The DeFi Collective - January 2025 Report

Luude

Luude- February 19, 2025

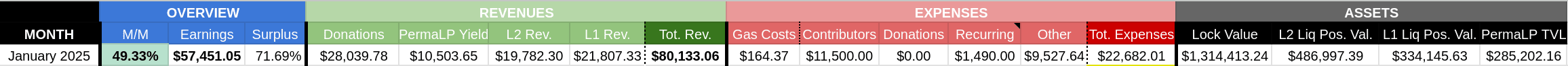

Welcome to the Collective’s January impact and treasury report. The treasury management team has maintained its focus on growing revenues and maintaining a healthy surplus, achieving a 49% month-on-month increase in total earnings compared to December—despite higher expenses this month.

January marked the long-awaited launch of BOLD, with liquidity swiftly deployed across Optimism, Arbitrum, and Base to support its L2 expansion. The Collective’s impact reached new heights through continued support for Perma-LP positions, while the BOLD PIL proposal garnered nearly 15% of votes, resulting in a $1,459.79 donation for promoting L2 liquidity.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

Now, let’s dive in and see what the ants achieved in January.

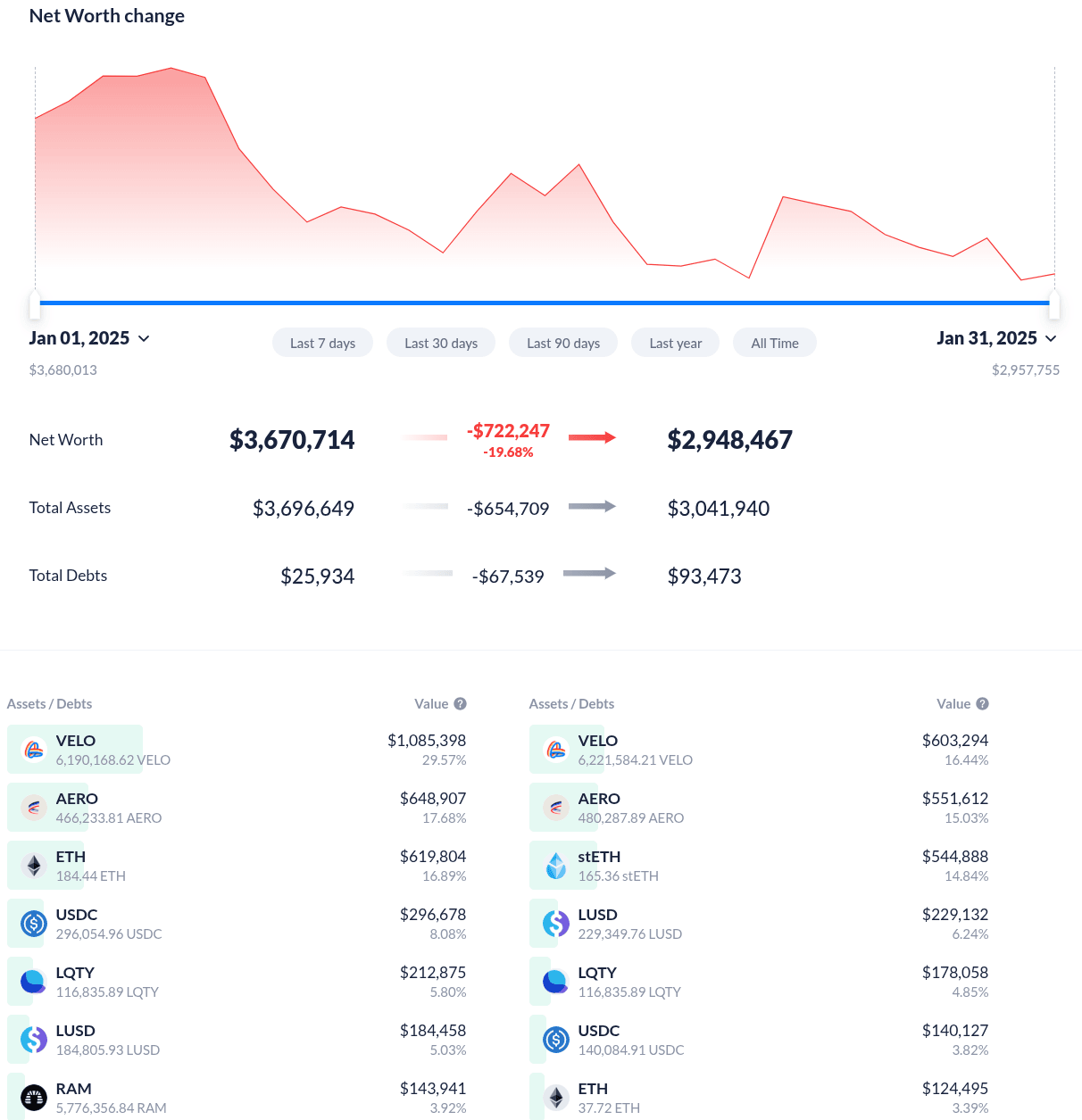

Treasury Report

The face value of assets controlled by the Collective (excluding grants) decreased by 19.68% in January, falling from $3,670,714 on January 1 to $2,948,467 by January 31. This total comprises 54% in locked assets, 20% in L2 liquid positions, and 14% in liquid positions on mainnet. The Collective’s Perma-LP wallet holds the remaining 12% in assets, providing an increasing liquidity base for supported protocols. The decline in total assets was primarily due to the sharp drop in locked assets, particularly veVELO, which experienced a 44% price decrease during January.

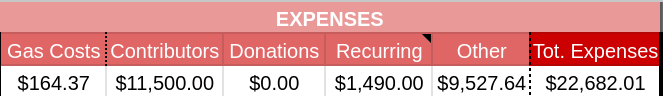

Expenses Report

Expenses are rising, as expected since the Collective is investing heavily in growing DeFiScan. New contributors will likely be onboarded in the coming months, leading to more increases before stabilization.

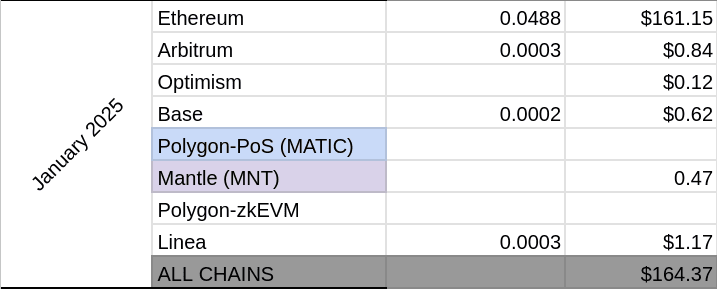

Gas costs increased in January due to heightened mainnet operations following the BOLD launch. L2 gas costs also rose during this period, as Safe sponsored transactions couldn’t fully cover the treasury management team’s activities. We expect gas costs to return to baseline levels as operations return to L2s.

Revenues Report

Earnings are up 49.33% compared to December, finishing the month at $57,451.05. Looking deeper into the earnings figures, January was unusual—the majority of revenue came from L1 auto-compounding positions that were withdrawn to mint BOLD. Because of auto-compounding accounting practices, all earnings accumulated during the deposit period were recorded at the withdrawal time. L2 revenues decreased compared to December, which was anticipated since most of the Collective’s positions had been moved to L1 for BOLD preparation. With BOLD now live and most activities returning to L2s, we expect the revenue composition to normalize, primarily driven by L2 activity.

The treasury management team is pleased that the 70%+ surplus was maintained throughout January, even after the increased expenses incurred.

Impact Report

Mainnet

The long-awaited launch of BOLD arrived in January. During this launch, the ants mobilized their accumulated ETH and stablecoins, minting BOLD and deploying liquidity across Optimism, Arbitrum, and Base. A portion of the minted BOLD was deposited into the wstETH and ETH stability pools. Additionally, the Collective’s LQTY position was migrated to v2, and voting support was carried out on the Collective’s LIP proposal.

With BOLD now deployed to L2s, we expect mainnet operations to decrease significantly over the coming months. Activity will shift back to L2s, where the Collective will spearhead the growth and maintenance of BOLD liquidity.

Arbitrum

As mentioned above, a portion of the Collective’s BOLD and stablecoin assets were mobilized to Arbitrum, with a BOLD/USDC pool established on Ramses. This pool received vote support from the Collective’s large veRAM position, while maintaining additional voting support for PoolTogether and Possum. Perma-LP support for POOL/wETH and PSM/wETH pools continued, growing in size as the Collective supports PoolTogether and Possum’s Arbitrum liquidity.

Optimism

The Collective’s BOLD liquidity strategy on Velodrome split our established LUSD/USDC pool into two BOLD pools: LUSD/BOLD and USDC/BOLD. These pools are supported by voting and bribe support on Velodrome. Meanwhile, we maintained our voting support for the POOL/ETH pool, which forms the Collective’s Perma-LP position on Optimism.

Base

Like Velodrome, the Aerodrome BOLD liquidity strategy focused on BOLD/LUSD and BOLD/USDC pools, both receiving vote and bribe support from the Collective. This support extended to the Collective’s Perma-LP POOL/LUSD position, which continues to receive voting support.

Polygon-PoS

A vote-only strategy on Retro remains in place, yielding very little results. This strategy will continue indefinitely.

Mantle

The Collectives vote-only strategy on Cleopatra remains with results varying from week to week. This strategy will continue indefinitely.

Linea

The vote-only strategy continues on Nile, with modest results recorded. This strategy will be maintained going forward to contribute to treasury growth.

Blast

A vote-only strategy on Fenix remains in place, yielding very little results. This strategy will continue indefinitely.

Perma LPs

In January, the Collective’s Perma-LP strategy established a stable pattern that we expect to maintain. Our major liquidity positions provide vote support, and we harvest yields monthly. By compounding these yields to grow liquidity, we strengthen our partners’ confidence in the increasing on-chain liquidity for their tokens.

The Collective is actively discussing with Liquity v2-friendly forks to identify new protocols we can onboard and support in our mission to back truly decentralized DeFi.

Parting Words

The year started well with the long-awaited event the ants have been anticipating. Now that BOLD is live, we’ve mobilized our accumulated assets from the past year to support Liquity’s L2 liquidity. The results of the first Liquity v2 PIL round were excellent, and we expect to receive a steady stream of BOLD that we can use as bribe support for growing L2 liquidity.

DeFiScan continues to make strong progress, with 14 protocols now reviewed. We’re actively seeking protocols for self-review—if you’d like to be listed on DeFiScan, reach out in the Collectives Discord and we’ll guide you through the process.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.