The DeFi Collective - August 2025 Report

Luude

Luude- September 22, 2025

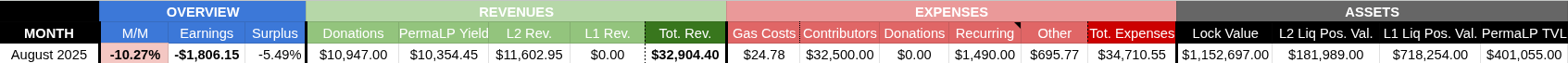

August delivered a steady performance for the Collective, with both expenses and earnings moving slightly lower — though importantly, expenses fell further, narrowing the gap to surplus. We closed the month 5.49% shy of breaking even, with a shortfall of only -$1,806.15. This result was mostly driven by a decrease in donations from the BOLD PIL incentive scheme, though higher L2 and Perma LP yields helped offset some of the decline.

On the positioning side, there were no major changes across liquid assets. A large Etherex veNFT was airdropped on Linea and is already producing strong revenues, while Perma LPs saw a BOTTO/BOLD pool seeded after the Collective began supporting BOTTO. Together, these moves strengthen diversification and future yield generation.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

The treasury closed August at $2,990,278 (+28.27% MoM, up from $2,331,255 in July). Gains in veAERO, PSM, and ETH were the primary drivers of this growth, supported by continued exposure to stable, income-producing assets.

By the end of August, 38% of the treasury was allocated to locked assets, 6% to L2 liquidity positions, 24% to L1 liquidity positions, and 13% to Perma LPs, with the remaining 19% held in smaller liquid positions and operational balances. This mix continues to mute volatility while positioning the treasury for sustainable long-term returns.

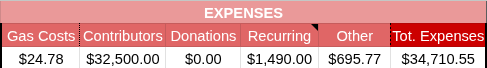

Expenses Report

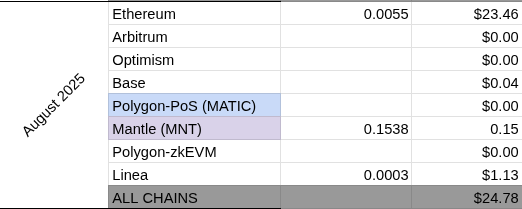

Total expenses came in at $34,710.55 (-7.6% MoM), returning to baseline after July’s elevated figures. Contributor compensation remained steady at $32,500, while operational costs totaled $1,490. Gas costs were negligible at $24.78, reflecting very low mainnet activity. Other one-off expenses came to $695.77.

Expenses are expected to remain at this level with no upside surprises anticipated in the near term.

Earnings Report

Earnings closed August at a -$1,806.15 shortfall despite total revenues of $32,904.40 (-10.2% MoM). The small gap was the result of lower donations, though it was partially offset by higher yields from both L2 activity and Perma LP harvests. Notably, the Perma LP harvest of $10,354.45 included July’s unharvested yield, while Layer 2 revenues rebounded to their highest level since March at $11,602.95, thanks to stronger activity on Base and the excellent launch performance of Etherex.

Donations were the weakest component at $10,947, reflecting a slowdown in BOLD PIL flows. L1 revenue remained at zero. Overall, treasury earnings are hovering close to break-even, with clear potential to swing into surplus as soon as donation levels recover.

The Collective remains well-capitalized, with stablecoin reserves covering more than four years of operations, allowing us to absorb monthly fluctuations without stress.

Impact Report

Mainnet

Activity was minimal, limited to bridging BOLD PIL rewards to Optimism and Base. No other notable changes occurred.

Arbitrum

Operations remained steady, with treasury activity focused on voting in supported Ramses pools. Current support continues for WETH/POOL and PSM/ETH, with no new strategy shifts.

Optimism

Activity was consistent with July, with support directed toward BOLD/USDC, BOLD/LUSD, and POOL/WETH. No new positions were added.

Base

Base remained productive, with continued support for BOLD/POOL, BOLD/LUSD, and BOLD/USDC. No changes to strategy were made.

Mantle

Operations ceased on Mantle following the wind-down of Cleopatra. There are no plans to resume treasury activities here in the near future.

Linea

Treasury activity shifted from Nile to the newly launched Etherex, which generated more than $5,000 in revenues in just its first three weeks. Vote support is now directed toward high-volume blue-chip pools to maximize treasury returns.

Perma LPs

The Collective’s Perma LP initiative continued to strengthen in August. Current supported pools include POOL/WETH and BOLD/LUSD on Velodrome, BOLD/POOL and a new BOLD/BOTTO pool on Aerodrome, as well as WETH/POOL and PSM/WETH on Ramses.

The strategy regarding BOTTO has been adjusted: from thereon, The Collectiver will accumulate the BOTTO obtained through its voting activity, and frequently (~monthly) match it with BOLD from its treasury to beef up the perma LP position: onward, maximally Botto-aligned!

A harvest of $10,354.45 was completed, including the yield from July, which had not been harvested. Moving forward, monthly harvests will continue as standard, with a portion compounded back into Perma LP positions and the remainder directed toward operations and expenses.

Parting Words

Market sentiment improved in August, driven by ETH’s price recovery and stronger on-chain volumes. While BOLD supply growth slowed, liquidity remained sticky across L2s thanks to the Collective’s efforts. Treasury performance is stabilizing, with expenses under control and multiple revenue sources showing signs of life.

We are not yet in surplus, but the bleeding has stopped. The goal for September is clear: achieve and hold a treasury surplus. A strong month of BOLD PIL donations would all but guarantee that outcome.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.