The DeFi Collective - July 2025 Report

Luude

Luude- August 13, 2025

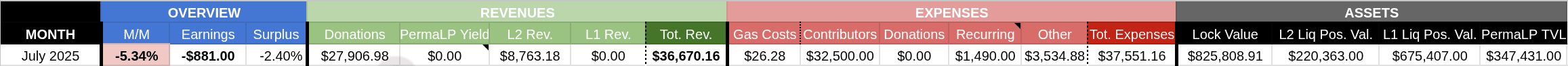

July delivered a steady performance for the Collective, with both expenses and earnings ticking down — though importantly, expenses fell further (-2.8% MoM), narrowing the gap to surplus. We ended the month just 2.4% shy of breaking even, with a shortfall of only -$881. However, this figure is slightly misleading, as the Collective’s Perma LP positions were not harvested in July.

Strategy-wise, very little changed, with the treasury primarily exposed to stable and ETH positions. This mix kept volatility muted while still delivering solid returns as we strive for sustainable, consistent performance.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

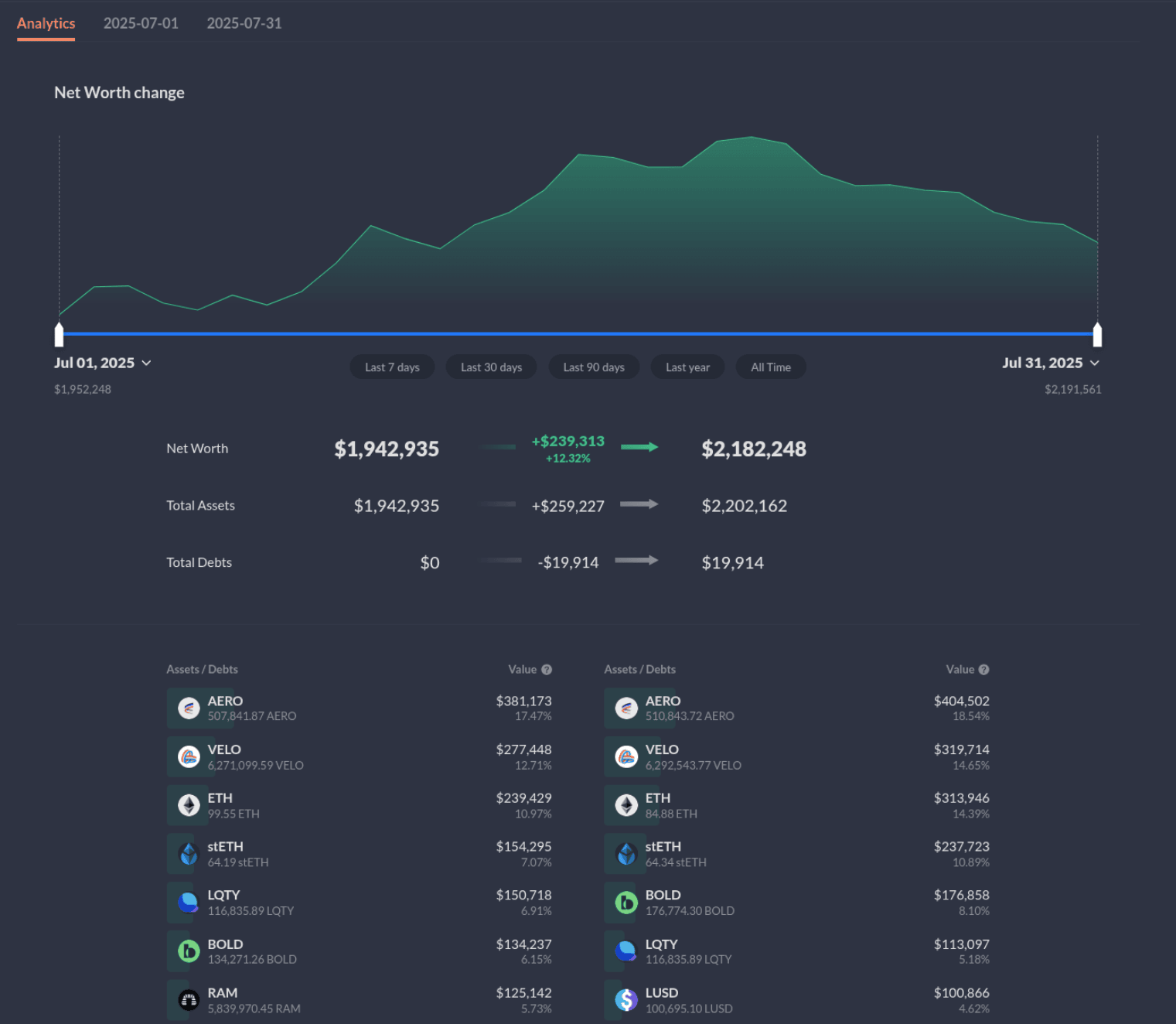

The treasury closed the month at $2,182,248 (+12.32% MoM, up from $1,942,935 in June). Gains in veAERO, veVELO, and ETH led the way, supported by a stable foundation in income-generating assets. By the end of July, locked assets made up 37.9% of the treasury, with L2 positions accounting for 10.1% and L1 positions representing 30.9%. Perma LPs comprised 15.9% of the portfolio, with the remainder held in smaller liquid positions and operational balances.

Expenses Report

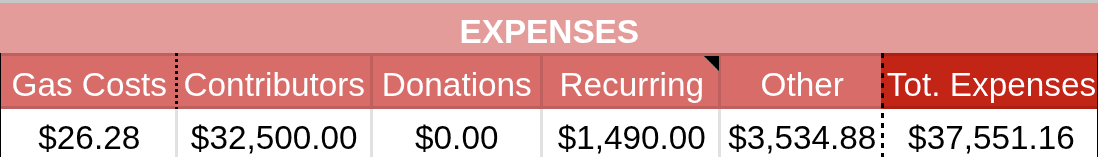

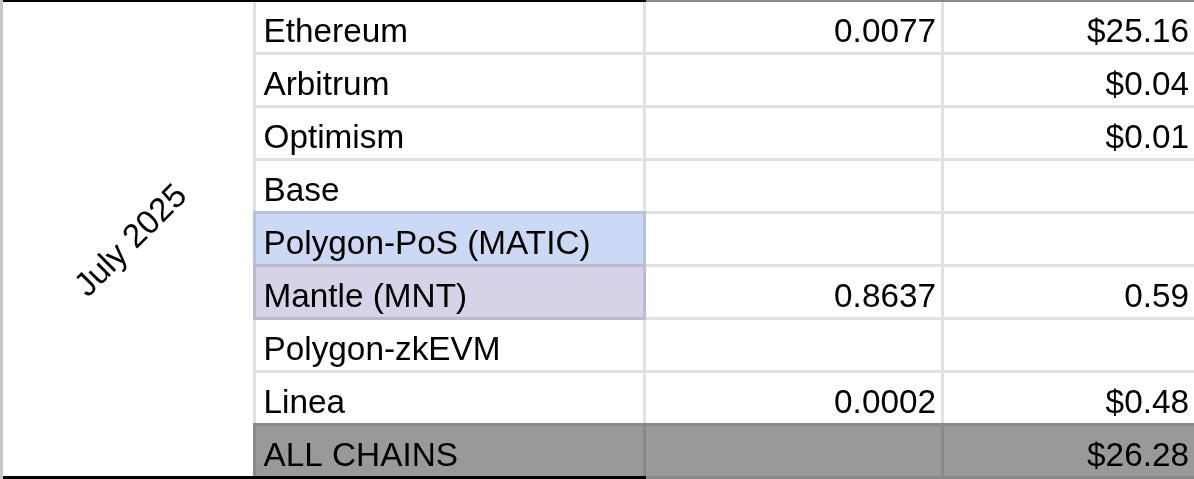

Total expenses came in at $37,551.16 (-15.57% MoM), driven by a -66.20% decrease in other one-off expenses. Contributor compensation stayed steady at $32,500 while gas costs were negligible at $26.28, thanks to minimal mainnet activity.

Expenses are expected to remain in this range with no foreseen increases on the horizon.

Earnings Report

Earnings closed July at a -$881 shortfall despite total revenues of $36,670.16 (-5.34% MoM). This small gap was the result of lower L2 revenues and the absence of any Perma LP harvests, which, if included, would have pushed July into a surplus. We remain optimistic about maintaining our current earnings trajectory, with market volatility and trading volumes, particularly on Aerodrome, and growing demand for BOLD across L2s will allow us to reach our goal of a treasury surplus by August.

The Collective remains well-capitalized, with stablecoin reserves alone providing over four years of operational runway. The BOLD PIL initiative once again proved its value, driving $27,906.98 in donations that directly strengthen our ability to maintain competitive APRs on both the Collective’s BOLD Perma LP and wider treasury positions. Layer 2 revenues contributed $8,763.18, with Base continuing to be the most consistent performer.

Impact Report

Mainnet

Mainnet saw very little activity throughout July, with the only notable movement being the transfer of ETH from Euler to Arbitrum. The treasury management team expects activity here to remain low over the coming months as operations continue to focus on L2s.

Arbitrum

Ramses revenue remained low, with no major changes to strategy. ETH from Euler on mainnet was deposited into Nerite, and USND was borrowed and deposited into the stability pool — continuing our support for Liquity v2-friendly forks. Vote support remains in place for the Collective’s WETH/POOL and PSM/WETH Perma LPs.

Optimism

Optimism operations remained steady throughout June, with vote support directed towards POOL/WETH, USDC/LUSD, USDT/LUSD, BOLD/USDC, and BOLD/LUSD. Additionally, the treasury team continues to optimize for revenues with voting support directed towards the high-volume WETH/USDC pool.

This strategy is yielding good results and is expected to continue in the coming months.

Base

Operations on Base remain steady, with continued vote support for the BOLD/POOL, BOLD/LUSD, and BOLD/USDC pairs. Additional bribe incentives, which come via the Collectives PIL initiative, are being directed toward the BOLD/LUSD and BOLD/USDC pools, further reinforcing their growth.

Mantle

Mantle operations continue unchanged.

Linea

Linea operations continue unchanged.

Perma LPs

The Collective’s Perma LP initiative continued to progress well in July, maintaining positions in POOL/WETH and BOLD/LUSD on Velodrome, BOLD/POOL on Aerodrome, and WETH/POOL and PSM/WETH on Ramses. No harvests were completed in July due to operational reasons. This revenue will carry across to August’s reporting and should all but guarantee a surplus is achieved.

Parting Words

With the market rebounding, our revenues followed suit, bringing us within touching distance of a sustained surplus. The aim now is not just to cross that line, but to hold it month after month. That means staying patient, keeping our stable-backed runway intact, and moving decisively only when opportunities are worth it.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.