The DeFi Collective - June 2025 Report

Luude

Luude- July 16, 2025

Welcome to the Collective’s June treasury and impact report. As you’ll see below, June was an uneventful (finally!) and reasonably successful month for the Collective. Revenues remained steady while expenses were slightly higher, and prices finally caught up with the fundamentals, allowing Liquity to receive the love and attention it deserves.

This should be a quick and easy report to digest, so let’s dive in.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

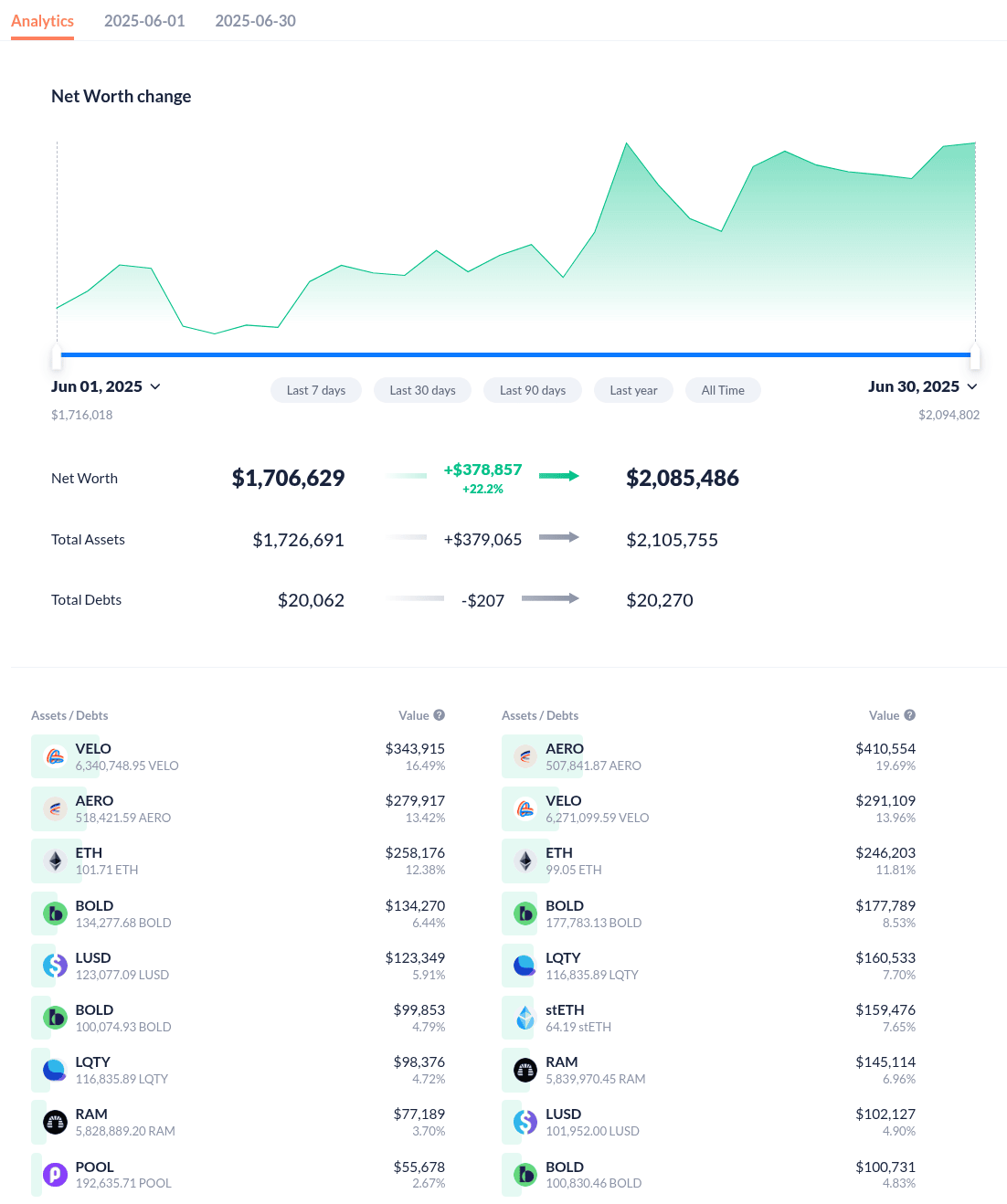

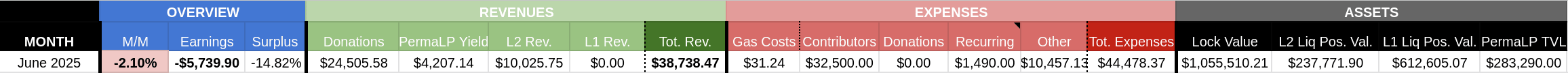

The face value of assets controlled by the Collective (excluding grants) increased by 22.2% in June, rising from $1,706,629 on June 1 to $2,085,486 by June 30. This total comprises 48% in locked assets, 11% in L2 liquid positions, and 28% in liquid positions on mainnet. The Collective’s Perma-LP wallet holds the remaining 13% in assets. The increase in treasury value was primarily driven by the price appreciation of the Collective’s veAERO holdings and an almost 100% increase in the LQTY position. It’s refreshing to see the market finally acknowledging the strong fundamentals of both protocols.

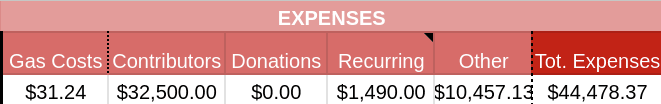

Expenses Report

Expenses remain higher than desired; however, given DeFiScan’s success and traction, these expenses are worthwhile. The Collective will continue to be frugal and expects costs to decrease in the coming months after the one-off expenses from our annual meetup and strategy planning session in Cannes at EthCC 2025 have been resolved.

Currently, the Collective is supported by a lean team of two full-time and five part-time contributors, covering key functions such as treasury management, business development and partnerships, community and marketing, protocol research, full-stack development, and data analysis.

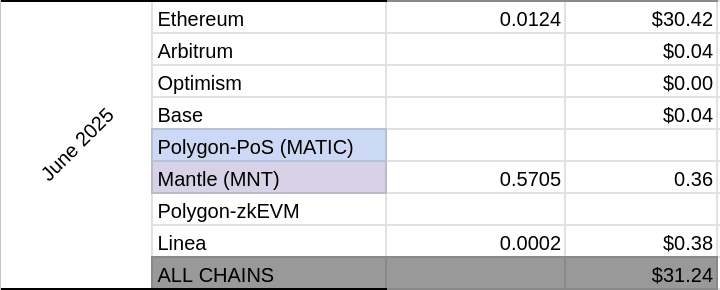

Gas expenses returned to baseline in June. We expect this trend to continue as the treasury management team conducts weekly operations on Mainnet to bridge BOLD PIL rewards to L2s. These rewards are then used to provide bribes on Aerodrome and participate in the perma-LP initiative on Velodrome.

Revenues Report

Earnings fell by 2.10% in June, declining from May’s spike to close the month at -$5,739.9. This decrease was driven by slightly higher expenses and lower revenues. We aren’t too concerned about this small setback as market volatility appears to be increasing along with demand for BOLD across L2s.

The Collective can remain solvent longer than the market stays retarded: our current stablecoin reserves enable us to sustain more than four years.

The Collective’s BOLD PIL initiative continues to drive impressive results with $24,505.58 in donations to the Collective, enabling us to increase APRs on both the Collective’s BOLD perma-LP position and general treasury positions. This cohesive flywheel is working well and demonstrates what a great liquidity mechanism Liquity has brought to market.

Impact Report

Mainnet

Mainnet operations were minimal throughout July, with activity limited to a small adjustment of the Collective’s BOLD trove and bridging of PIL rewards to L2s. The treasury management team anticipates this limited activity will continue, with the only manual task being the occasional claiming of rewards from the Collective’s LQTY position, which we will complete every few months.

Arbitrum

Operations on Arbitrum continue to be limited, with the Collective’s sizable veRAM position generating just over $400 for the month. Unfortunately, we don’t see conditions improving soon, but we will continue to generate as much revenue as possible from this position to fund further treasury initiatives and cover expenses.

Vote support continues for the Collectives WETH/POOL and PSM/WETH perma-LPs.

Optimism

Optimism operations remained steady throughout June, with vote support directed towards POOL/WETH, USDC/LUSD, USDT/LUSD, BOLD/USDC, and BOLD/LUSD. Additionally, the treasury team continues to optimize for revenues with voting support directed towards the high volume WETH/USDC pool.

This strategy is yielding good results and is expected to continue in the coming months.

Base

Operations on Base remain steady, with continued vote support for the BOLD/POOL, BOLD/LUSD, and BOLD/USDC pairs. Additional bribe incentives which come via the Collectives PIL initiative, are being directed toward the BOLD/LUSD and BOLD/USDC pools, further reinforcing their growth. This strategy has proven highly effective, with both pools surpassing $5 million in TVL while maintaining strong, sustainable APRs.

Mantle

Mantle operations continue unchanged, with no real change in monthly revenues to report.

Linea

Linea operations continue unchanged.

Perma LPs

The ants’ Perma-LP initiative continued to see steady growth throughout June. Current positions include POOL/WETH and BOLD/LUSD on Velodrome, BOLD/POOL on Aerodrome, and WETH/POOL and PSM/WETH on Ramses. Together, these positions account for approximately 13% of the Collective’s treasury assets and generated $4,207.14 in yield during June, some of which is being reinvested to compound growth.

The Perma-LP strategy remains a long-term commitment. These positions will continue to expand over the coming months, reinforcing a strong and sustainable liquidity foundation for the supported pairs.

Parting Words

June built on the momentum from May, and while there’s still work ahead to reach a sustained surplus, we’re confident that the goal is within reach.

It was also great to see some of the team come together in Cannes for EthCC to align on the path forward for the Collective.

The future of DeFi remains bright, and the Collective will continue to serve as stewards of the vision we all share.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.