The DeFi Collective - August 2024 Report

Luude

Luude- September 12, 2024

Welcome to the Collectives’ August impact and treasury report. Driven by a huge increase in mainnet revenues, thanks to the market finally recognizing DYAD’s value as an innovative and capital-efficient CDP protocol, August saw the Collective generate its second top-month in terms of revenues and the best month ever in terms of earnings. The Collective’s focus on the mainnet DYAD position came just in time as L2 revenues cooled off over the month.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

So, without further ado, let’s dive in and see what the ants achieved in August.

Treasury Report

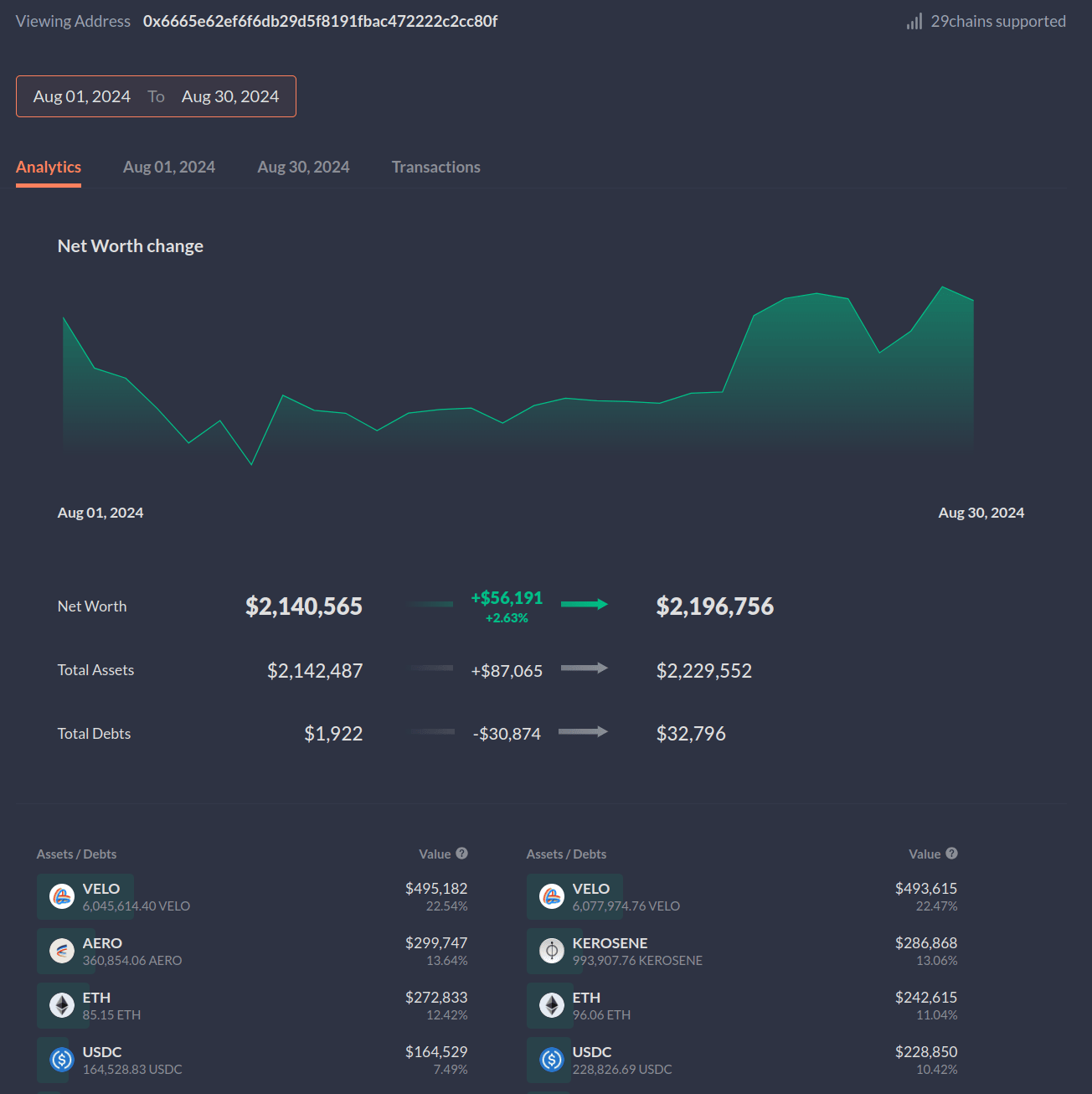

The face value of assets controlled by the Collective (excluding grants) increased by 2.63% in August, rising from $2,140,565 on August 1 to $2,196,756 by August 30. Despite the market’s volatility during this period, the Collective’s holdings of ETH and stablecoins, along with its liquidity-directing assets, positioned it well to weather the fluctuations. This strategy allowed the Collective to generate revenue that can be reinvested to support mission-critical assets once the market trends upward again.

Expenses Report

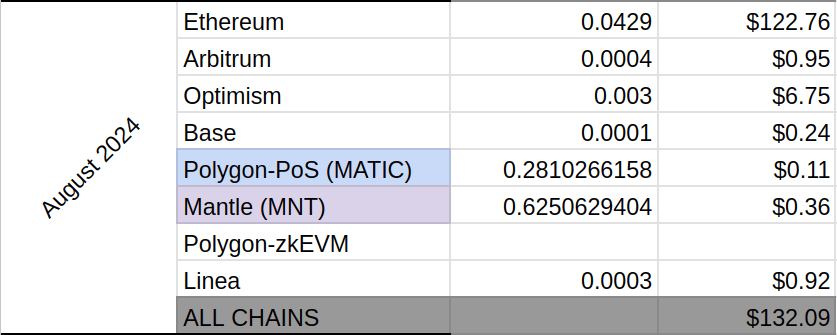

Expenses were slightly elevated compared to July, driven exclusively by an increase in mainnet gas costs. Although mainnet expenses were slightly up month-over-month, considering the substantial revenue increase produced by the ant’s mainnet operations, this is a cost well spent. These relatively low and steady monthly expenses allow us to continue growing a healthy surplus of stablecoins and ETH in preparation for BOLD support coming soon.

As mentioned above, the Collective’s gas expenses on mainnet increased compared to July, primarily due to compounding our DYAD position. L2 gas expenses remain extremely low, with operations on L2s running on autopilot.

Revenues Report

Revenues are up 33.43% compared to July, finishing the month at $78,596.78. As mentioned above, the significant revenue increase was driven by the ants identifying the opportunity early to scale up their DYAD position. L2 revenues were down in previous months as activity dropped on Arbitrum, Base, and Optimism, where the ants hold their largest liquidity-driving positions.

The Collective continues to operate with a healthy surplus, which was our highest ever in August sitting at 87.11%. This surplus is being used to accumulate ETH in preparation for Liquity v2 launching BOLD later this year.

Impact Report

Mainnet

The July treasury report hinted that the ants were redirecting excess liquidity towards DeFi’s most productive stablecoin farm. Some clever ants likely figured this out and followed suit, supporting mission-critical DYAD by providing liquidity to the DYAD/USDC Uniswap pool. When we’re fortunate enough to spot an opportunity to back crucial projects that also happen to be the highest-yielding pool in DeFi, the ants are quick to capitalize on it.

Our support for DYAD involved depositing ETH and Kerosene to mint DYAD and pairing it with USDC liquidity from treasury operations. This strategy has enabled the Collective to establish a substantial LP position, which continues to generate significant Kerosene rewards.

Moving forward, the treasury management team plans to maintain a DYAD and Kerosene accumulation strategy while also further building our ETH position on the mainnet.

Arbitrum

Operations remained steady on Arbitrum during August, with continued vote-only support for our core positions LUSD/USDC, PSM/LUSD, and wETH/POOL. The ants continue to direct a portion of our voting power towards blue chip assets, with the primary goal of revenue generation, which is used elsewhere to support aligned protocols.

Optimism

Treasury activities on Optimism remained steady in August, with ongoing liquidity support for HAI/LUSD, USDC/LUSD, and POOL/ETH pairs. Additionally, the ants have been leveraging their substantial veVELO position to provide generous voting support for various LUSD CL and legacy pools.

This strategy is expected to continue, given its strong performance over recent months.

Base

Similar to Optimism, treasury activity on Base remained steady where the ants continued to provide substantial vote and bribe support for the LUSD/USDC and LUSD/POOL pools.

Trading volumes decreased compared to July, largely due to the northern hemisphere summer holidays, causing revenues from trading fees on Aerodrome to drop substantially.

Regarding the impact on Aerodrome, the ants continue to provide substantial vote and bribe support for the LUSD/USDC and LUSD/POOL pools.

Continuing the strategy from previous months, the mission to accumulate as much veAERO as possible progresses, with another 6.12% added during August. This approach has proven extremely successful, with the Collective’s position growing more than threefold in the past 11 months.

Polygon-PoS

On Retro, the strategy remains consistent with the previous months, with the veRETRO voting power allocated to support Bluechip pools like wMATIC/wETH, wBTC/wETH, or wMATIC/USDC.

Mantle

The Mantle strategy remained the same during July with a vote-only strategy being conducted with a small amount of LUSD/USDC liquidity being provided on Cleopatra.

Linea

The Linea strategy remained the same during July with a vote-only strategy being conducted with a small amount of LUSD/USDC liquidity being provided on Nile.

Parting Words

The treasury management team is happy with August’s performance, which saw us time the market well with concentration into certain supported pools. We plan to continue this more strategic approach as we inch closer to our treasury composition goals.

In other areas of the colony, great work is being done. Florian, TokenBrice, Spicypiz, and Stengarl produce regular content that is a must-read to stay up to date with the latest in genuine DeFi, compliance, and security practices.

Although treasury operations seem quite stable, good discussions are ongoing about planning our next expansion. The next few months will be action-packed for the Collective, and we can’t wait to continue supporting DeFi’s most important protocols.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.