The DeFi Collective - July 2024 Report

Luude

Luude- August 15, 2024

Welcome to the Collectives’ July impact and treasury report. Following a similar trajectory to the previous months, July saw the Collective maintain healthy revenues and an increased surplus that will be recycled back into supporting mission-critical projects with their liquidity.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

So without further ado, let’s dive in and see what the ants achieved in July.

Treasury Report

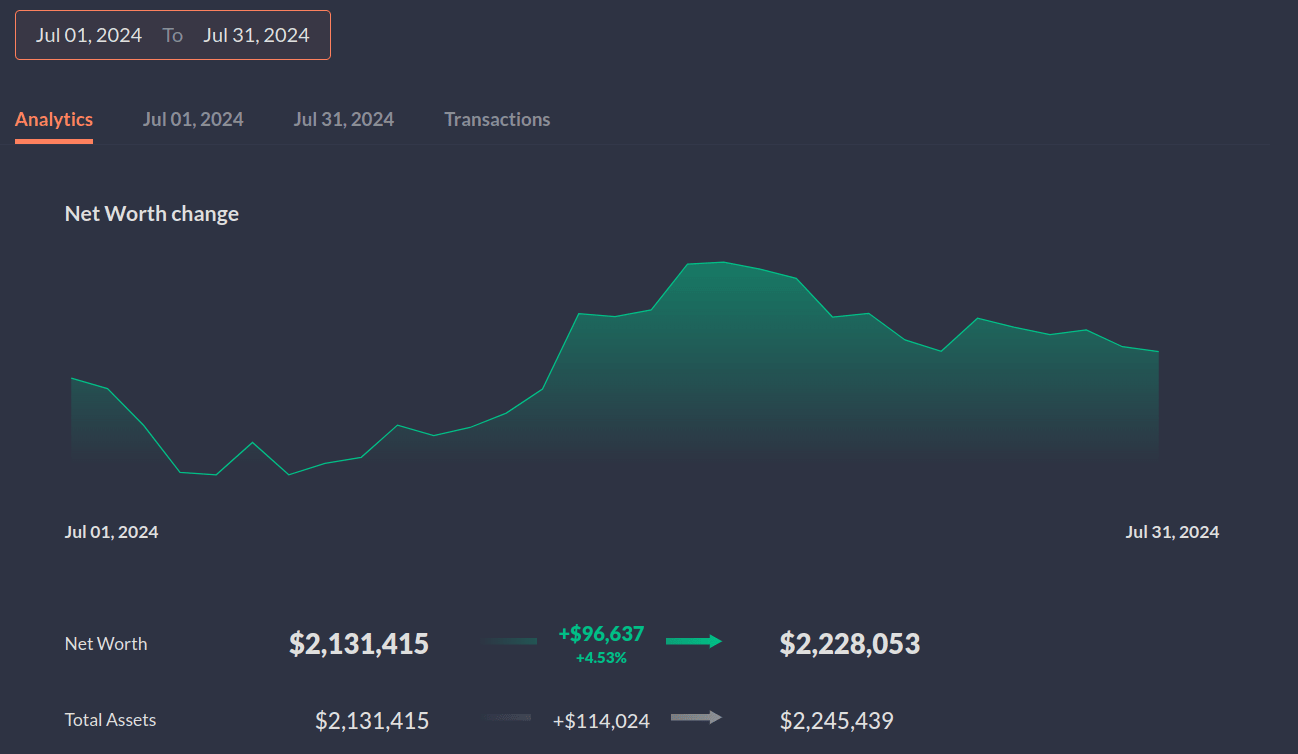

The face value of assets controlled by the Collective (excluding grants) increased by 4.53% in July, increasing from $2,131,415 on the 1st of July to $2,228,053 by the 31st of July. This slight increase reflects the market conditions over July which, although volatile, didn’t see much price change between the beginning and end of the month.

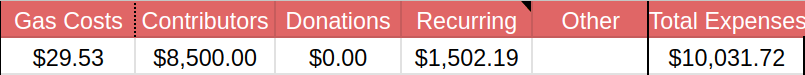

Expenses Report

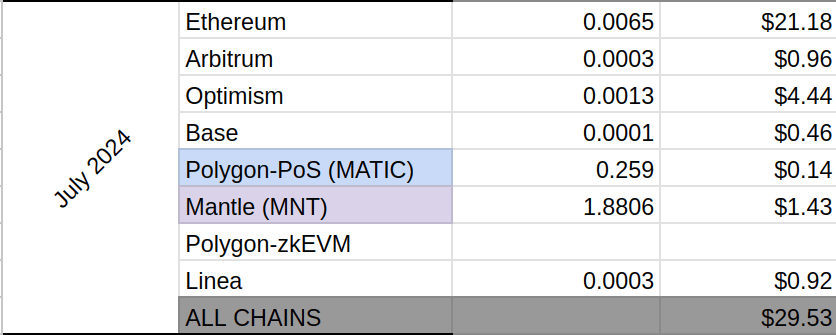

Expenses were slightly down in July compared to June, primarily due to decreased gas expenses on Mainnet. Expenses are expected to remain steady at this level, which when combined with the steady revenue the Collective is maintaining allows us to operate at around a 70% - 80% surplus month on month.

The Collective’s gas expenses fell to the lowest level in our history in July. Driven by low mainnet activity resulting in a staggeringly low base fee, reduced treasury operations on mainnet, and the reduced gas costs we are enjoying post Dencun. It is hard to believe that gas costs will continue to be so low going forward, but the ants are enjoying it while it lasts.

Revenues Report

Revenues are up 42.66% compared to June, finishing the month at $58,905.97. The overall revenue increase was largely driven by an outsized L1 harvest in July, which consisted of both June and July’s yield. L2 revenues were slightly down compared to June, due to a steady decrease in activity on L2s and lower market price of farming emissions received.

Overall as mentioned above, the Collective secured a healthy surplus of 82.97%, which will be recycled into supporting mission-critical projects.

Impact Report

Mainnet

Mainnet activity was low during July, as shown by the record low gas expenses above and only involved the ants claiming June and July’s farming rewards and removing our liquidity from both Maverick BP#2 and BP#3. This liquidity is to be redirected into DeFi’s most productive stablecoin farm, which also falls within the Collectives mandate.

I am sure some of you clever ants can work this out, but you will have to wait for next month’s treasury report to find out.

Arbitrum

Operations remained steady on Arbitrum during July, with continued vote-only support for our core positions LUSD/USDC, PSM/LUSD, and wETH/POOL. In addition to this, a portion of vote support has been directed to blue chip pools on Ramses to further bolster the treasury assets which allow for further impact on other chains.

Optimism

The liquidity management strategy changed course slightly on Velodrome during July. In previous months we had migrated our core positions to the new Slipstream CL pools. Although these pools are far more efficient in terms of volume, they do not suit the Collectives’ liquidity management style as much as legacy pools do.

The change in strategy has seen all the Collectives’ core positions moved back to legacy volatile or stable swap pools which are receiving significant vote support. In addition to this, we are also providing supplementary voting support to the CL pools of these positions. This results in a harmonious relationship between the Collective who provide liquidity across the full range and will ensure the projects we support will always have liquidity and allows the more hands on LPs to actively manage and receive either fees they produce or increased VELO emissions due to our voting.

Base

Aerodrome also saw the same liquidity strategy change as its Optimism counterpart, with the Collective moving away from CL positions and ensuring we are providing reliable full-range liquidity for the pools we are supporting. This results in the Collective providing vote and bribe support for LUSD/USDC and POOL/LUSD pools, as well as a rainy day stash of ETH in the ETH/cbETH/wstETH pool.

As mentioned in the June report, the Collective continues to aggressively add to our veAERO position, which increased another 6.96% MoM.

Polygon-PoS

On Retro, the strategy remains consistent with the previous months, with the veRETRO voting power allocated to support Bluechip pools like wMATIC/wETH, wBTC/wETH, or wMATIC/USDC.

Mantle

The Mantle strategy remained the same during July with a vote-only strategy being conducted with a small amount of LUSD/USDC liquidity being provided on Cleopatra.

Linea

The Linea strategy remained the same during July with a vote-only strategy being conducted with a small amount of LUSD/USDC liquidity being provided on Nile.

Parting Words

July saw the Collective onboard our newest official contributor, Stengal who will be joining us as a Community Manager. Although it was his first month in his official position, Stengal has been an outstanding contributor to the Collective since he joined, winning Ant of the Month in June and writing content for the Collective over the previous months.

In July, we’ve also launched the Impact page on the website, which enables our community members to easily track the liquidity growth support we provide, and join in on the pools carried by the ants – have a look: Impact Dashboard – Liquidity Growth Support.

Although the markets have been choppy throughout July, the treasury management team is happy with the performance and high surplus we have maintained. This allows us to continue to add to positions and build firepower for when the next protocol is onboarded.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.