The DeFi Collective - June 2024 Report

Luude

Luude- July 15, 2024

Welcome to the Collective’s June impact and treasury report. As expected, the Collective’s overall revenues continued to move lock-step with the market and contracted compared to May. However, with expenses also down, the surplus is preserved, which leaves the Collective in a comfortable position moving into July. The impact was also steady, with a renewed focus on mission-critical protocols established across all chains.

Let’s dive in and see what the ants achieved in June without further ado.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

This report is also available in PDF format.

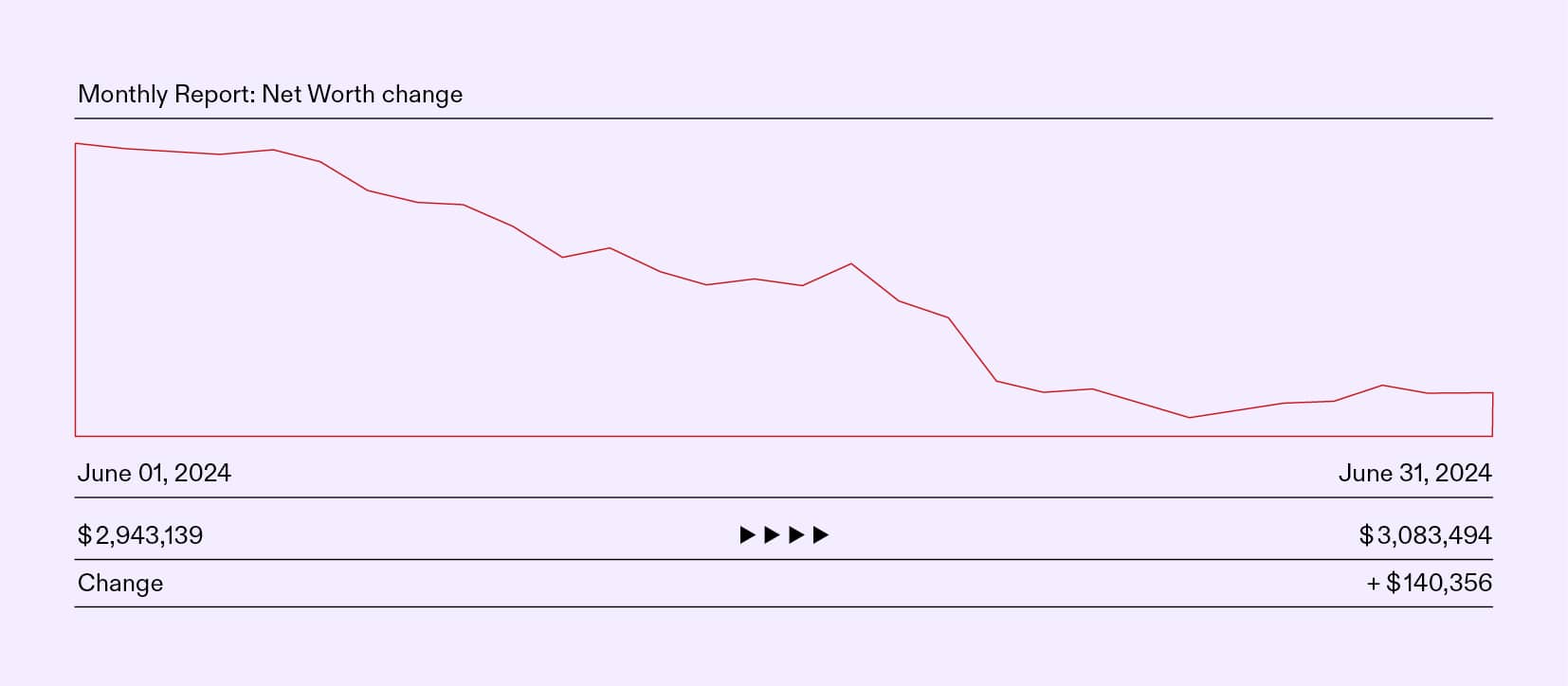

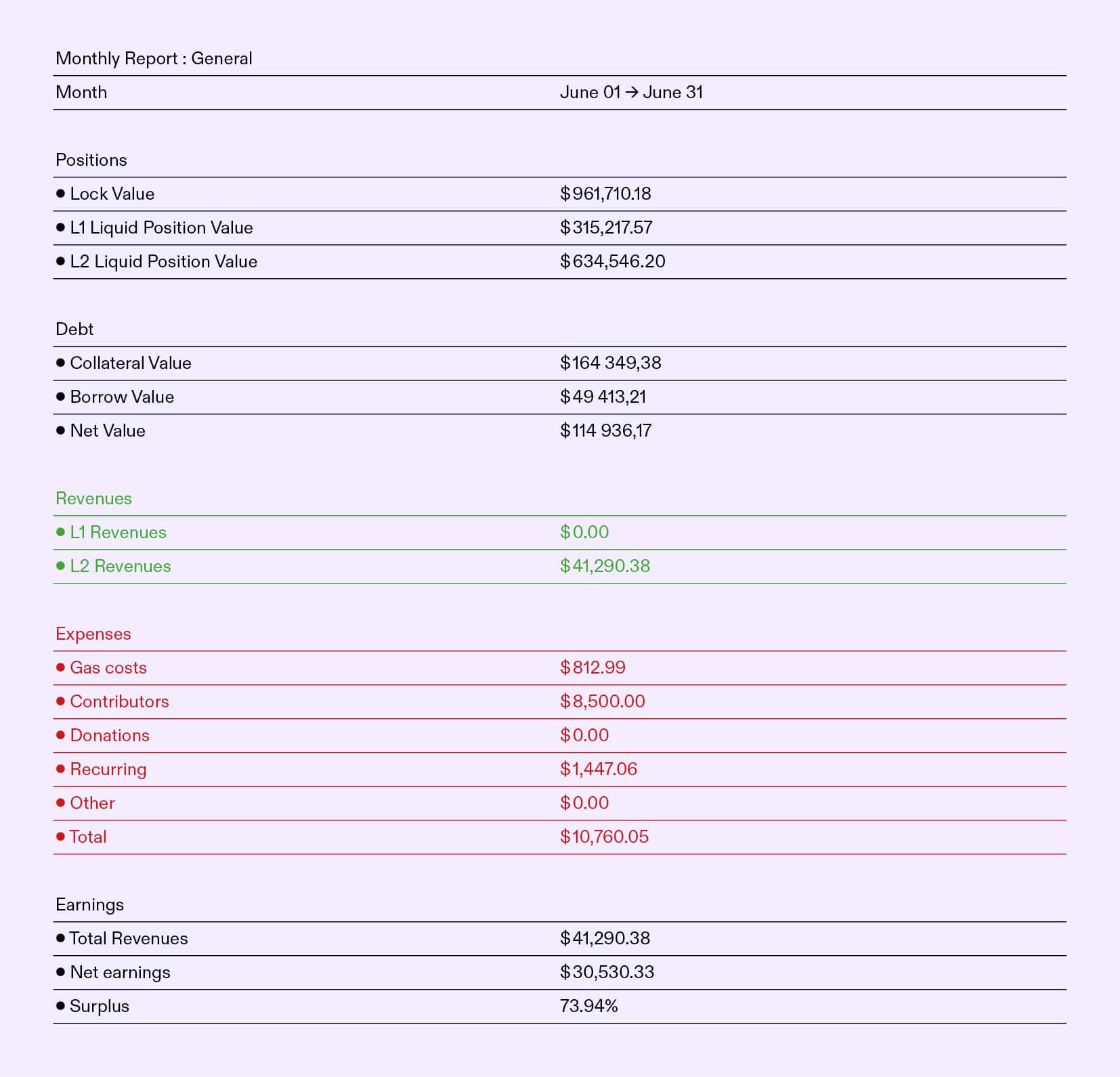

Treasury Report

The face value of assets controlled by the Collective (excluding grants) decreased by -30.81% in June, decreasing from $2,935,202 on the 1st of June to $2,030,737 by the 30th of June. The treasury decline compared to May was mainly driven by the contraction in the market, especially the Collective’s locked positions (veVELO, veAERO, and veRAM), which saw their face value fall almost 50% compared to May. However, this significant drop in value wasn’t entirely market-related, as the collective returned 3M veRAM to Ramses upon their request. More details about this asset return will be highlighted below.

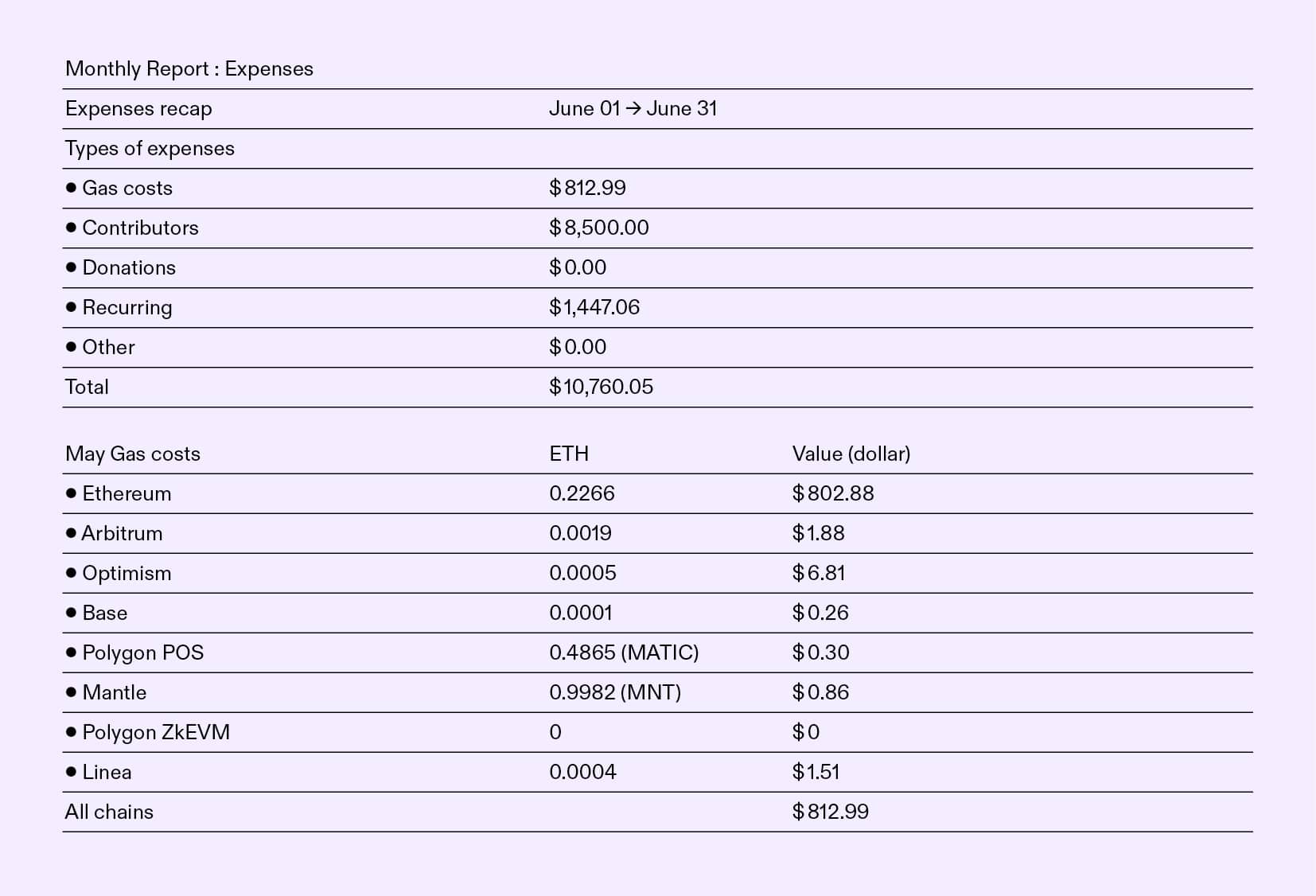

Expenses Report

Expenses returned to the expected baseline in June, with no one-off expenses. We expect expenses to remain steady over the coming months, allowing the treasury management team to bolster our firepower as we head into the latter half of the year.

Gas costs increased significantly compared to May, the Collective’s lowest month ever. The increase was primarily due to the creation of Maverick v2 LUSD/USDC BP#2 and BP#3. The Collective also migrated its DYAD position to the v2 contract, which saw further mainnet operations increase gas expenses. Gas costs on L2 chains remained steady and moderate, as observed since Dencun.

Revenues Report

Revenues are down 28.04% compared to May, settling at $41,290.38 for the month. The revenue decrease was primarily due to the falling market price of assets yielded during farming operations and the Collective’s reduced veRAM position removing some voting firepower. In addition, the treasury management team did not harvest mainnet positions in June, which will be carried over into the July harvest.

Although revenues were down compared to May, due to the reduced expenses outlined above, the Collective increased its surplus, which leaves us in a very healthy position even with decreasing revenues.

Impact Report

Mainnet

As discussed briefly above, the ant’s activity on mainnet increased slightly during June as Maverick released their long-awaited v2 implementation. The treasury team quickly deployed and incentivized two LUSD/USDC boosted positions with BP#2 being a static pool and BP#3 being a both-mode pool.

We also migrated our DYAD balance to the v2 contract, re-deployed liquidity to the Uniswap DYAD/USDC pool, bridged our LQTY balance from Arbitrum back to mainnet, and staked.

Beyond this, no other farming operations were performed during June.

Arbitrum

The ant’s operations on Arbitrum took a step back during June. As mentioned above, a mutual agreement was decided between the Collective and Ramses to return the original gifted veRAM NFT that was donated to the Collective. This saw us return 3M veRAM to Ramses. Due to our significant farming and locking history on Ramses this still leaves the Collective with a significant amount of veRAM which will continue to be utilized to support our positions such as LUSD/USDC, PSM/LUSD and wETH/POOL.

Looking forward, our strategy will remain the same with voting support to these pools with the goal of maintaining liquidity for these pairs.

Optimism

The strategy on Optimism remained relatively unchanged during June. We continued to support LUSD/USDC, LUSD/HAI, POOL/ETH and fETH/LUSD pools with liquidity whilst also providing significant bribing and voting support for LUSD/GRAI, LUSD/USDT and LUSD/ETH in addition to the pools we provide liquidity to.

As Optimism has now firmly established itself as the home of the ants, we also moved across our LUSD Aave position from Arbitrum that is used to pay contributors and other expenses.

Base

As mentioned in the May report again, our operations on Base stayed consistent during June, with ongoing liquidity, voting, and bribe support for LUSD/USDC and POOL/LUSD continuing.

The ant continues to aggressively compound our veAERO position which grew another 6.85% MoM, now resulting in a substantial position that enables us to carry out efficient operations on Base. We plan to continue this strategy indefinitely as it yields good results.

Polygon-PoS

On Retro, the strategy remains consistent with the previous months, with the veRETRO voting power allocated to support Bluechip pools like wMATIC/wETH, wBTC/wETH, or wMATIC/USDC.

Mantle

The Mantle strategy remained the same during June with a vote-only strategy being conducted with a small amount of LUSD/USDC liquidity being provided on Cleopatra.

Linea

As discussed during the May report, the Linea LUSD/USDC position was being monitored and during June it was decided to remove a large portion of this position and move it to a more productive position, using the majority of the funds to seed a LUSD/USDC sAMM pool on Velodrome.

A small amount of LUSD/USDC liquidity remains on Nile, and a vote-only strategy similar to the one on Mantle is being conducted.

Parting Words

Unfortunately, June won’t be a month that the ants look back on fondly. We saw a sharp drop in treasury holdings, decreased revenues, and the biggest loss of them all: our first-ever contributor outside of the board members, Abmis, had to step away from his active role on the treasury team due to his increasing responsibilities at Velodrome and Aerodrome.

The Collective is highly grateful for Abmis and the work he has done while with us, and we are excited to see him joining one of DeFi’s best teams and close collaborators of the Collective. This isn’t goodbye to Abmis, as he will be around the Discord from time to time preaching the gospel that the Collective stands for.

We look forward to what July will bring, with the onboarding of our newest contributor, the increase in content, and the Collective’s continued support of the most resilient and important protocols in DeFi.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice, Abmis, and myself.