The DeFi Collective - January 2024 Report

TokenBrice

TokenBrice- February 13, 2024

Welcome to the first treasury report of the Collective for 2024, covering the month of January. This month’s edition packs two new chains where the Collective now operates, sustained growth of operations started in December, and preparations for several much anticipated DEX launches in the upcoming weeks: let’s dive in!

For more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy recently published.

This report is also available in PDF format, courtesy of Ricogourmette.

Treasury Report

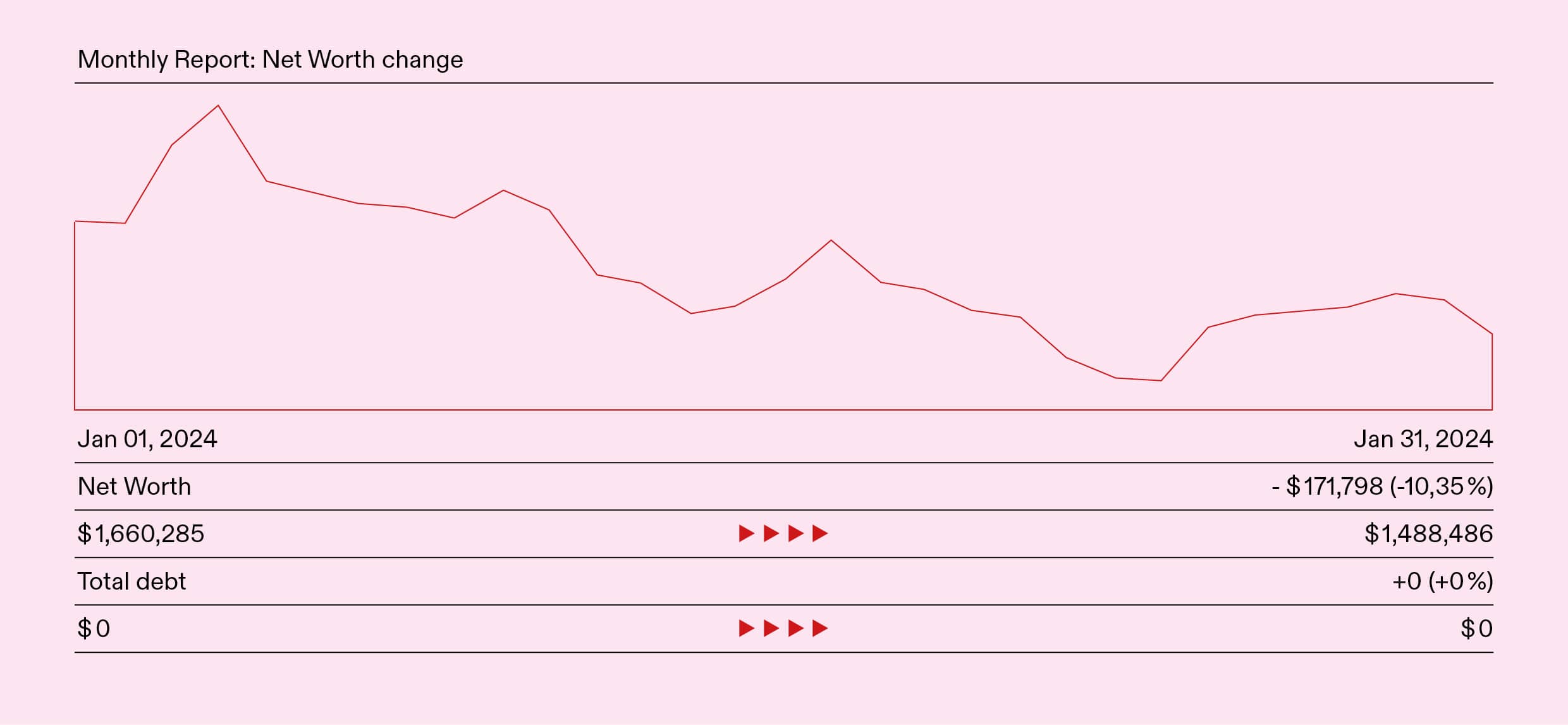

The face value of all assets controlled by the Collective (excluding grants) shrank by $171k in January, a 10.35% decrease from the previous month.

The vast majority of the moves come from the decrease in the price of locked assets the Collective controls a large amount of, most of which had an incredible month in December:

- VELO, down 21.12% over the period

- RETRO, down 66%

- RAM, down 7.31%

In January, the Collective started operating on two new chains: Mantle & Linea, more on this in the Impact Report section below.

Expenses Report

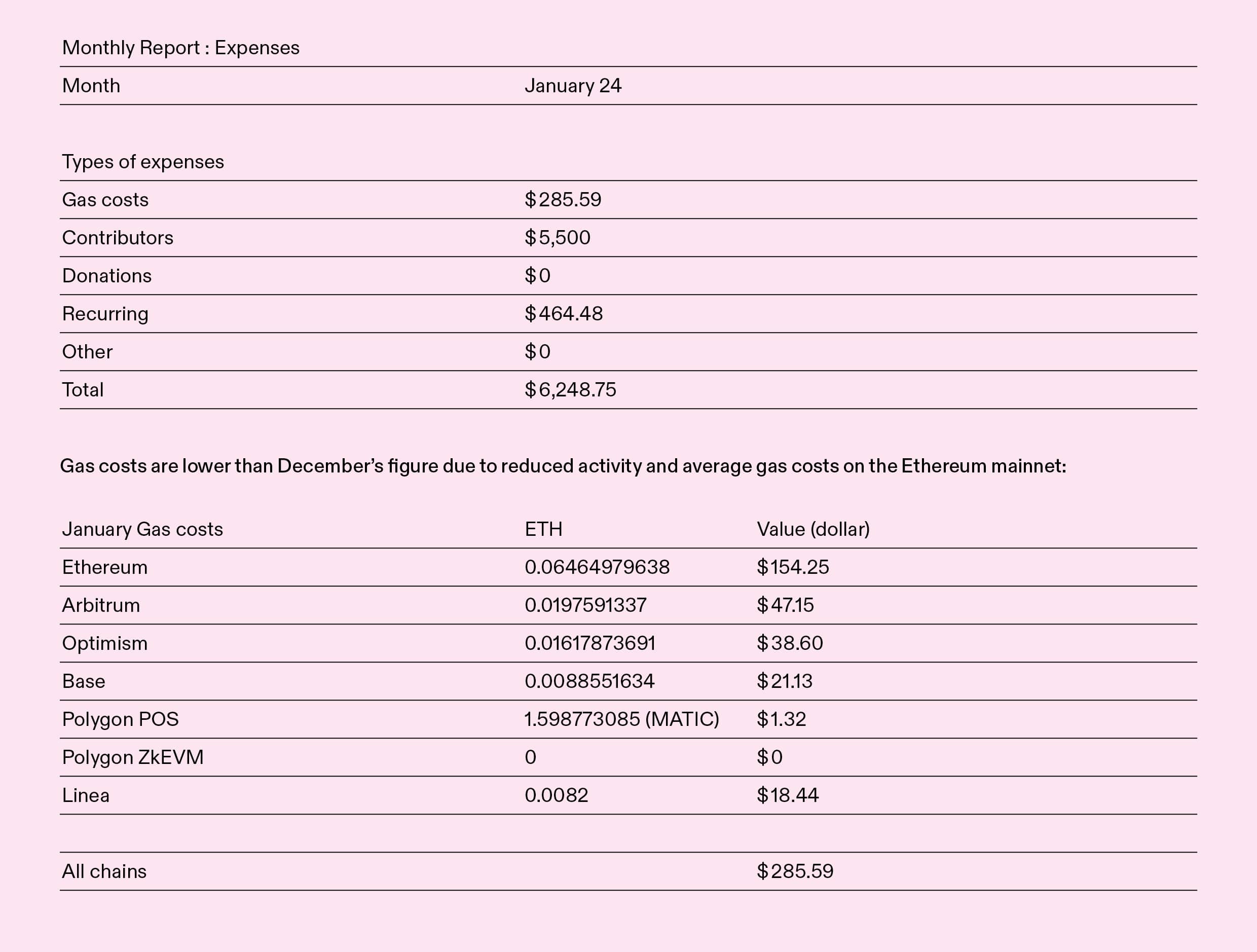

In January, expenses mainly were composed of recurring expenses and gas costs. The contributor-related expenses are up $1500 compared to the previous baseline, as January was the first month where the salary of our third contributor, Luude, was incurred (started in December + 1-month delta).

Gas costs are lower than December’s figure due to reduced activity and average gas costs on the Ethereum mainnet.

Revenues Report

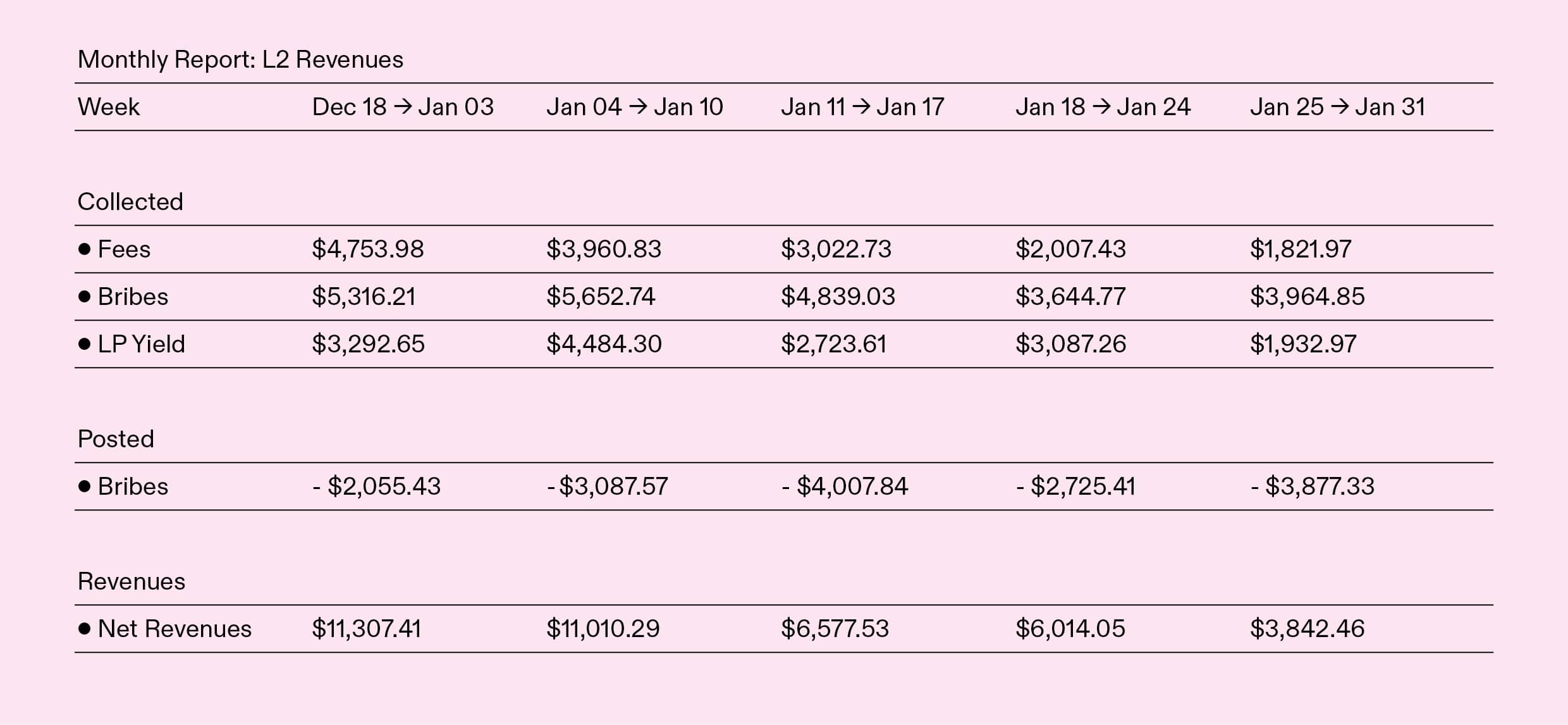

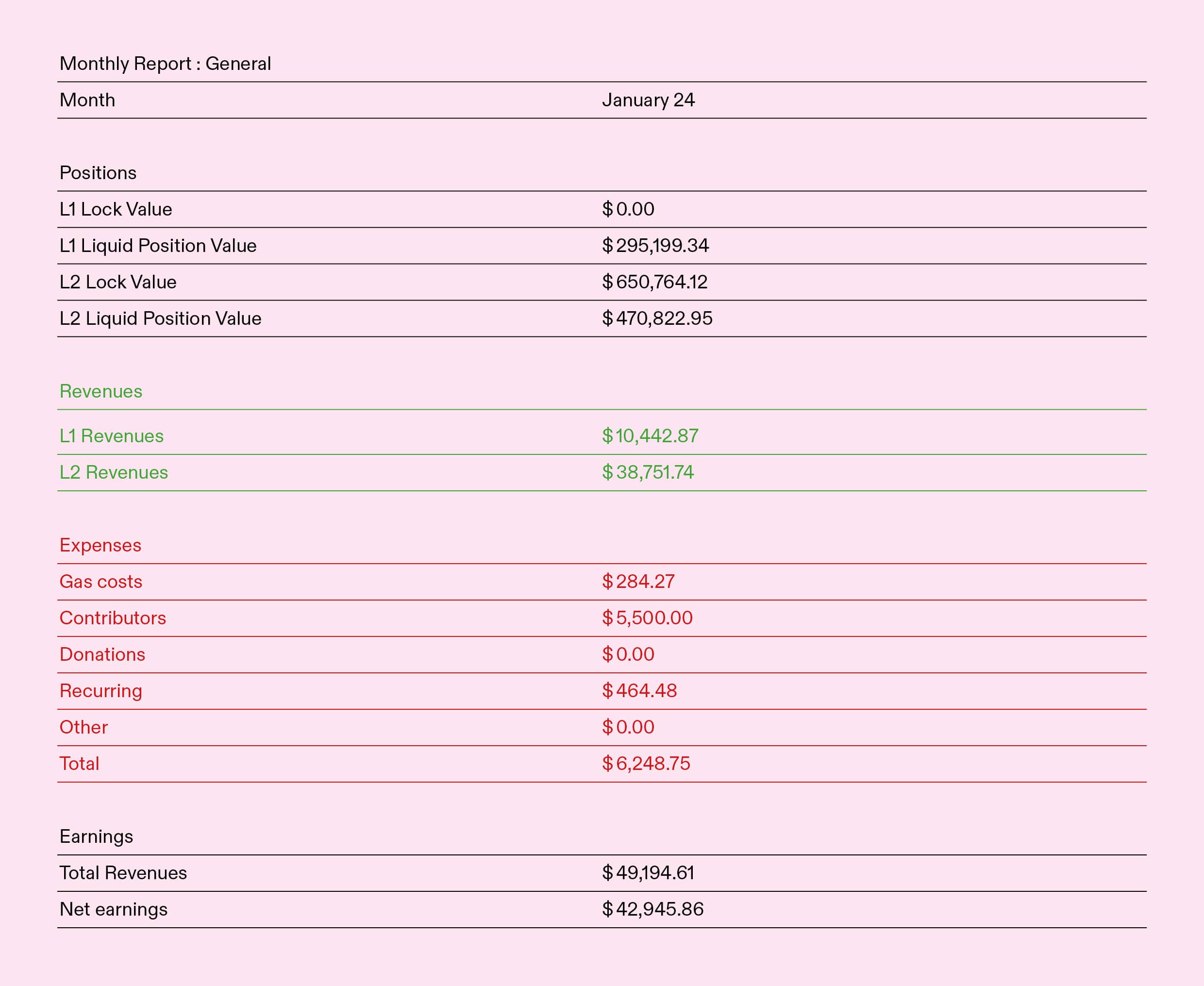

Revenues are up 38.32% compared to the previous month, settling at $49,194.61. The increase is driven by spectacular performance on Arbitrum and Optimism, especially early in the month, with two consecutive weeks above the $10K revenue threshold. It also stems from the accounting logic, which led January to be a month with five weeks for the Collective:

You might notice the massive revenue spread between the first and last week: a lesson hard learned for the ants. Indeed, launching new chains is usually, at least at first, a costly endeavor, as it comes with increased vote incentive expenditures. At the same time, revenues usually lag by at least a few weeks. Vote incentives have since been reduced and refocused to restore the performance for the following weeks.

Thanks to this new revenue ATH and moderate expenses, the Earnings figure also marks a monthly ATH, settling at $42,945.86, a 40.15% monthly increase.

Impact Report

Mainnet

As seen in the incurred gas costs, the ants were quiet on the mainnet in January, mostly anticipating further movement with the upcoming launch of Blueprint in February. Still, over the period,** the Collective supported DYAD by holding ~17.5% of the stablecoins DYAD/USDC liquidity, with a $50k position.**

~30k LUSD were supplied to the Aave mainnet market to “park” them for upcoming usage in strategies to be implemented in February.

Arbitrum

The strategy remained constant on Arbitrum in January, most of the focus being put on the Ramses LQTY/ETH pool. The volume processed by the pool was in a downtrend during the period, so further asset allocation optimization is being evaluated.

Optimism

On Velodrome, the support the ants extended to the POOL/ETH proved fruitful, as the pool crossed the $50k TVL figure during the month.

Focus is also being put on diversifying the stable pairings for LUSD, with increased support provided to LUSD/USDT and LUSD/ERN pools.

Base

On Base, why change a winning strategy? On top of the Collective patiently growing its veAERO position, the LUSD/USDC pool is sustaining its growth. Thanks to the price appreciation of AERO, as well as the sustained support, the pool’s TVL almost doubled during the period:

Polygon-PoS

It’s been a pretty slow month on Polygon / Retro, with no changes to the voting strategy.

Mantle

Ants arrived to Mantle thanks to Cleopatra, a Ramses fork. To begin with, a LUSD/USDC pool is to be developed thanks to veCLEO voting, vote incentives, and liquidity seeding.

Initially launched as a concentrated liquidity pool, it has been transitioned to a stableswap, considering LUSD’s minimal peg variance and the easier management it allows for LPs.

Linea

Nile is another fork of Ramses, this time on the Linea network. The strategy implemented is the same as the one harnessed on Cleopatra.

Both chains are freshly launched, and TVL is still moderate despite attractive yields. You’ll hear more about them in the coming weeks; meanwhile, it’s a great opportunity if you like LUSD LPs and are not afraid of bridging to a new chain. On both chains and as always, you can bridge LUSD from mainnet using the canonical standard bridge.

Parting Words

Another record month for the Collective, further cementing the demonstration that opinionated treasury management geared towards supporting DeFi mission-critical protocols can be profitable and thus compound into a flywheel of support for DeFi’s most resilient protocols.

As announced during the last community call, one of the focuses for Q1 is providing ever-increasing transparency on how the Collective operates; with the Reporting Policy published, we’re now one step closer and not stopping there!

Ants are particularly excited for February, as the launch of Blueprint will mark the first ve(3,3) on mainnet managed by the Collective. It will be harnessed at first to diversify LUSD stable pairings, with the initial focus on LUSD/bLUSD, LUSD/DYAD, and LUSD/GRAI pools. If you’re interested in these pools, stay tuned and follow the Collective Twitter account; you’ll hear more about them shortly.

— TokenBrice, on behalf of the treasury and liquidity management team of the DeFi Collective: Abmis, Luude, and myself.

![The DeFi Collective - 3rd Quarter Summary [Q2 2024]](/images/articles/tdc-q3-summary.png)