The DeFi Collective - November 2025 Report

TokenBrice

TokenBrice- December 17, 2025

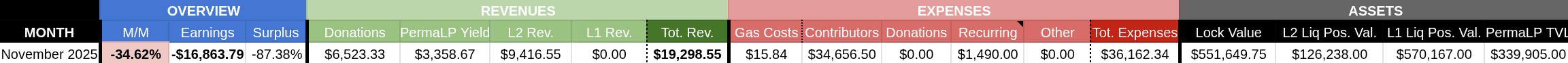

November was a harsher month for the Collective, closing its books in the red with a shortfall of - $16 863.79. This represents a drop of revenues of about 35% month-on-month.

Expenses and other revenues remained steady, and there were no major strategic adjustments to treasury composition. The focus remained firmly on sustainability and supporting our ecosystem partners.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

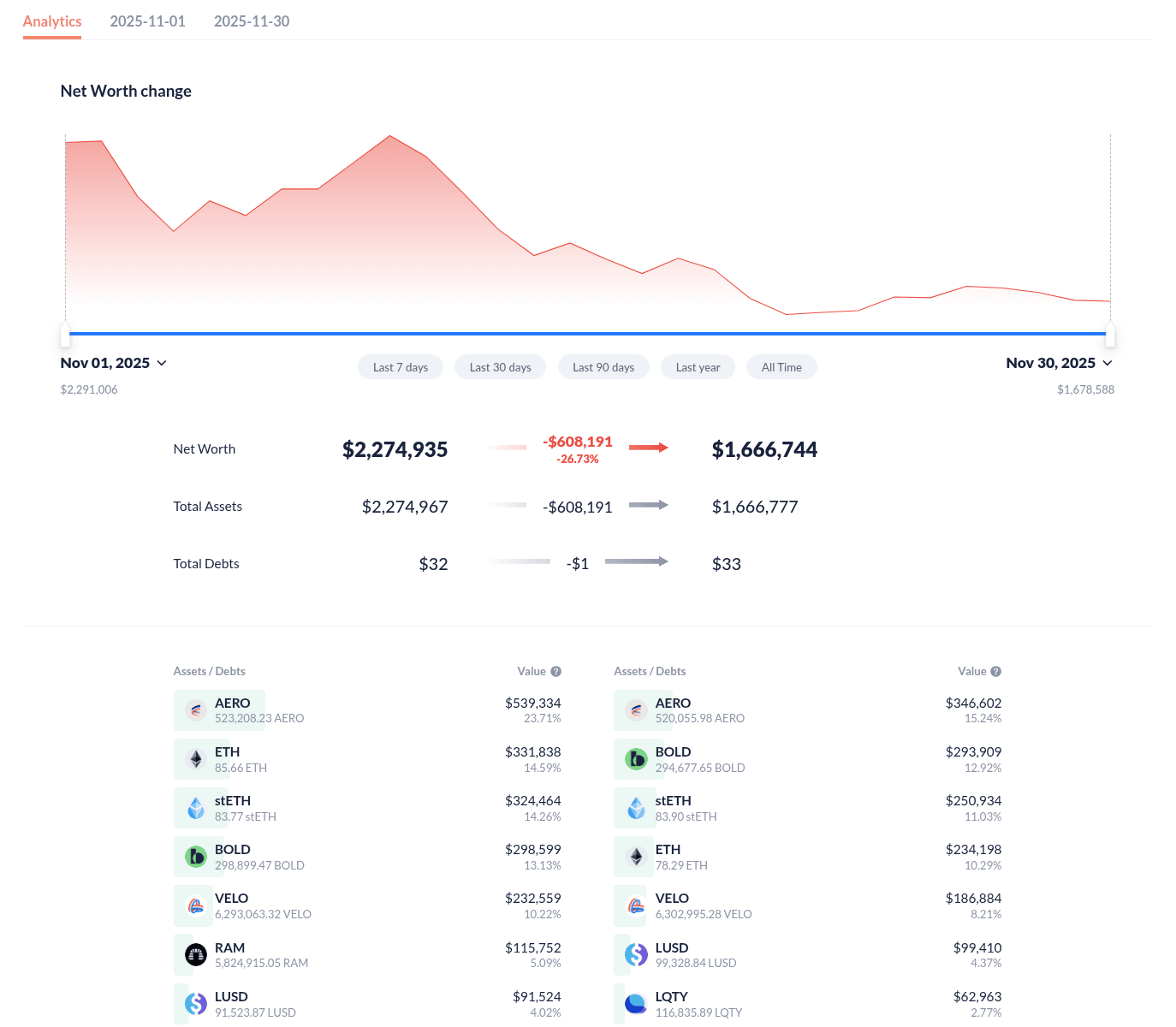

The treasury closed November at $1,666,744 (-26.73% MoM, down from $2,274,935 in October). Most asset values held steady, with the apparent drop primarily attributed to a pricing discrepancy on DeBank, which mispriced the Collective’s PSM holdings at the start of the month.

By month’s end, the treasury allocation stood at 35% locked assets, 8% in L2 liquidity positions, 36% in L1 liquidity positions, 21% in Perma LPs, and the rest held in liquid operational balances. Despite the accounting error in external data, the treasury remains well-structured and stable, with capital consistently deployed across productive assets.

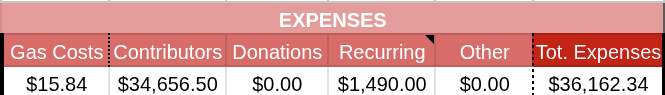

Expenses Report

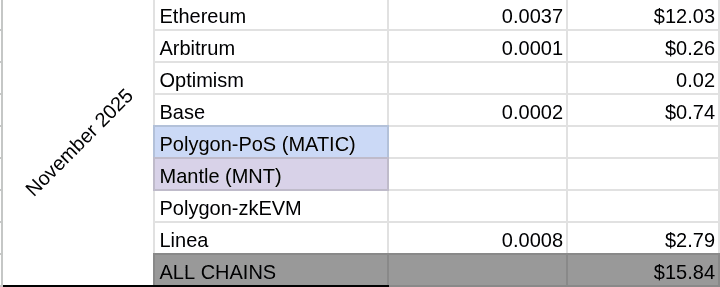

Total expenses for November came in at $36,162.34 (stable MoM). Contributor compensation accounted for $34,656.50, while operational costs held steady at $1,490. Gas costs remain moderate at $15.84, reflecting routine mainnet operations, and there were no one-off expenses this month.

Overall, expenses remain stable within expected ranges, and no material increases are anticipated in the short term.

Earnings Report

Revenues totaled $19,298.55 (-34.62% MoM), resulting in a shortfall of -$16,863.79. Adverse market conditions, decreasing DEX volumes contributed to this underperformance, however, the Collective holds enough stablecoin balance to weather yet another storm.

L2 revenues came in at $9,416.55, representing a fall of about 50% against October, mostly explained by accounting logic (5 weeks in Oct vs 4 in Nov), and depreciating revenues on Ramses and Nile.

Donations totaled $6,523.33, thanks to the DeFi Collective Liquity’s Protocol Incentivized Liquidity Initiative, supporting BOLD’s liquidity on L2s. No harvest was performed on mainnet, and the permaLP positions returned $3,358.67 this month.

While headline revenues were lower, core yield-generating activities continue to operate smoothly. The Collective remains well-capitalized, with stablecoin reserves still providing multiple years of operational runway and flexibility for opportunistic deployment.

Impact Report

Mainnet

Activity on mainnet remained steady with minimal strategic changes.

Arbitrum

Operations on Arbitrum remained unchanged. The Collective continued to support the WETH/POOL and PSM/ETH pools. Ramses activity has slowed significantly, reducing overall revenues, though the Collective will remain active as opportunities arise.

Optimism

No strategy adjustments were made this month. Support remained consistent across BOLD/USDC, BOLD/LUSD, and POOL/WETH pools.

Base

Activity on Aerodrome was steady, though September’s elevated yields did not carry over. The treasury continued to support BOLD/POOL, BOLD/LUSD, BOLD/BOTTO, and BOLD/USDC.

Linea

Voting on blue-chip pools continued throughout November, although revenues are decreasing.

Perma LPs

The Collective’s Perma LP program continued to perform reliably in November, with positions remaining unchanged across POOL/WETH and BOLD/LUSD on Velodrome, BOLD/POOL and BOLD/BOTTO on Aerodrome, and WETH/POOL and PSM/WETH on Ramses.

Parting Words

The broader market remained choppy in November, but the Collective’s treasury held steady, which is a testament to its careful composition and sustainable yield focus. While revenues dipped from September’s highs, the underlying structure remains resilient, and the treasury continues to perform as designed.

We couldn’t back up last month’s surplus, but the goal remains unchanged. Surplus sustainability is our north star, and the team remains focused on achieving and maintaining it over the coming months.

— TokenBrice, on behalf of the treasury and liquidity management team of the DeFi Collective: Luude and myself.