations cease on Polygon-PoS. Due to this, Polygon-PoS will be removed from future treasury reports until operations restart.

Mantle

The Collectives vote-only strategy on Cleopatra remains, with low results varying from week to week. While this approach will be maintained for now, it will be closely monitored and discontinued if it proves ineffective.

Linea

The vote-only strategy on Nile remains in place, though revenues have continued to decline. While this approach will be maintained for now, it will be closely monitored and discontinued if it proves ineffective.

Blast

April saw operations cease on Blast. Due to this, Blast will be removed from future treasury reports until operations restart.

Perma LPs

The Collective’s Perma-LP initiative continued through April, with 15% of treasury assets permanently allocated to support liquidity for partner protocols PoolTogether and Possum. While no new partners are expected to join the initiative in the near term, ongoing support for existing partners will remain in place as previously agreed.

Parting Words

April was tough. Expenses hit an all-time high, and revenues dropped harder than expected—marking the first time the Collective has run a deficit. It’s not something we take lightly.

At the end of the month, the Collective’s board and core contributors came together to align on next steps. A cost-cutting plan is already underway, underused assets are being mobilized, and the focus on generating sustainable revenue has never been sharper.

On a brighter note, DeFi Scan continues to make strong progress. The recent donation from the Ethereum Foundation has helped solidify the vision and shine a light on this important initiative.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.