The DeFi Collective - December 2024 Report

Luude

Luude- January 29, 2025

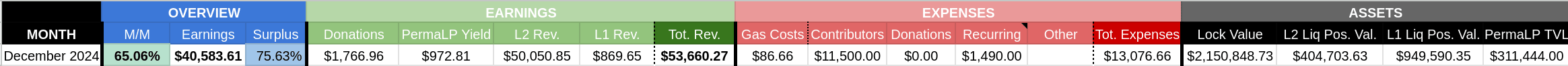

Welcome to the Collective’s December impact and treasury report. As discussed in the November report, the treasury management teams focused on growing revenues during the holiday season—and succeeded. With December including five harvests in its monthly total due to accounting practices, the Collective achieved a 65% month-over-month increase in earnings, pushing its monthly surplus back above 75%.

The Perma-LP strategy is now fully implemented. We have moved the Collective’s large LP positions for supported protocols to the Perma-LP wallet, where they will remain untouched indefinitely. While this has reduced our liquid position balance, it provides a clearer view of available positions that can support additional protocols in the future.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

So, without further ado, let’s dive in and see what the ants achieved in December.

Treasury Report

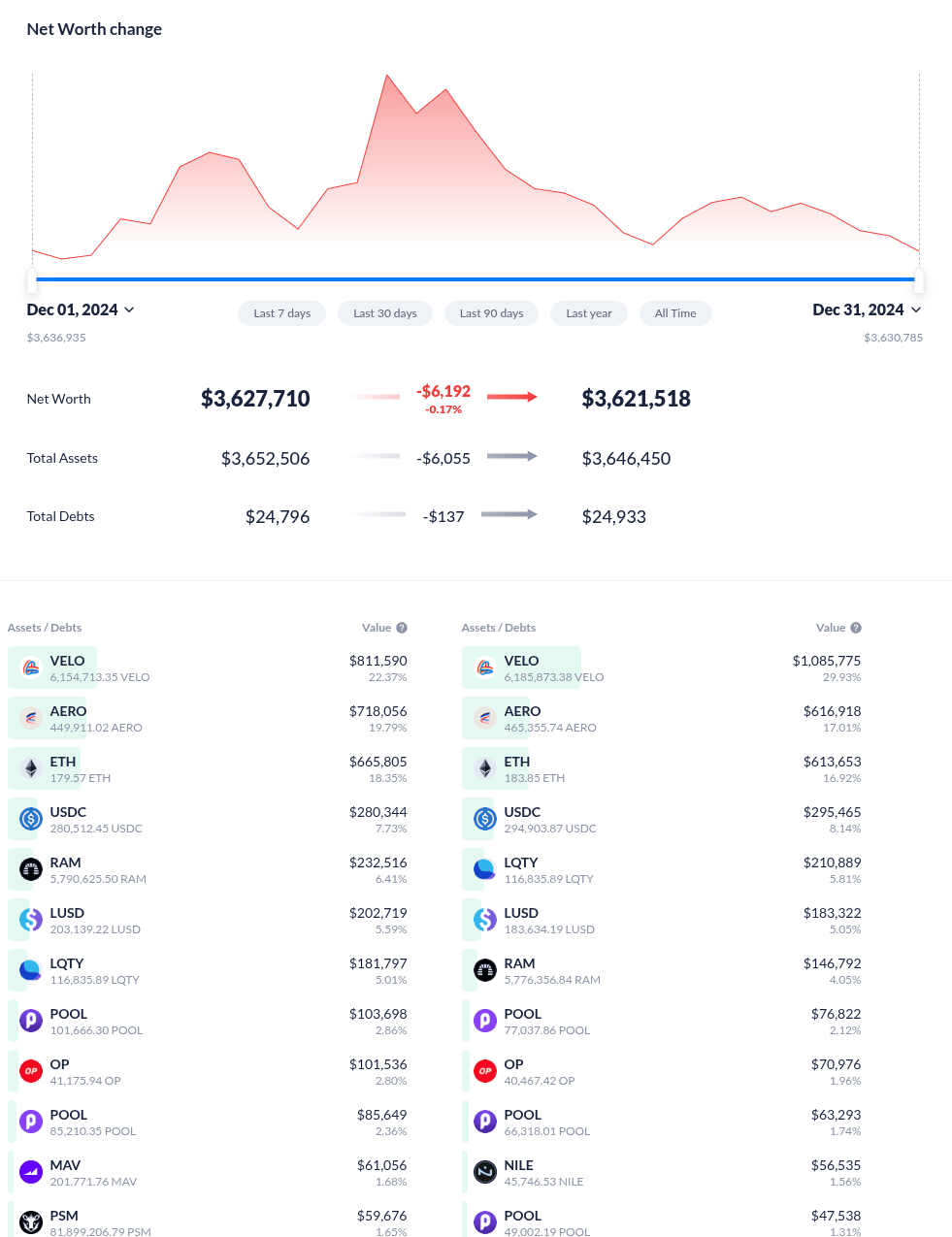

The face value of assets controlled by the Collective (excluding grants) remained roughly stable in December, ending at $3,621,518 by December 31. This total comprises 56% in locked assets, 10.6% in L2 liquid positions, and 25% in liquid positions on mainnet. Additionally, the Collective’s Perma-LP wallet holds 8.4% in assets, providing a strong liquidity base for supported protocols. The treasury management team is satisfied with the current treasury composition and will maintain its strategy of increasing strategic asset holdings while building assets to support upcoming launches, such as BOLD.

Expenses Report

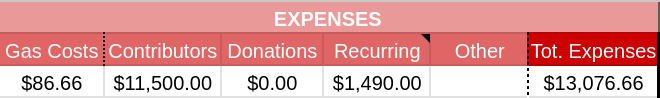

Expenses returned to normal after November’s increase following the launch of DeFiScan. We expect expenses to remain stable over the coming months, though they may rise as we onboard more contributors into the colony.

)

)

Gas costs continue to follow the trend of decreasing M/M, with L2 gas costs virtually non-existent in December. This is expected to continue until mainnet operations increase, sometime in Q1.

Revenues Report

Earnings are up 65.06% compared to November, finishing the month at $40,583.61. As noted in the November report, growing revenues throughout December was a key priority for the treasury management team. While December included an extra week due to accounting practices, the month delivered strong results. The team plans to maintain this successful revenue growth strategy where feasible.

With the surplus again exceeding 70%, the Collective can expand and bring on new contributors to help scale DeFiScan and other upcoming initiatives.

Impact Report

Mainnet

The Collective’s mainnet operations were minimal during December, only transferring a portion of the POOL donation from PoolTogether into the prizePOOL vault and conducting small farming operations on Liquis.

As noted in previous treasury and impact reports, the Collective is awaiting the launch of BOLD before initiating new mainnet liquidity initiatives.

Arbitrum

The Arbitrum strategy remains consistent, maintaining voting support for PoolTogether and Possum on Ramses. To prepare for potential future Arbitrum and Arbitrum Orbit initiatives, we are gradually accumulating xGRAIL to hedge against the veRAM position. This approach uses small portions of farming revenue to build the position. It is unknown how long this strategy will be implemented, but for now, it will remain while there is no clear DEX winner on Arbitrum.

Optimism

Treasury activities on Optimism remained steady in December, with ongoing liquidity support for USDC/LUSD and POOL/ETH pairs. The Collective has continued to leverage its substantial veVELO position to provide voting support for various mission-critical pools.

The treasury management team plans to maintain this strategy while using a portion of the veVELO position to boost revenues during high trading volumes, ultimately increasing the Collective’s operating surplus.

The Collective’s veVELO voting relay (#26739) is now available. If you hold veVELO and wish to support the Collective’s mission, you can assign your voting power to relay #26739, and we will vote on your behalf. These votes currently support the POOL/ETH pool.

Base

Operations remain steady on Base, with continued support for LUSD/USDC and LUSD/POOL pools. The Collective has begun leveraging its substantial veAERO position to boost December revenues, which will likely continue until that voting power is needed elsewhere.

Following Optimism’s model, we have launched the Collectives relay (#62488) on Aerodrome. For now, all voting support through this relay will focus on the LUSD/POOL pool.

Polygon-PoS

A vote-only strategy on Retro remains in place, yielding very little results. This strategy will continue indefinitely.

Mantle

The Collectives vote-only strategy on Cleopatra remains with results varying from week to week. This strategy will continue indefinitely.

Linea

The vote-only strategy continues on Nile, with modest results recorded. This strategy will be maintained going forward to contribute to treasury growth.

Blast

Following the Ants veFXS airdrop, Fenix implemented a vote-only strategy. While Fenix performed well in early December, its performance has since declined, following the trend of other smaller chains. The treasury management team will maintain the vote-only strategy for now.

Perma LPs

The Collective’s perma-LP positions have been migrated from the main treasury wallet to a dedicated perma-LP wallet during December. This migration enables more efficient accounting and provides a clearer overview of the Collective’s treasury balances. The transferred positions include Aerodrome LUSD/POOL, Velodrome POOL/ETH, Ramses wETH/POOL, and wETH/PSM. These positions will receive monthly yield compounding and voting support from the Collective’s liquidity-driving positions—with potential additional support from community veVELO and veAERO through relays established on Velodrome and Aerodrome.

The perma-LP represents a significant advancement, assuring partners who donate assets that they will maintain a foundation of liquidity for their tokens without incurring any monthly costs for this liquidity.

Parting Words

December was a great month for the Collective. DeFiScan maintained its momentum, the perma-LP initiative progressed to its next phase, and the Collective achieved a healthy revenue surplus. We hope all the ants in the community enjoyed wonderful holidays, and we’re excited for 2025 as we continue supporting genuine, resilient DeFi.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.