The DeFi Collective - March 2025 Report

Luude

Luude- April 10, 2025

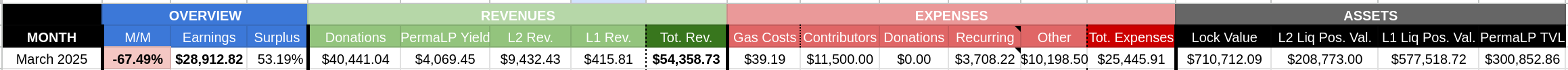

March continued the challenging trend from February, delivering further setbacks for the Collective. Revenues declined, expenses rose, and our newest DeFi partner, SIR Protocol, suffered an exploit that led to asset losses for the ants.

Despite the difficulties, the Collective maintained a 50% earnings surplus, largely thanks to a generous contribution from the Ethereum Foundation. Meanwhile, the ants remained committed to making a positive impact within genuine DeFi.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

While March was disappointing, let’s take a closer look at the details and how the treasury management team plans to navigate toward stronger results.

Treasury Report

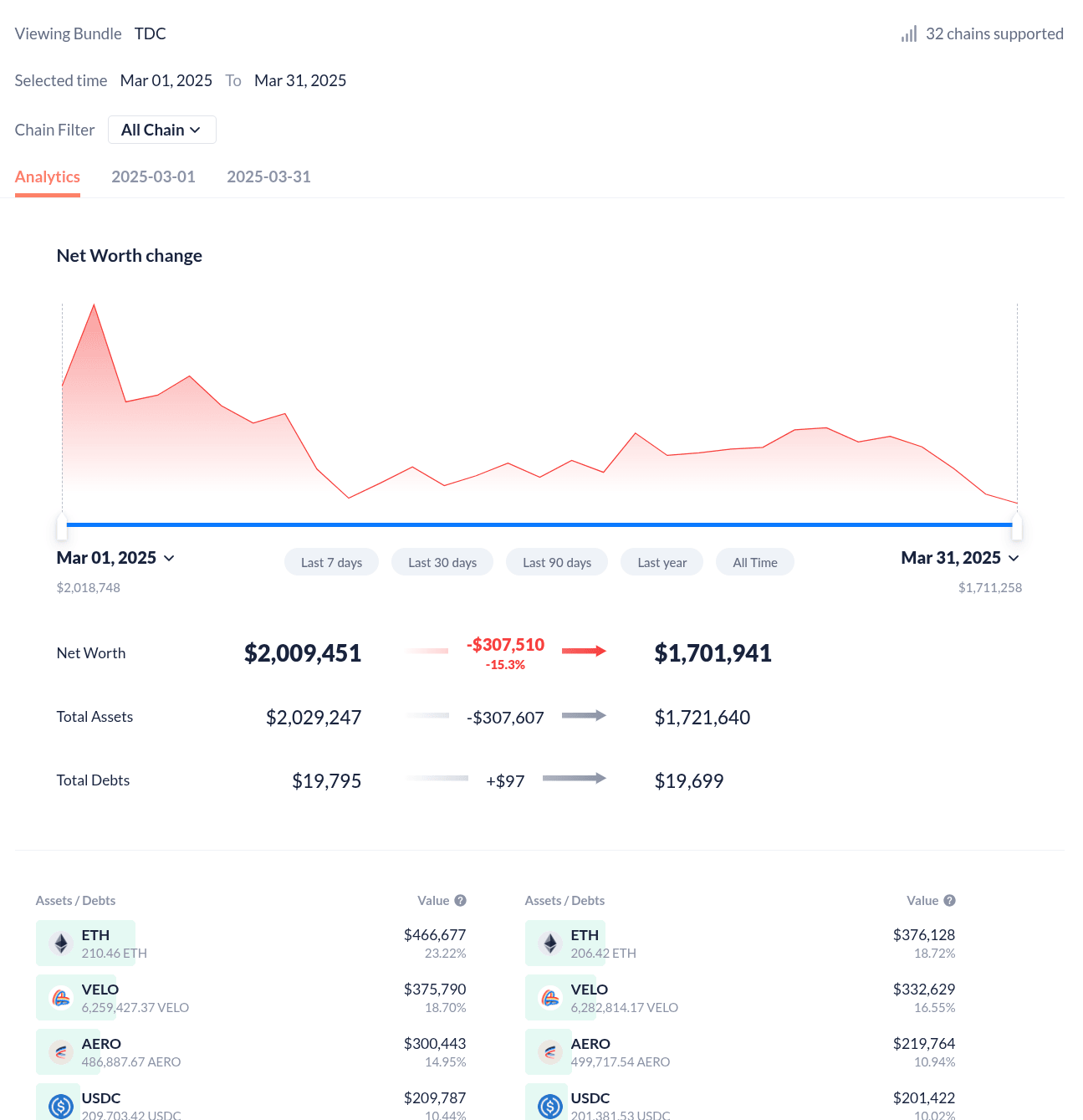

The face value of assets controlled by the Collective (excluding grants) decreased by 15.3% in February, falling from $2,009,451 on March 1 to $1,701,941 by March 31. This total comprises 40% in locked assets, 12% in L2 liquid positions, and 32% in liquid positions on mainnet. The Collective’s Perma-LP wallet holds the remaining 16% in assets. This slight decrease in treasury value was primarily driven by the continued downturn in the Collective’s liquidity-driving positions, compounded by broader market declines affecting the value of liquid assets. Given the persistent downward trend in recent months, the treasury management team will emphasize revenue growth and increasing holdings of strategic assets.

Expenses Report

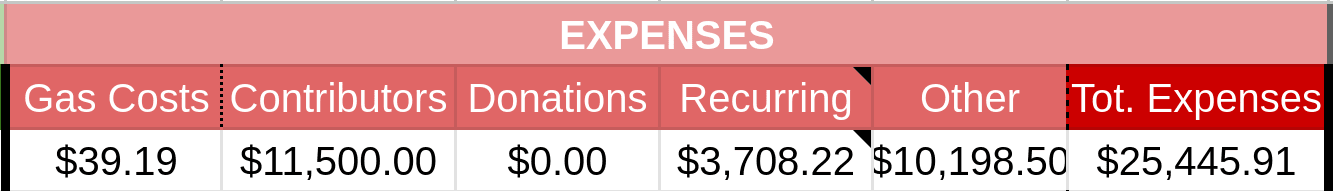

Expenses saw a slight increase compared to February, driven by the renewal of annual subscriptions and ongoing investments in scaling DeFi Scan. Contributor expenses remained stable at $11,500 for the month, covering a team of nine paid contributors. These resources span treasury management, business development and partnerships, community and marketing, protocol research, full-stack development, and data analysis.

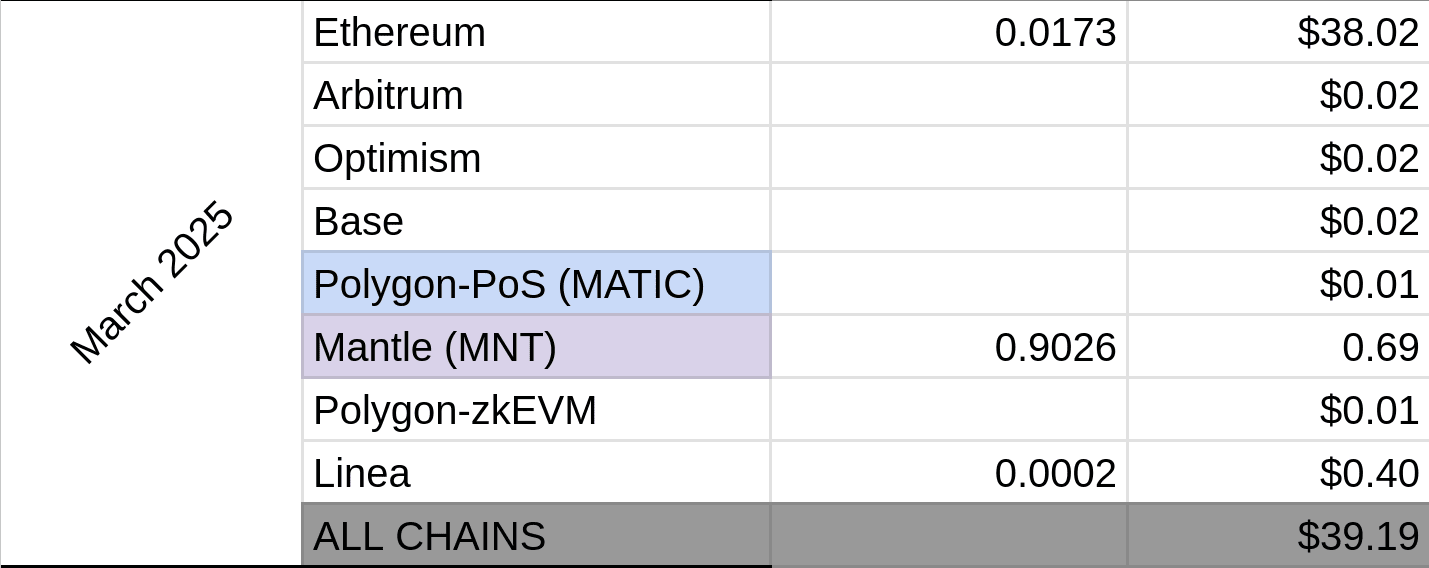

Gas expenses remain negligible due to low mainnet base fees and the majority of the L2 treasury operations being sponsored by Safe.

Revenues Report

Earnings fell by 67.49% in March compared to February, closing the month at $28,912.82. This sharp decline was partially offset by the first of three 12.49 ETH ($26,000) grants from the Ethereum Foundation. These grants will be used to scale DeFi Scan and further the Collective’s mission of supporting genuine DeFi.

Both L1 and L2 revenues dropped significantly from previous months, largely due to reduced activity across all chains ahead of the BOLD relaunch. As noted earlier, the treasury management team will renew its focus on revenue growth, aiming to build strategic assets that will be deployed in the months ahead.

Impact Report

Mainnet

In March, the Collective began supporting SIR Protocol, which was in the process of submitting a DeFiScan review, and donated 6.7 million SIR tokens to the Collective. These were paired with 6 ETH from the treasury and deployed into the SIR/ETH Uniswap V2 pool. The intention was to establish a stable liquidity foundation for SIR on mainnet as the protocol scaled. 15 ETH were also supplied to the ETH/USDC vault.

Unfortunately, just weeks after the partnership began, SIR Protocol was exploited through a complex vulnerability, resulting in the complete loss of the protocol’s TVL and liquidity — including the 21 ETH total provided by the Collective.

A detailed report on the SIR partnership and subsequent exploit will be published soon.

Looking ahead, mainnet operations will remain in a holding pattern as the ants await the relaunch of BOLD. A significant portion of ETH and stablecoins remains deployed in auto-compounding positions on mainnet, helping to navigate the current market volatility.

Arbitrum

Our focus for March was to increase revenue on Arbitrum; however, we did not see the results we expected. Ramses saw a 35% drop in month-over-month revenue between February and March, resulting in a significantly lower return on the Collective’s veRAM strategy than anticipated.

Going forward, we will maintain our revenue-focused approach and continue support for the wETH/POOL perma-LP position.

Optimism

The treasury management team maintained steady operations on Optimism throughout March by providing continued voting support for both LUSD and POOL pools on Velodrome. To maintain a steady revenue stream that can be used to cover expenses, the team focused on growing revenues by voting for bluechip high-fee pools.

Additionally, the ants enjoy a steady stream of ETH thanks to our LUSD and USDC positions on PoolTogether.

Base

Aerodrome operations remain steady, with voting support focused on the BOLD/POOL and LUSD/USDC pools. Additionally, the Collective’s remaining voting power is being used to increase revenues and fund operations.

Given its success, this strategy is expected to continue over the coming months.

Polygon-PoS

A vote-only strategy on Retro remains in place, yielding very little results, because of the very limited activity overall on Retro. We are starting to phase out Polygon-PoS-related operations.

Mantle

The Collectives vote-only strategy on Cleopatra remains, with low results varying from week to week. This strategy will continue indefinitely.

Linea

The vote-only strategy continues on Nile, with modest results recorded. This strategy will be maintained going forward to contribute to treasury growth.

Blast

A vote-only strategy on Fenix remains in place, yielding very little results. This strategy will continue indefinitely.

Perma LPs

The Collective’s Perma-LP initiative continued throughout March, although the unfortunate events surrounding the newest addition, SIR Protocol, dampened the positive outcomes achieved.

Overall, we are pleased that 16% of the Collective’s treasury assets are committed indefinitely to supporting protocols. This gives them the reassurance that a base level of liquidity is being built for their tokens, allowing them to focus on growing their products.

Parting Words

March was undoubtedly one of the most challenging months in the Collective’s history, and we are determined to avoid a repeat. However, the ants remain united and have been building significant momentum with other initiatives, notably DeFiScan. The grant from the Ethereum Foundation will be utilized to bolster DeFiScan’s resources, enabling the Collective to scale its operations, review additional protocols, and raise awareness of true decentralized finance.

We are optimistic about April and look forward to increasing our treasury surplus while continuing the Collective’s valuable work.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.