The DeFi Collective - May 2024 Report

Luude

Luude- June 15, 2024

Welcome to the Collective’s May impact and treasury report. Following the spike in March’s revenues and April’s expenses, May saw the Collective’s overall balance sheet settle to what we expect to be a baseline going forward, with revenues and expenses closing the month at more sustainable levels as the overall market consolidates sideways. Impact levels also increased with another mission-critical protocol onboarded into the colony, as shown below.

Let’s dive in to see what was on the menu in May.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

This report is also available in PDF format.

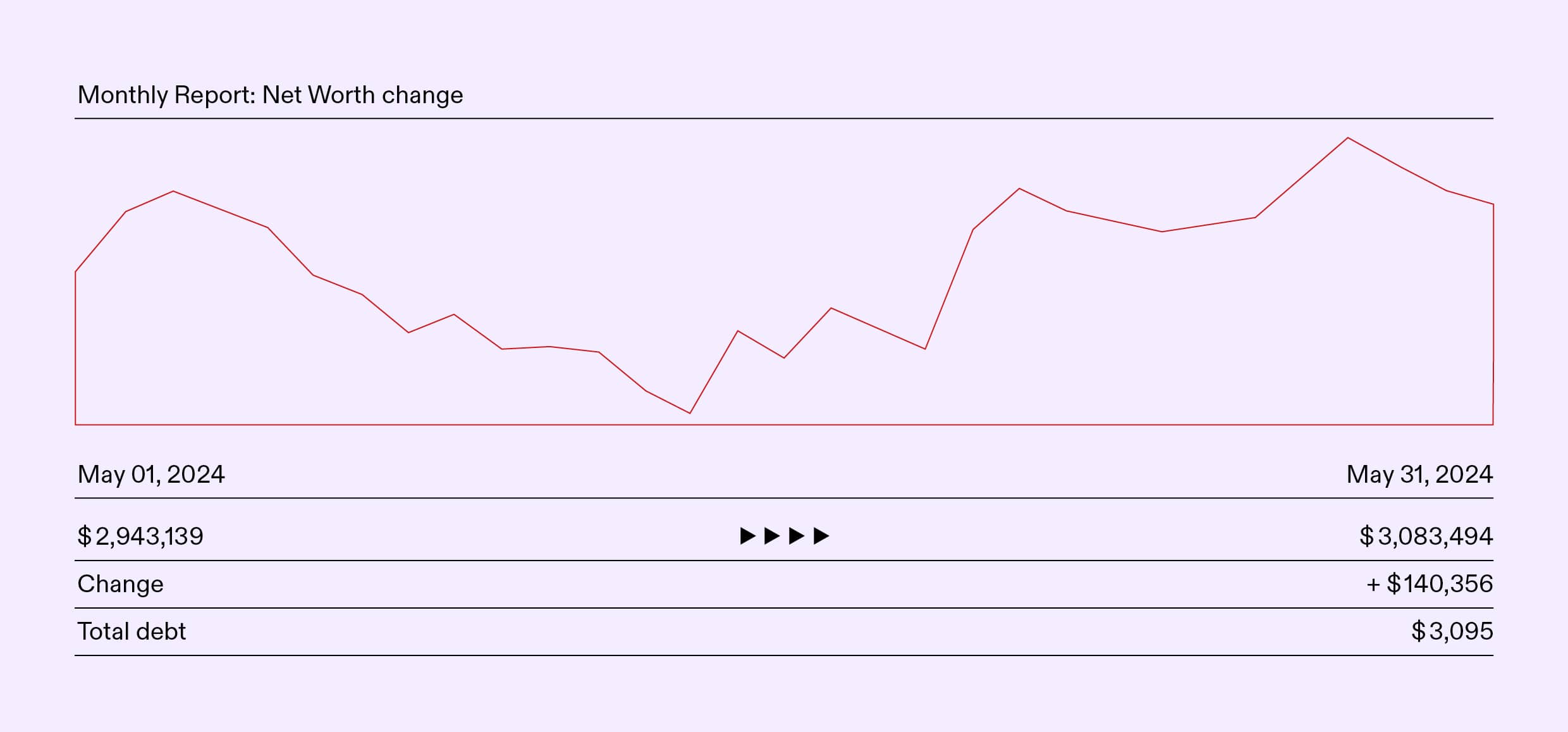

Treasury Report

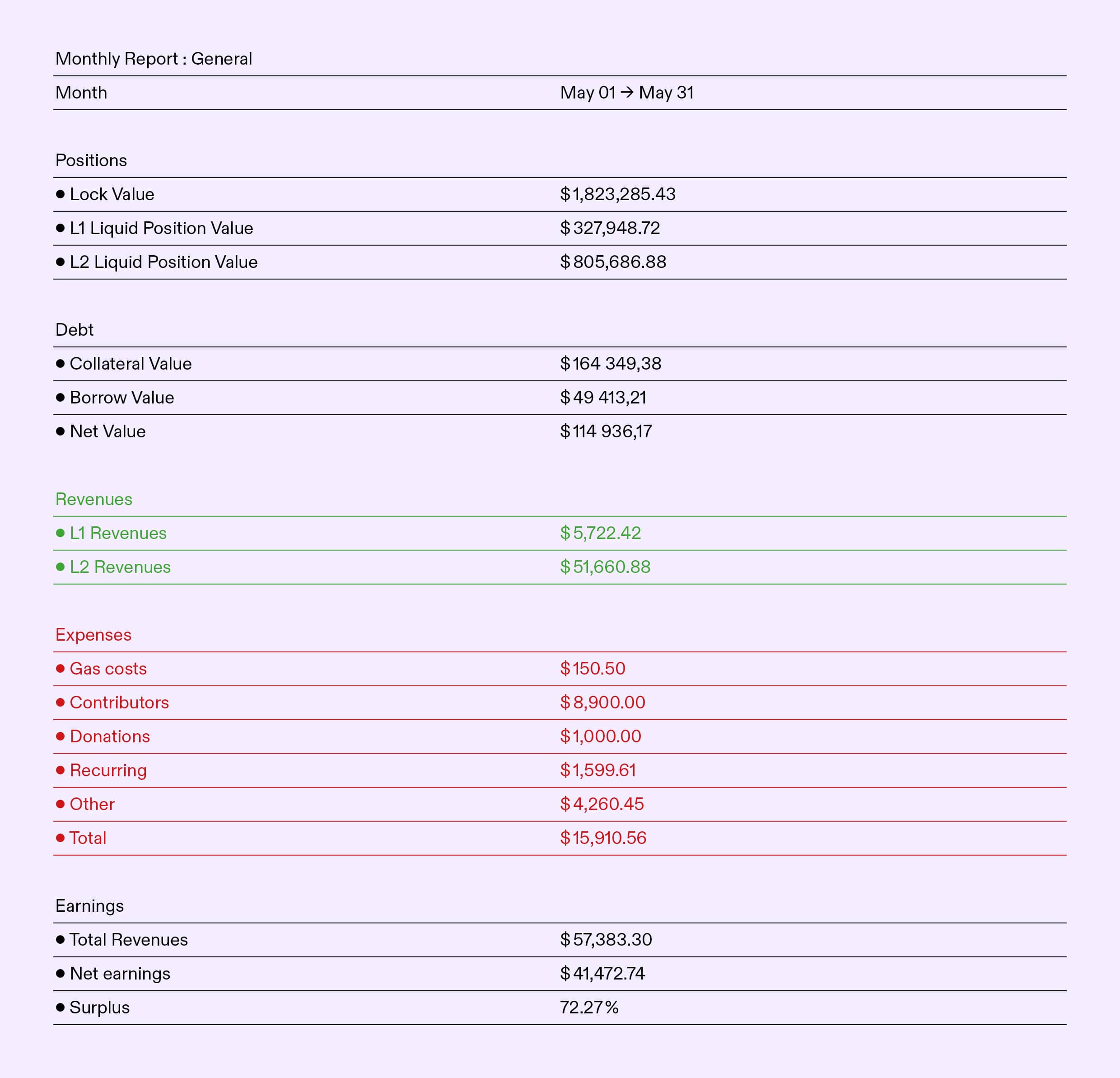

The face value of assets controlled by the Collective (excluding grants) increased by 4.77% in May, increasing from $2,943,139 on the 1st of May to $3,083,494 by the 31st of May. The treasury increase over May was marginal, driven mostly by existing holdings rebounding a little after April’s decline, the Collectives’ consistent farming efforts are doing their job at growing the treasury sustainably over time.

No new chains were launched in May, however, the Collective initiated support for Possum Labs, receiving a PSM grant which has been paired with assets from the Collectives treasury to ensure robust liquidity for PSM on Arbitrum. Further details of the Collective’s partnership with Possum Labs will be outlined in the Impact Report below.

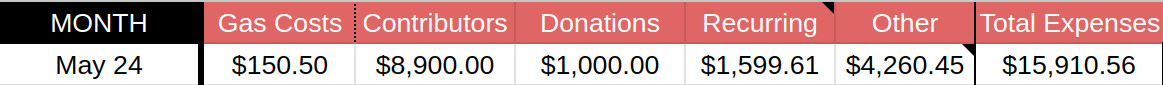

Expenses Report

Expenses were up slightly in May, mostly due to one-off expenses like the Collective contributors getting together to spread the Ant gospel at ETH Belgrade. Contributor expenses were also up as the one-month lag for contributor payments caught up after onboarding our new content strategist in April. The Collective also continued to support those who support our cause by donating 1000 LUSD to 0xKhmer who builds & maintains a comprehensive gas tracking Dune analytics dashboard allowing the Collective to streamline the accounting of gas-related expenses.

Gas costs were down significantly in all previous months, with minimal Collectives operations on the mainnet, a low L1 base fee, and the optimizations achieved on L2s via the Dencun upgrade. Ethereum is scaling nicely!

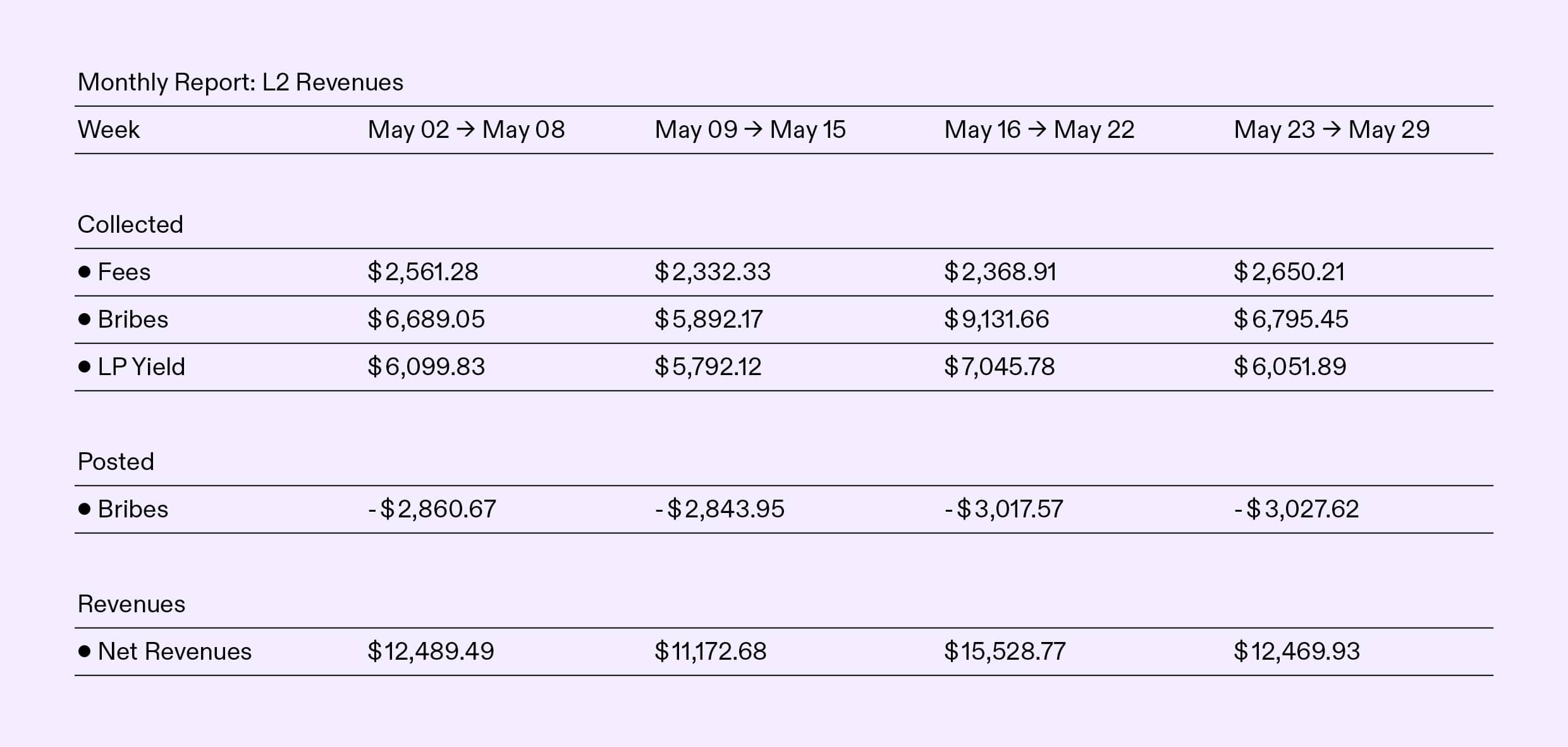

Revenues Report

Revenues are up 17.57% compared to April, settling at $57,383.30. The revenue increase was primarily due to the reduction in incentivization-related expenses compared to April, with total income for May being the third best month behind March and April. We expect this to become the new baseline as we continue our work supporting mission-critical protocols, regardless of the earnings they provide.

As always, we strive for sustainability, with our total revenues at a 72.27% surplus over the expenses. This allows us to scale up our support for existing partners and accumulate firepower to onboard the next mission-critical protocols we identify.

Impact Report

Mainnet

The ants’ operations on Mainnet have slowed significantly over the past months, with ongoing support continuing for DYAD/USDC and a POOL position provided as liquidity in Across to facilitate the bridging of POOL between mainnet, Arbitrum, Optimism, and Base.

We expect this to continue as our Mainnet operations have no signs of picking up in the near future.

Arbitrum

Arbitrum was again at the forefront of the ants’ operations in May, when the Collective began to support Possum Labs and their PSM token. This partnership consisted of Possum donating $30k of PSM to the Collective, which was paired with $30k of LUSD from the treasury and provided as liquidity on Ramses via a wide-range CL pool.

The Collective also continued to provide voting and bribing support for LUSD/LQTY, POOL/WETH, LUSD/USDC, and now the PSM/LUSD throughout the month, which has resulted in these pools delivering attractive returns and maintaining substantial liquidity.

Optimism

The Collective’s operations on Velodrome saw some slight changes throughout May. We tidied up some smaller LP positions and added a fETH/LUSD Slipstream pool, which allows f(x) Protocol to have fETH liquidity on Optimism for the first time.

Support continued for LUSD/GRAI for most of the month, but this position was ultimately consolidated into other LP positions to streamline the management of liquidity positions on Velodrome.

Significant bribe and voting support continued for LUSD/USDC, LUSD/ETH, LUSD/fETH, LUSD/USDT, LUSD/HAI, LUSD/GRAI, POOL/ETH throughout the month.

Base

Operations on Base stayed consistent during May, with ongoing liquidity, voting, and bribe support for LUSD/USDC and POOL/LUSD continuing.

The ants continue to be AERO bulls, locking another 25k AERO, which saw our position grow 8.76% month over month. Our treasury management team will continue to follow this strategy, believing our impact on Base will only increase over the coming months and years.

Polygon-PoS

On Retro, the strategy remains consistent with the previous months, with the veRETRO voting power allocated to support Bluechip pools like wMATIC/wETH, wBTC/wETH, or wMATIC/USDC.

Mantle

The Collective’s vote-only strategy continued on Mantle, with a small amount of LUSD/USDC liquidity provided on Cleopatra. This position continues to be monitored, and if activity on Mantle increases, it can be scaled up.

Linea

In the April treasury report, we highlighted a mysterious LUSD bull who had been bribing the LUSD/USDC pool quite substantially. Unfortunately, this has stopped, and this pool has become much less productive for us. We still maintain a sizable, six-figure LUSD/USDC LP there; however, this position is currently under review to be better utilized elsewhere.

Parting Words

Although May didn’t deliver the revenue we saw in March or quite the impact we saw in April, we believe this is what the colony can expect as a standard month going forward. It was great to see that although the market and prices of our assets consolidated, we continue to have a healthy surplus and are consistently growing firepower to support the next protocol we plan to onboard.

Some very exciting conversations are happening in the background with potential new partners and some of our existing partners, so be sure to keep your eyes and ears on our socials to see what the ants are cooking.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice, Abmis, and myself.