The DeFi Collective - May 2025 Report

Luude

Luude- June 15, 2025

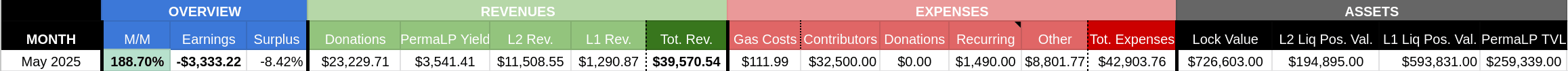

The April treasury report outlined the Collective’s mission to return to a revenue-over-expenses surplus by August 2025, and we’re pleased to share that May marked meaningful progress toward that goal. While May still closed with a negative balance, the deficit was significantly reduced compared to April, bringing us much closer to surplus territory.

This improvement has been driven in part by the recent BOLD relaunch. The treasury management team successfully redeployed a substantial amount of liquidity across L2s, and the Collective has also benefited from strong participation in BOLD’s PIL initiative, which supports the expansion of BOLD liquidity on L2s.

With that, let’s dive into May’s treasury report, one that’s (finally) exciting to write.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

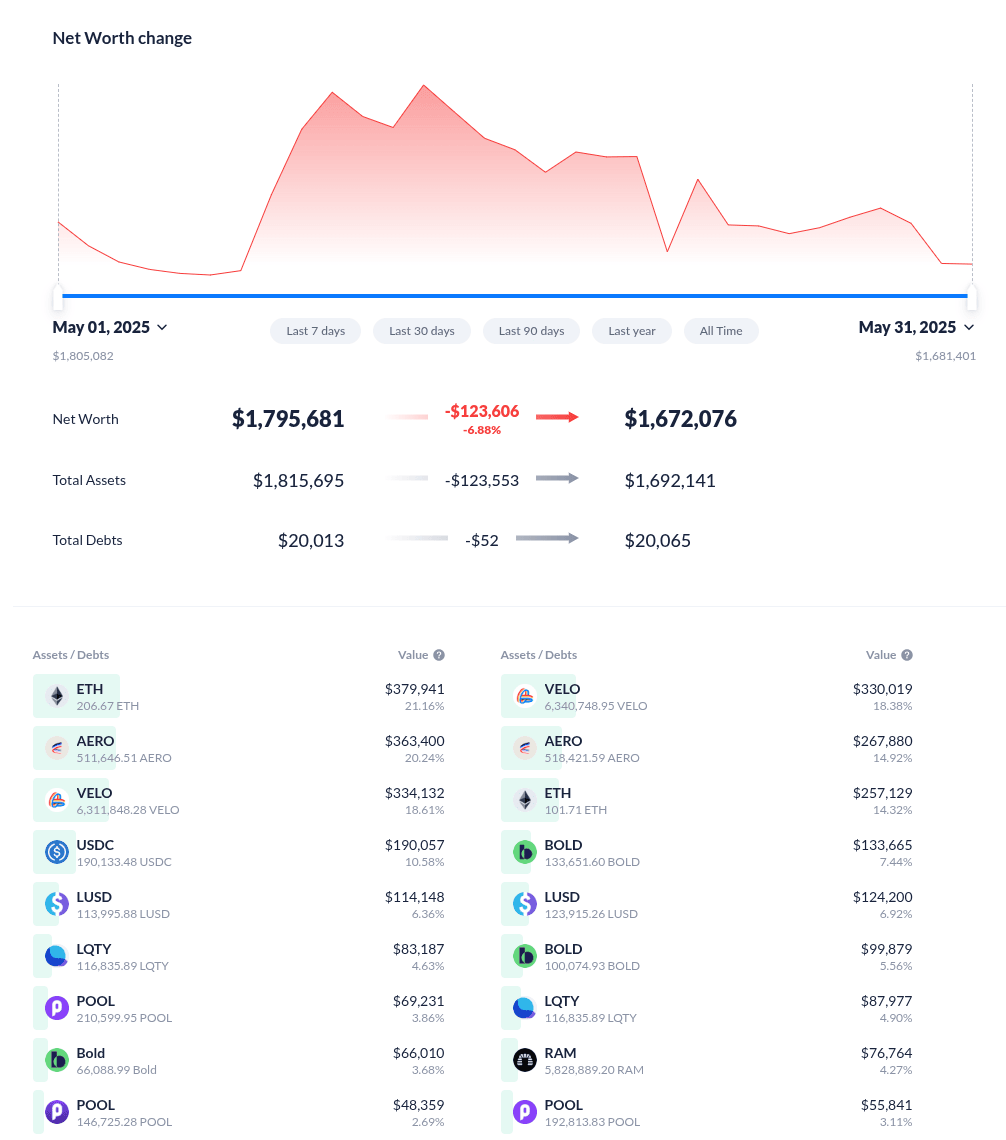

Treasury Report

The face value of assets controlled by the Collective (excluding grants) decreased by -6.88% in May, falling from $1,795,681 on May 1 to $1,672,076 by May 31. This total comprises 41% in locked assets, 11% in L2 liquid positions, and 33% in liquid positions on mainnet. The Collective’s Perma-LP wallet holds the remaining 15% in assets. The decrease in treasury value was primarily driven by the ongoing decline in the Collective’s liquidity-driving positions, further compounded by broader market downturns affecting liquid asset valuations. However, the treasury has remained relatively resilient compared to the overall market, largely thanks to its substantial stablecoin holdings.

Expenses Report

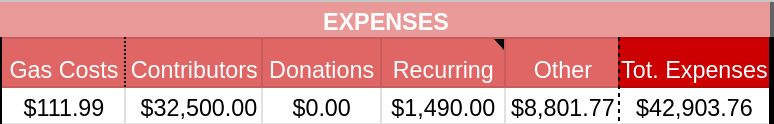

Following April’s record-high expenses, the Collective focused more on cost reduction and saw modest progress in May. This decrease was largely due to the unfortunate departure of two part-time contributors, Spicypiz and CookingCrypto, although they remain open to collaborating on a task-by-task basis.

Looking ahead, the Collective remains committed to further lowering expenses where possible. Combined with efforts to grow earnings, this strategy keeps us on track to return to a surplus in the coming months.

Currently, the Collective is supported by a lean team of two full-time and five part-time contributors, covering key functions such as treasury management, business development and partnerships, community and marketing, protocol research, full-stack development, and data analysis.

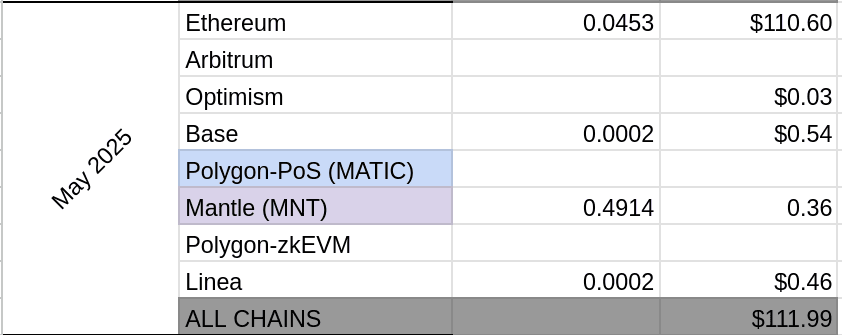

Gas expenses spiked during May due to the treasury operations associated with the BOLD redeployment. This gas spike is expected to be a one-off and fall back to baseline in June.

Revenues Report

Earnings rose by 188.70% in May, rebounding from April’s lows to close the month at -$3,333.22. This significant growth was driven by a 300+% increase in revenue, primarily fueled by higher L2 revenues and increased donations to the Collective. The boost was largely due to the BOLD PIL initiative, which saw the Collective capture approximately 18% of votes to expand BOLD liquidity on Optimism mainnet and Base.

Additionally, DeFi Scan gained strong community support, with 71 donors contributing through Gitcoin’s GG23 OSS round. These funds will be used to continue scaling DeFi Scan and to support the impactful work being done by the ants.

As previously noted, expenses decreased slightly following the departure of two part-time contributors. We sincerely thank them for their valuable contributions to the ants and the broader DeFi ecosystem.

Looking ahead, we remain focused on reaching our August revenue surplus target and will continue implementing cost-cutting measures to support this goal.

Impact Report

Mainnet

Mainnet operations remained active throughout May, beginning with the rebalancing of auto-compounding positions early in the month, followed by BOLD-related activities toward the end. The ants engaged with Liquity v2, staking our LQTY position and voting in the Collective’s PIL gauge. BOLD rewards from this initiative were used to strengthen the Collective’s Velodrome BOLD/LUSD Perma-LP and to fund bribes on Aerodrome BOLD pools. Additional operations included minting BOLD and depositing it into the ETH stability pool.

Looking ahead, mainnet activity is expected to decrease, with operations primarily focused on transferring BOLD from mainnet to Optimism and Base after each PIL vote.

Arbitrum

The disappointing decline of Ramses persisted throughout May, with no indication of a turnaround. Despite the Collective holding a sizeable veRAM position, it currently generates less than $100 in weekly revenue. The treasury management team will continue to generate as much revenue as possible from this position while monitoring for signs of recovery, at which point a potential BOLD position may be seeded.

Optimism

Following the relaunch of BOLD, the treasury team successfully split the LUSD/USDC position into two, seeding both a LUSD/BOLD pool and a BOLD/USDC pool. These pools benefit from strong vote support via the Collective’s veVELO position.

Additionally, the treasury management team continues to allocate a portion of veVELO voting power to optimize for revenue generation. This strategy performed well in May, contributing to the highest monthly revenue in recent memory.

Base

In a similar approach to Optimism, the ants deployed BOLD/USDC and BOLD/LUSD pools on Aerodrome. These pools receive vote and bribe support, leveraging the Collective’s sizeable veAERO position and 50% of the PIL rewards allocated from Liquity voters.

Mantle

Mantle operations continue unchanged, with no real change in monthly revenues to report.

Linea

Linea operations continue unchanged. May saw a slight increase in weekly revenues, which returned to levels seen in February.

Perma LPs

The ants’ Perma-LP initiative continues growing steadily, with additional capital allocated to these positions. In May, BOLD pools were redeployed on both Optimism and Base, including a BOLD/LUSD pool on Velodrome and a BOLD/POOL pool on Aerodrome. The Optimism BOLD/LUSD pool will receive ongoing liquidity support, as 50% of the Collective’s PIL rewards will be added to this pool each epoch.

These Perma-LP positions continue to generate modest but consistent revenues, a portion of which is reinvested to expand them further, ensuring sustained liquidity growth for the protocols the Collective actively supports.

Parting Words

May marked a meaningful turning point in the Collective’s journey back to financial sustainability. While challenges remain, the strong performance of our BOLD-related strategies, growing Perma-LP positions, and a renewed focus on lean operations have brought us measurably closer to our August surplus target.

This progress wouldn’t be possible without the continued support of LQTY voters and the broader community of DeFi participants, who believe in the long-term vision of the Collective and DeFi Scan.

We’re pleased with the positive change in direction and look forward to sharing even stronger results in the months ahead.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.

![The DeFi Collective - 1st Quarter Summary [Q4 2023]](/images/articles/tdc-q1-summary.jpg)