The DeFi Collective - February 2024 Report

TokenBrice

TokenBrice- March 13, 2024

Welcome to February’s monthly report for the Collective. It marks the first-ever edition where our unstoppable revenues up-only trend is not sustained, but there is a context to it: the outlook remains highly positive, so stick around to understand why!

For more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

This report is also available in PDF format.

Treasury Report

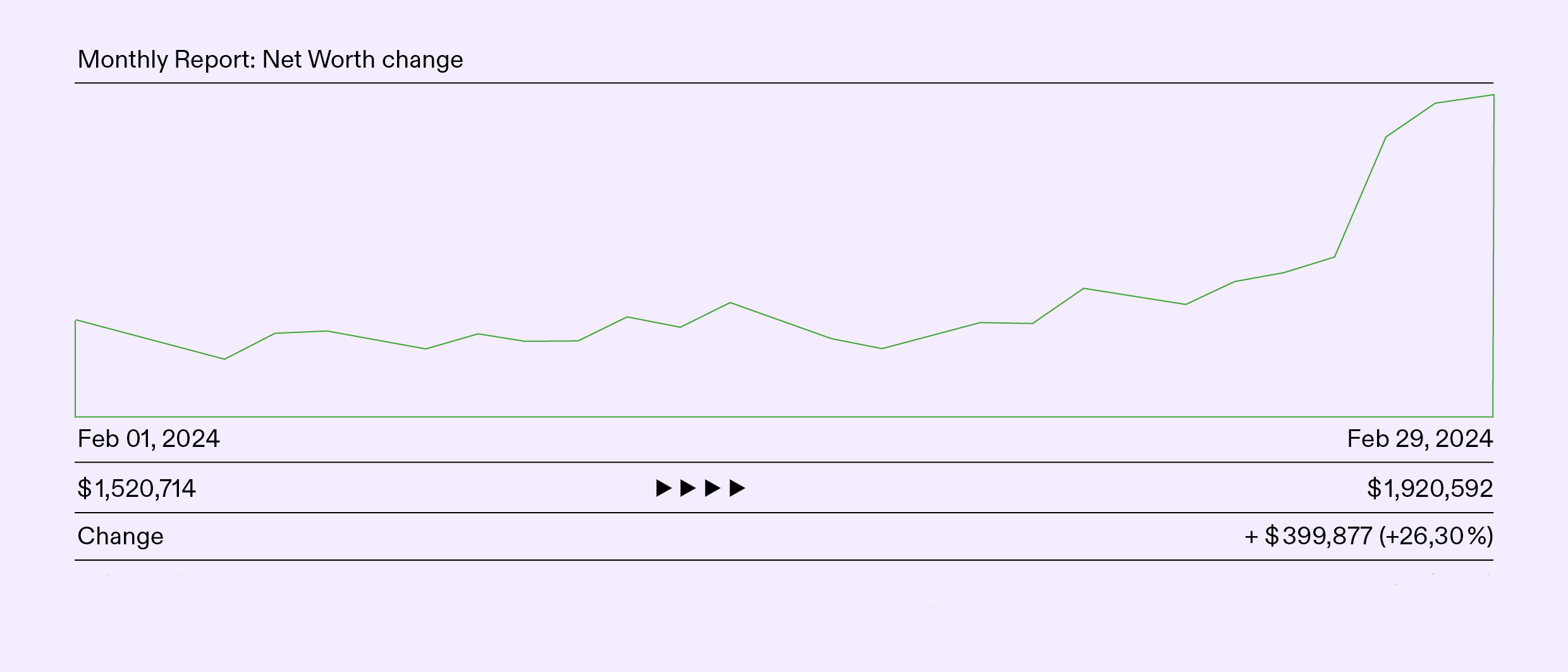

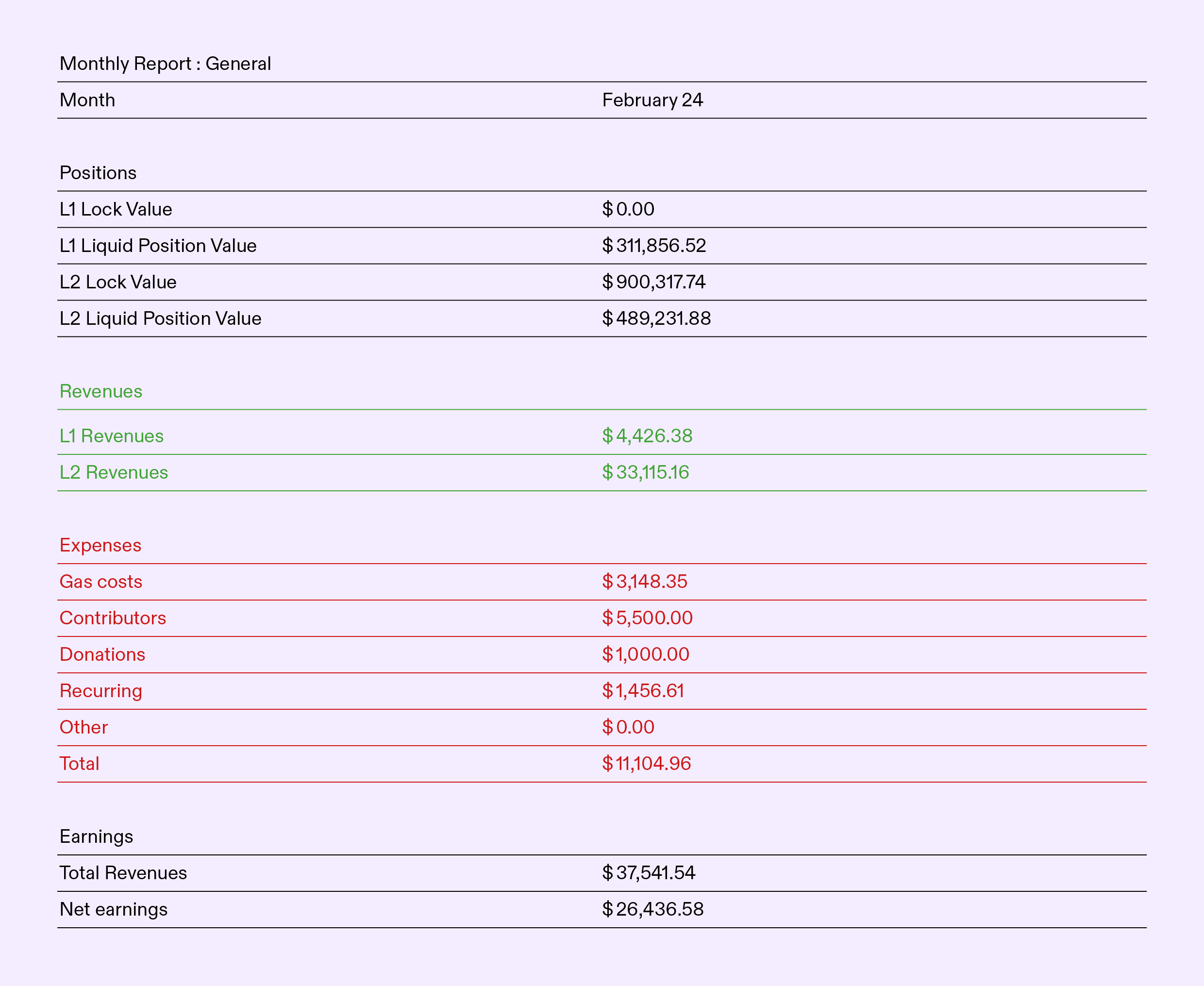

The face value of assets controlled by the Collective (excluding grants) grew by 26.3% in February, jumping from $1,520,714 (Feb 01) to $1,920,592 (Feb 29). The bulk of the asset value growth stems from the dynamic price action observed in the period, particularly over ETH, VELO & especially AERO, which saw its price roughly quadruple during the month.

No new chains were launched in February, but operations were initiated on two new exchanges: Blueprint on Mainnet and Stratum on Mantle. Outside of liquidity-driving tokens, ETH, LQTY, and stablecoins remain the three top liquid exposures of the Collective, including over 300K LUSD, enough to cover several years of expenses.

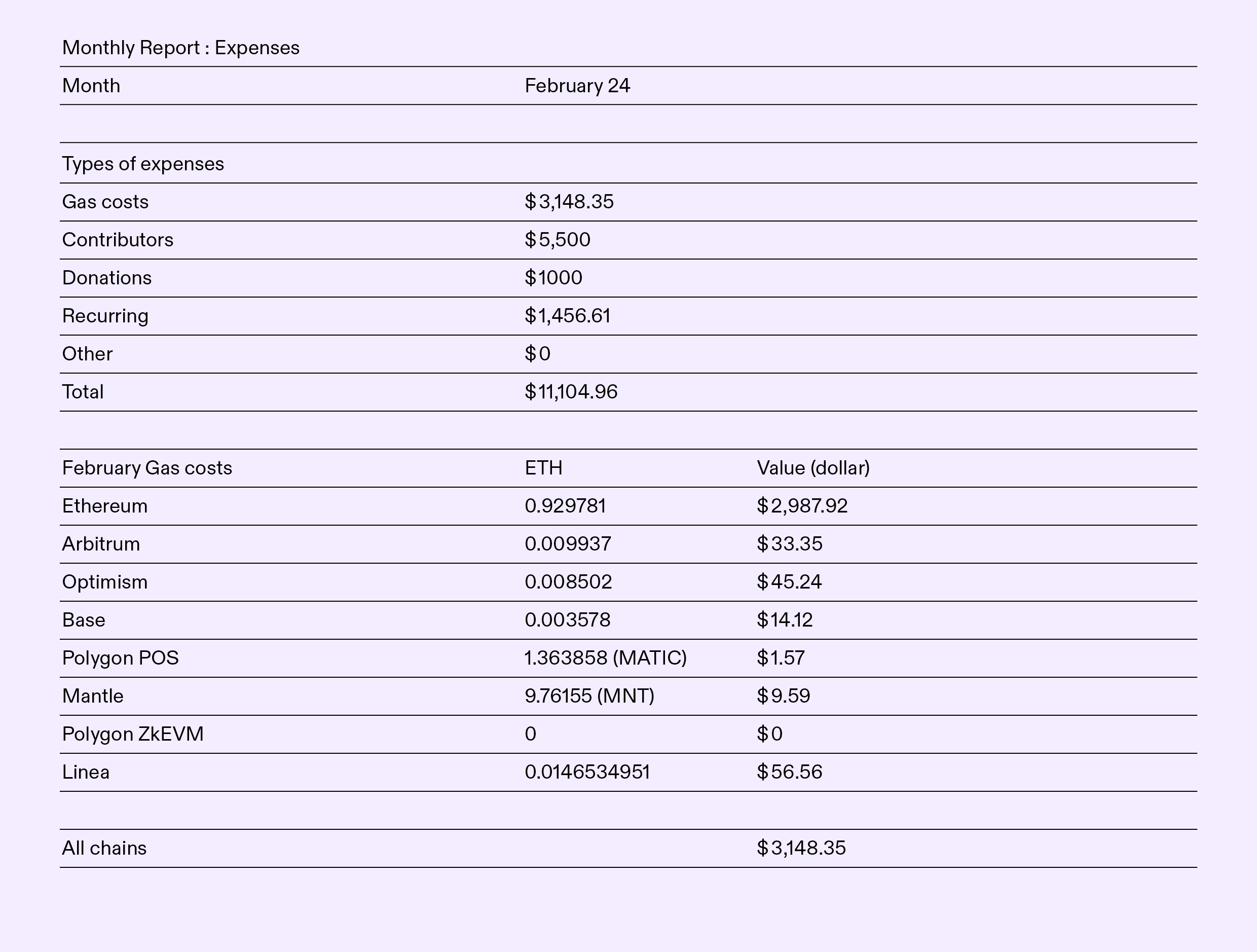

Expenses Report

Expenses are up in February compared to the previous month due to several factors:

- The launch of Blueprint accelerated the activity on the mainnet and required executing several gas-intensive operations (such as creating liquidity pools).

- A 1000 LUSD donation to the chads of Smoldapp, who produce MultiSafe, a tool enabling the Collective to streamline its cross-chain operations.

- Increased recurring expenses, such as an IRL accounting advisory service.

Revenues Report

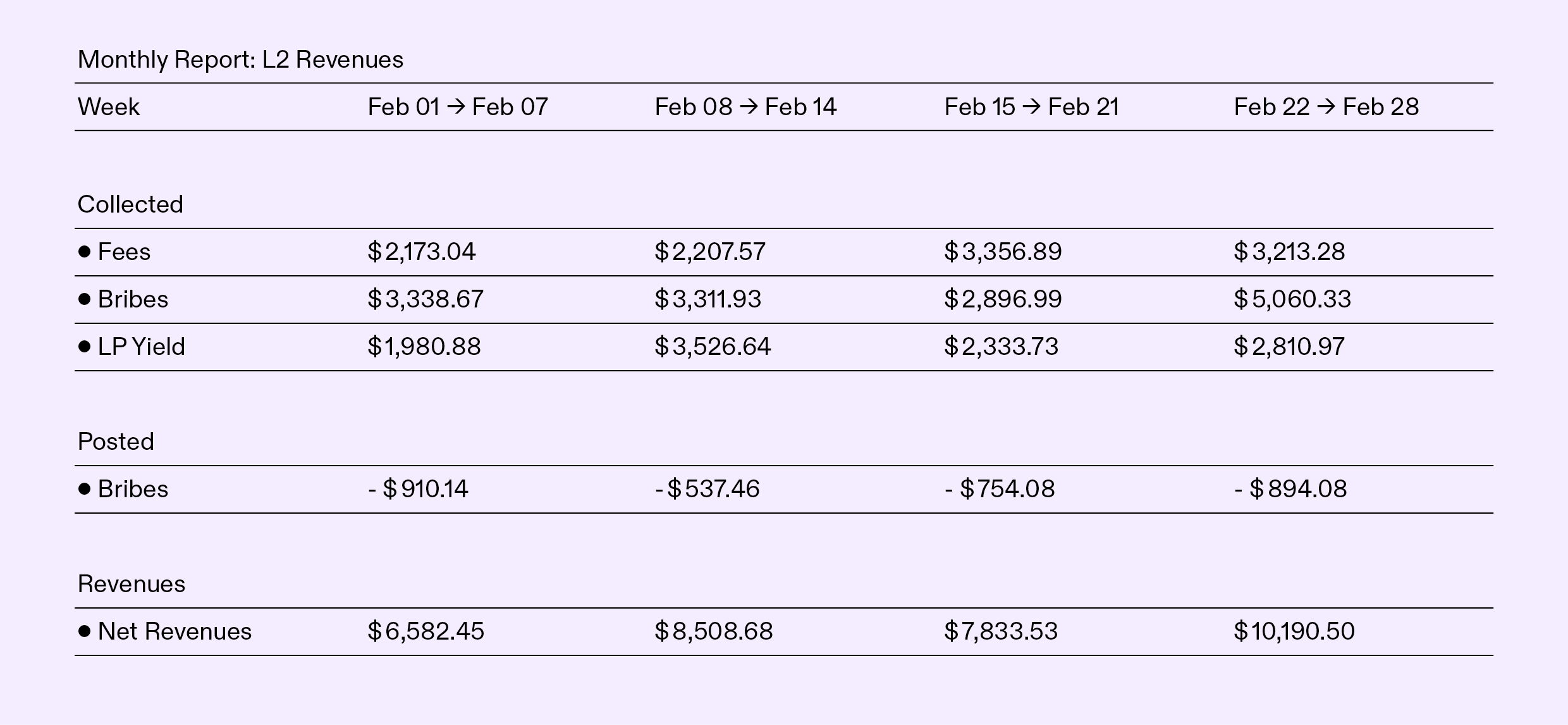

Revenues are down 23.68% compared to the previous month, settling at $37,541.54. With increased expenses and reduced revenues, earnings are also taking a hit, ending at $26,436.58, down 38.44% monthly.

The Collective L2 activities remain its main source of income:

There are several elements of context to understand why, despite this trend reversal, the ants are not worried for a minute:

- Accounting logic shenanigans: January had five weekly harvests, while only four were in February.

- Delayed harvesting: per RP.3, yields are only accounted for when harvested. With the increase in gas costs on mainnet, several positions were not harvested this month, leading to a much lower L1 revenue ($4,426.38 in February, vs $10,442.87 in January)

- Increased expenses: The collective expenses have almost doubled in February compared to January, which impacts the earnings figure sizably.

Impact Report

Mainnet

With the launch of the much-anticipated Blueprint on the mainnet, ants have been busy. Two pools were deployed—LUSD/DYAD and bLUSD/LUSD—and seeded with $73k and $67k, respectively.

The pools grew rapidly, supported by the Collective’s massive initial 1M veBLUE position and LQTY bribes. LUSD/DYAD quickly became the top liquidity source for DYAD, with over $400k supplied by the end of February. With its support for DYAD, the Collective received the veBLUE position, initially envisioned for DYAD, raising its total starting allocation to 1.25M veBLUE.

Ants often come with friends, and it was no exception on Blueprint. Gravita and Paladin joined the party, with LUSD/GRAI & LUSD/PAL pools also supported. Talks with other projects looking to build liquidity against LUSD on the mainnet are ongoing.

Arbitrum

On Ramses, where the ants control a veRAM position over 8M strong, the strategy evolved to divert some voting power away from the LQTY/ETH pool, which failed to attract sizable TVL despite generous incentives. A majority of the voting power is now allocated to high-performing bluechip pools, such as ETH/ARB, ARB/USDC & ETH/USDC, creating an additional revenue stream for the Collective while supporting the sustained growth of Ramses on a path to capture a growing share of the trading volume on Arbitrum.

Optimism

On Optimism, the strategy remains consistent with the previous months, with major LUSD pools supported with vote and vote incentives—LUSD/wETH, LUSD/USDC, LUSD/USDT—and smaller pools also benefiting from the ants’ love, such as POOL/ETH and LUSD/GRAI. With the positive traction observed on Velodrome, all the pools supported by the Collective grew this month.

The Collective also seeded initial LUSD liquidity on VMEX, enabling it to grow its LUSD-leverage market providing additional options for LUSD liquidity providers.

Base

February was the month of the awakening for AERO, with its price almost quadrupling and widespread recognition. Of course, it left marks on the TVL of the main pool supported by the Collective there, LUSD/USDC, which almost doubled in TVL, from $430k at the start of the month to $829k by its end.

Polygon-PoS

On Retro, the strategy remains consistent with the previous months, with the veRETRO voting power allocated to support Bluechip pools like wMATIC/wETH, wBTC/wETH, or wMATIC/USDC.

Mantle

Ants keep developing their presence on Mantle gently, with sustained support for Cleopatra’s LUSD/USDC pool and the beginning of operations on Stratum, where both a LUSD/USDC and a LUSD/USDT pool are supported.

Linea

Finally, on Linea, like on Mantle, ants are positioning themselves for sustained growth with the development of the LUSD/USDC pool on Nile.

Parting Words

Another month with positive cash flow and impact for DeFi; all hail the ants! Our focus for March is on the Mission-Critical Protocol Guidelines, the first version of which is stated for the end of Q1. The first version of the Treasury Management Policy will also be released by then: the Collective is progressively taking shape.

Thanks to its growing and sturdy treasury, the Collective is now ready to onboard more contributors to speed up its growth, with two connected roles now opened to improve its presence and reach: a Community Manager and a Content Strategist. Check out the joint job descriptions, and reach out if that could be you.

— TokenBrice, on behalf of the treasury and liquidity management team of the DeFi Collective: Abmis, Luude, and myself.