The DeFi Collective - December 2025 Report

TokenBrice

TokenBrice- January 12, 2026

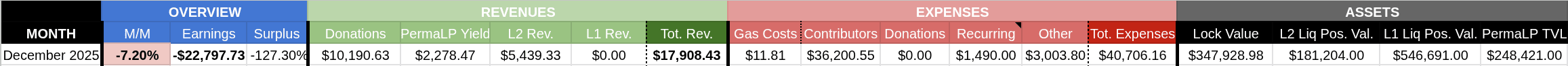

December was another challenging month for the Collective, closing its book yet again with a shortfall, this time of - $22 797.73, with a slight drop of revenues of - 7.2%.

While those figures can seem alarming at face value, they have to be confronted to the increased expenses incurred since April, following investments into growing DeFiScan. The Collective is built to sustain, and still commands enough stable reserves to keep operating in these tough markets.

Expenses and other revenues remained steady, and there were no major strategic adjustments to treasury composition. The focus remained firmly on sustainability and supporting our ecosystem partners.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

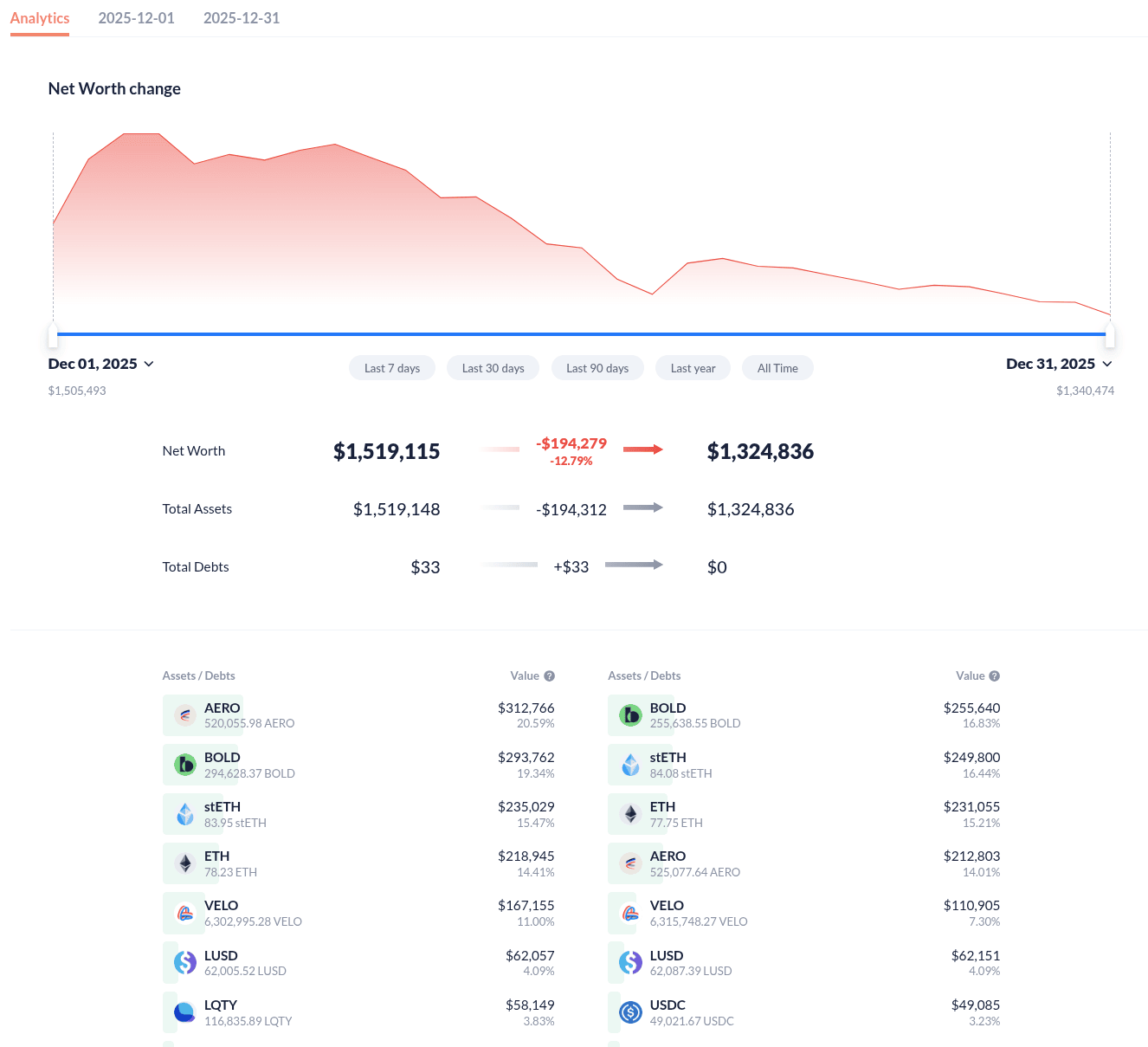

The treasury closed December at $1,324,834 (-12.7% MoM*, down from $1,519,115 in November). The bulk of the drop can be attributed mainly to AERO, VELO and LQTY, three assets which witnessed adverse price action this month, and which constitutes core holdings for the Collective’s treasury.

By month’s end, the treasury allocation stood at 26% locked assets, 14% in L2 liquid positions, 41% in L1 liquid positions, 19% in Perma LPs, and the rest held in liquid operational balances. The treasury remains well-structured and stable, with capital consistently deployed across productive assets.

Expenses Report

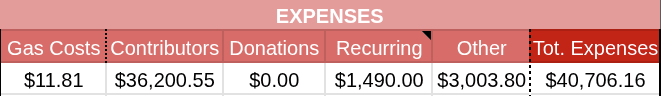

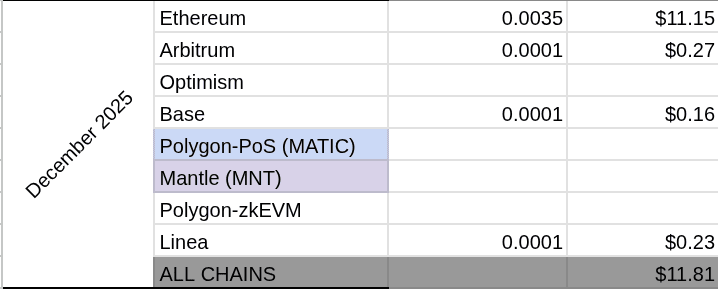

Total expenses for December came in at $40,706.16 (roughly stable MoM). Contributor compensation accounted for $36,200.55, while operational costs held steady at $1,490. Gas costs remain contained at $11.81, reflecting routine mainnet operations.

Overall, expenses remain stable within expected ranges, and no material increases are anticipated in the short term.

Earnings Report

Revenues totaled $17,908.43 (-7.2% MoM), resulting in a shortfall of -$22,797.73. Adverse market conditions and decreasing DEX volumes contributed to this underperformance, however, the Collective holds enough stablecoin balance to weather yet another storm.

L2 revenues came in at $5,439.33, representing a drop of ~40% compared to November, stemming from diminishing volumes observed on DEXes.

Donations totaled $10,190.63, thanks to the DeFi Collective Liquity’s Protocol Incentivized Liquidity Initiative, supporting BOLD’s liquidity on L2s, and 4049.44 USDC obtained from the latest Giveth campaign. No harvest was performed on mainnet, and the permaLP positions returned $2,278.47 this month.

Impact Report

Mainnet

Activity on mainnet remained steady with minimal strategic changes.

Arbitrum

Operations on Arbitrum remained unchanged. The Collective continued to support the WETH/POOL and PSM/ETH pools. Ramses activity has slowed significantly, reducing overall revenues, though the Collective will remain active as opportunities arise.

Optimism

No strategy adjustments were made this month. Support remained consistent across BOLD/USDC, BOLD/LUSD, and POOL/WETH pools.

Base

Activity on Aerodrome was steady. The treasury continued to support BOLD/POOL, BOLD/LUSD, BOLD/BOTTO, and BOLD/USDC.

Linea

Voting on blue-chip pools continued throughout December, although revenues are decreasing.

Perma LPs

The Collective’s Perma LP program continued to perform reliably in December, with positions remaining mostly unchanged across POOL/WETH and BOLD/LUSD on Velodrome, BOLD/POOL and BOLD/BOTTO on Aerodrome, and WETH/POOL and PSM/WETH on Ramses. One notable addition is the deployment of PIL and its matching into Aerodrome’s BOLD/LUSD pool, after having accumulated over $100k of permaLP in Velodrome’s BOLD/LUSD pool.

Parting Words

The broader market remained choppy in December, but the Collective’s treasury held steady, which is a testament to its careful composition and sustainable yield focus. While revenues dipped from September’s highs, the underlying structure remains resilient, and the treasury continues to perform as designed.

— TokenBrice, on behalf of the treasury and liquidity management team of the DeFi Collective: Luude and myself.