The DeFi Collective - December Report

TokenBrice

TokenBrice- January 16, 2024

Welcome to the monthly report of the Collective, covering December, a packed and record month for the ants: let’s dive in!

This report is also available in PDF format.

For more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to Reporting Policy, which provides extensive context.

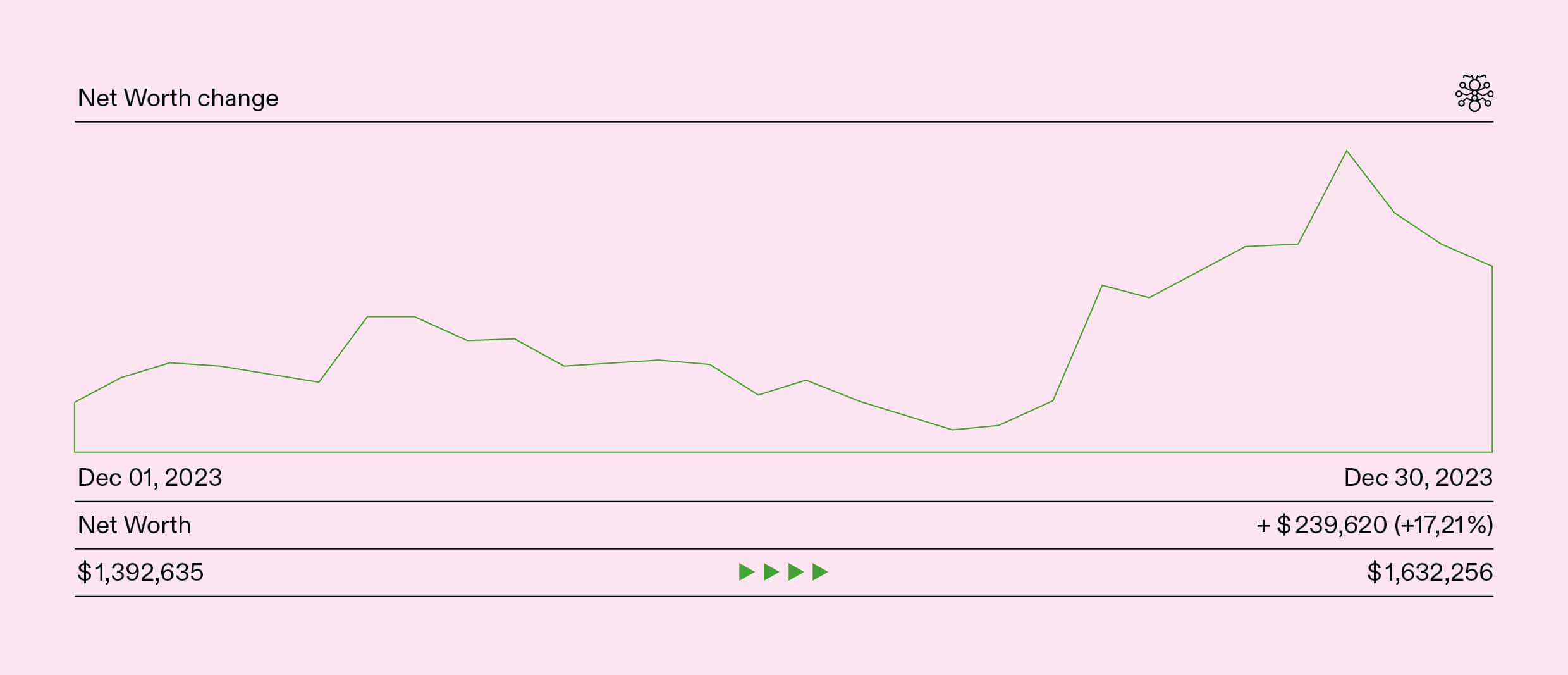

Treasury Report

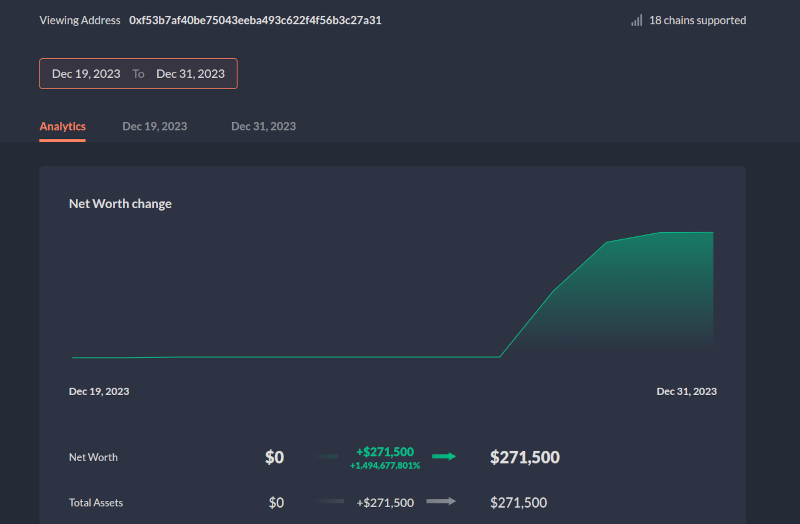

The face value of all assets controlled by The Collective grew by $239K in December, a 17.21% increase from the previous month.

While the performance can look eye-blowing at first glance, we would like to remind our readers that the bulk of the assets the Collective controls are 2 to 4 years locked DEX tokens such as VELO or RAM, in veNFT position (semi-liquid thanks to OTC markets). VELO, in particular, had a spectacular month, with the Collective’s position seeing a 50% appreciation from $251k to $376k.

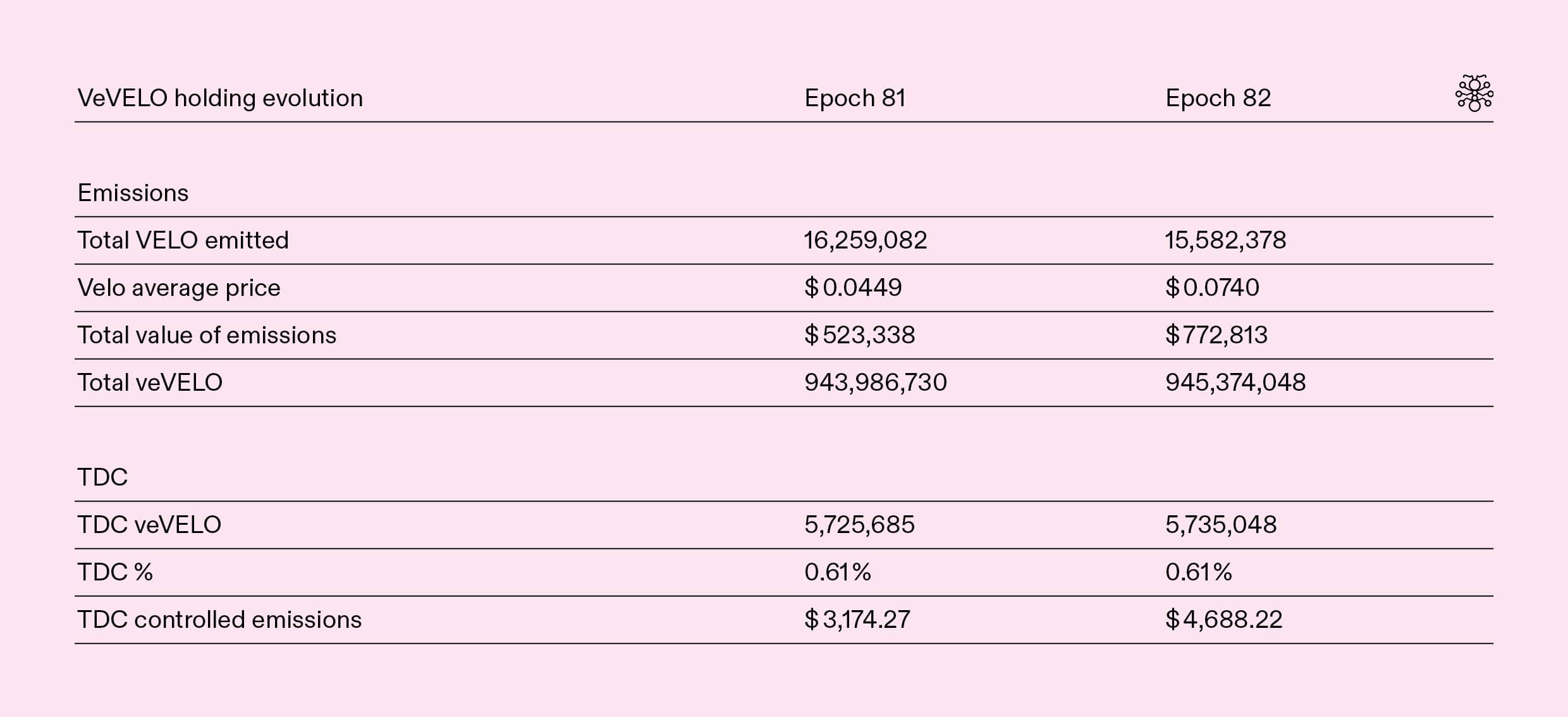

While we ants have no intention to part with our precious liquidity-driving veNFT positions, the appreciation of the underlying token (i.e., VELO) is still great news, as it means an increased liquidity-driving capability on the given DEX. Let’s examine some data to clarify what it means, comparing two epochs where VELO’s price rose:

- Epoch 81 (Dec 14 to 21, 2023), VELO = $0.0449

- & Epoch 82 (Dec 21 to 28), VELO = $0.0740

With 5.7M veVELO / ~ 0.61% of the total of all veVELO,** the $-value of the emissions the Collective can direct every week on Velodrome went from $3,174 to $4,688, a 47.7% increase, providing more firepower to support mission-critical tokens on the network**, such as LUSD or POOL.

The Collective still maintains a sizeable amount of stablecoin reserves, with over 25% of the total value of the assets in various stablecoins, such as LUSD, GHO, GRAI, USDC, and bLUSD. On top of the revenues, the volatile assets The Collective is exposed to, such as ETH, also performed well in December, contributing to the overall increase of the value of assets controlled:

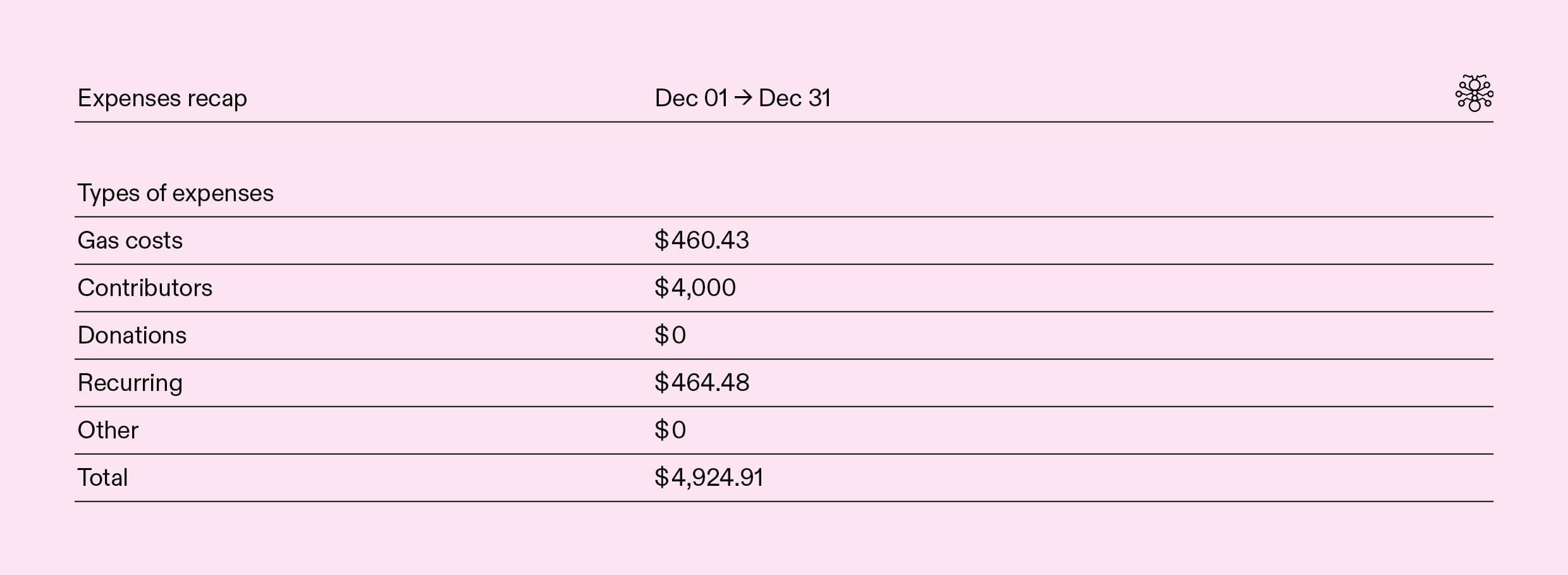

Expenses Report

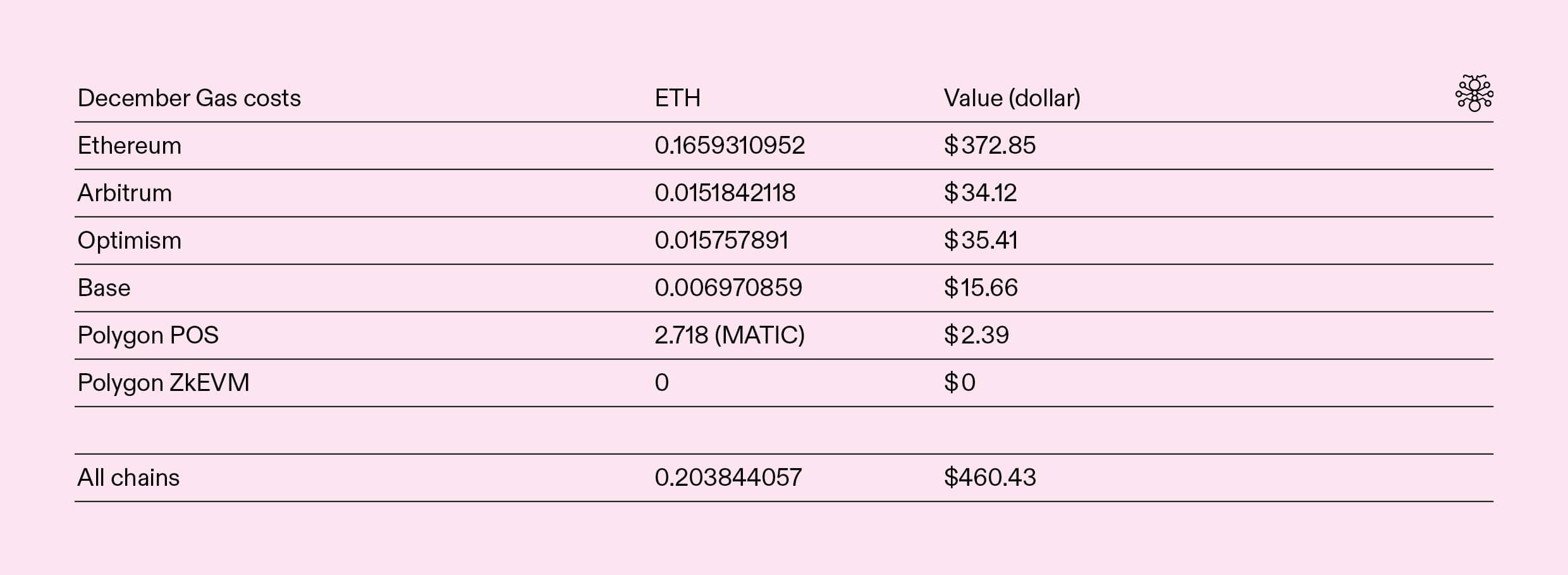

In December, expenses are moderate and entirely composed of recurring expenses: contributor compensations, office (mailbox), and gas costs. We’re now segregating the expenses more precisely than the previous month, with separate categories for recurring expenses and donations, easing their tracking.

Gas costs are significantly reduced compared to the previous month, thanks to the lower activity of the Collective on the mainnet and the more reasonable base fee.

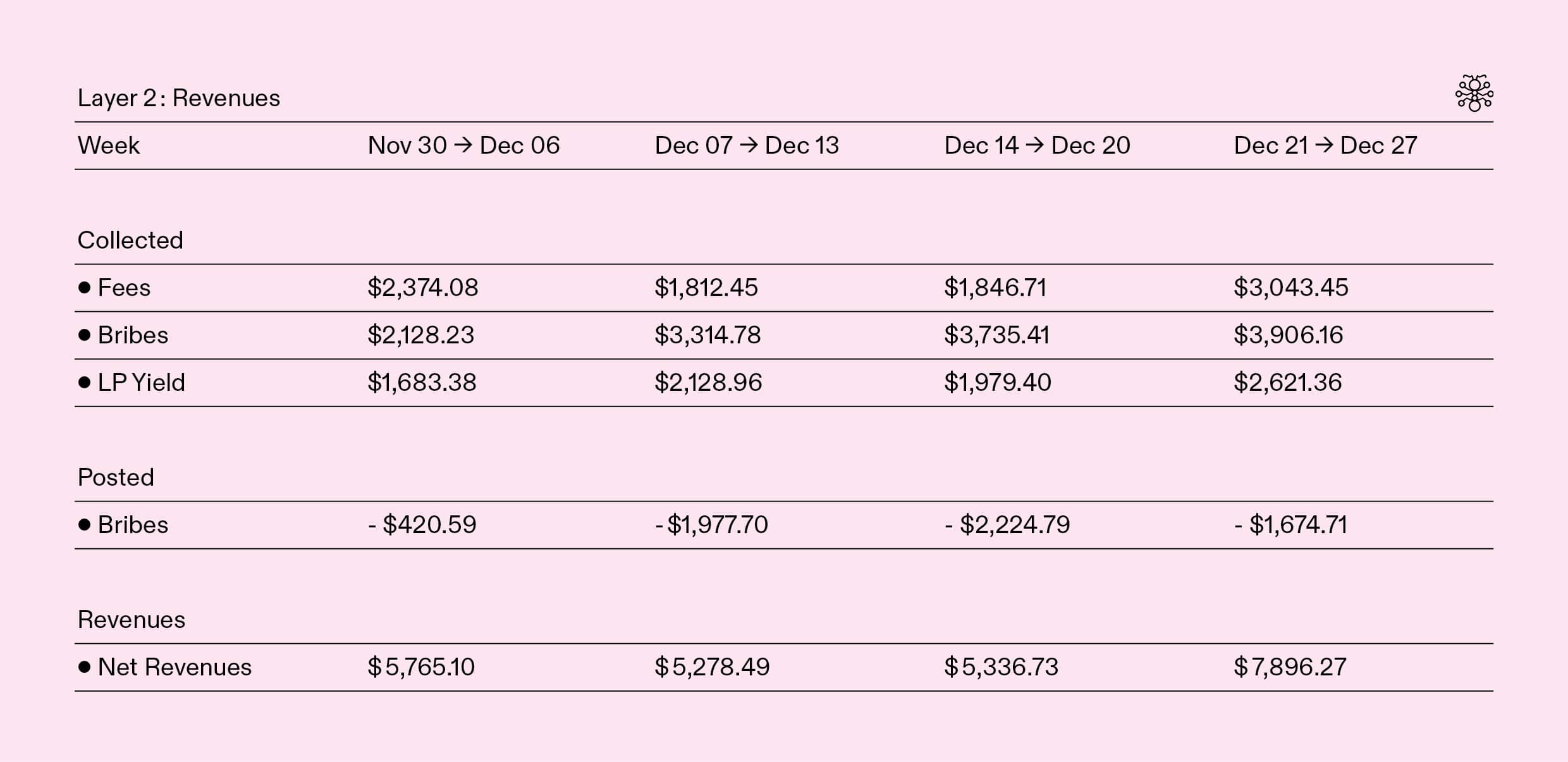

Revenues Report

Revenues are up 7.87% compared to the previous month, settling at $35 565. This increase is driven mainly by the increased revenues from Optimism and Mainnet.

Thanks to more contained expenses this month, the Earnings increased by over 45% compared to the previous month, settling at $30 641.

Impact Report

Mainnet

In December, the focus was put on diversifying the assets supported by the Collective and providing much-needed support to resilient and promising projects like DYAD. Indeed, the ants are one of the top suppliers of wETH and minters of DYAD - looking to source some of the stablecoin to be ready to support it liquidity-wise. The ants’ love embrace goes beyond the chain! Thanks to their campaigning, the Dyad protocol and its stablecoin were properly processed on DeBank by the end of the month.

On Liquis, voting power allocated to the bLUSD/LUSD Bunni pool was increased - the Collective also ensures a baseline of liquidity on this pool with a direct $110k supply. Several other positions were adjusted to free capital and prepare for the launches of Blueprint on mainnet, Zero on zkEVM, and Cleo on Mantle.

Optimism

On Optimism, the keyword of the month was support diversification!

- A baseline of $20k was supplied to the Velodrome LUSD/GRAI pool, along with some voting power to help it grow.

- Assistance is also ramping up to the POOL/ETH Velodrome pool, which was supplied and supported by increasing veVELO votes.

Base

On Base, the month’s highlight was the migration of the LUSD/USDCb pool to LUSD/USDC (native/canonical), supported with consistent votings and bribes and >$50k of liquidity providing. The pool promptly attracted north of $250k TVL, ensuring a liquidity baseline for LUSD on Base:

Arbitrum

On Ramses, the veRAM voting was diversified to offer greater gauge-voting support to the ARB/ETH & RAM/ETH pools. Our strategy on Camelot remains consistent, with decent LP exposure to progressively grow the ants’ xGRAIL position.

Polygon

Finally, on Polygon-PoS, our strategies remained consistent with previous months: supporting the bluechip pairs such as wMATIC/USDC, wMATIC/wETH & wETH/wBTC.

Parting Words

December was another incredible month for the ants, where the vision for a self-sustaining flywheel to support DeFi’s mission-critical tokens further materialized. Transparency is paramount to us, and we strive to improve the precision of our reporting every month, as we hope you’ll notice. Feel free to suggest any further improvements you could envision.

We’ll publish a consolidated trimestrial report in the coming days, offering a clear overview of the first full quarter of the Collective’s activities (Q4 2023). We’ll also discuss our past results and future projects at the next Community Call, scheduled for Thursday, 18 at 3 PM GMT+1; as always, it will happen on our Discord server; feel free to join us.

Thanks to Ricogourmette who produced the visuals included in this report & the PDF version.

— TokenBrice, on behalf of the treasury and liquidity management team of the DeFi Collective: Abmis, Luude, and myself.