The DeFi Collective - November Report

TokenBrice

TokenBrice- December 28, 2023

Welcome to the DeFi Collective’s second report, covering the month of November. The DeFi Collective is a Swiss nonprofit organization managing its proprietary onchain treasury to support the highest quality DeFi protocols.

For more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the first report published in October, which provides extensive context.

Treasury Report

Overall, the composition of the collective treasury remained relatively constant in November; the primary exposures are still locked liquidity-driving assets such as veRAM, veVELO, or veRETRO.

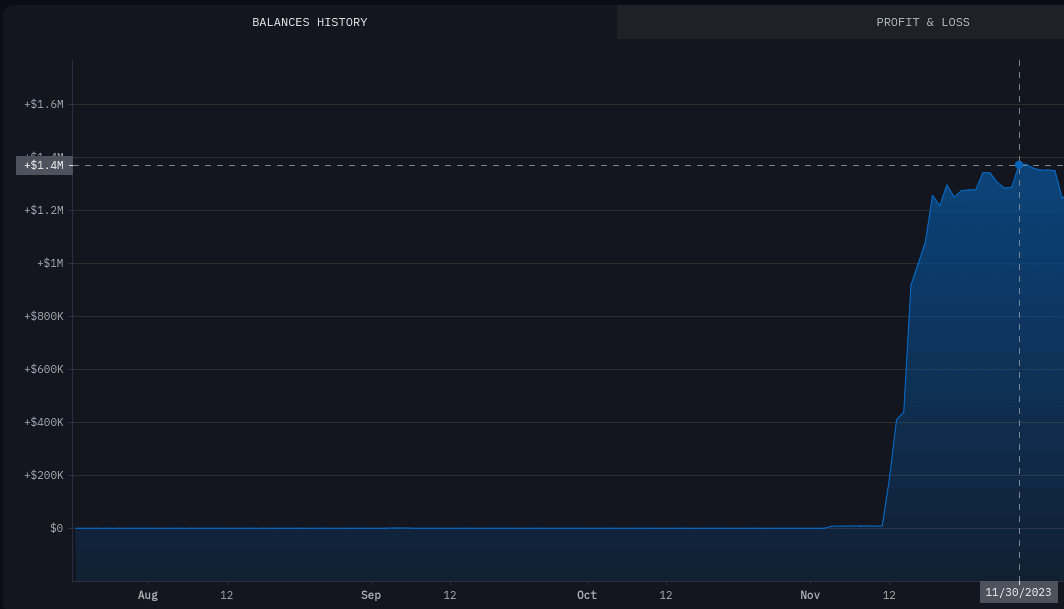

The bulk (>30%) of the liquid assets comprises stablecoins or stablecoin-based assets (such as bLUSD). Thanks to price appreciation observed on ETH over the period, as well as some liquidity-driving assets (especially veRAM) and the revenues it produced, the total value of assets the Collective controls is up from $1.3M in October to $1.4M by the end of November.

Expenses Report

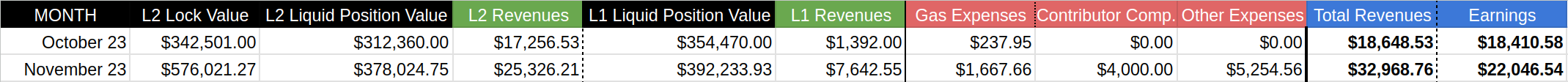

As expected, the expenses in November are up sizably, as it’s the first month the Collective faced most of its recurring expenses (such as contributors’ compensation) and additional one-time expenses related to its incorporation (such as tax advice and commercial registry entry).

In November, gas costs also increased compared to October, primarily due to the increased activity of the Collective on the Ethereum mainnet, where the average gas cost was also higher than the previous months.

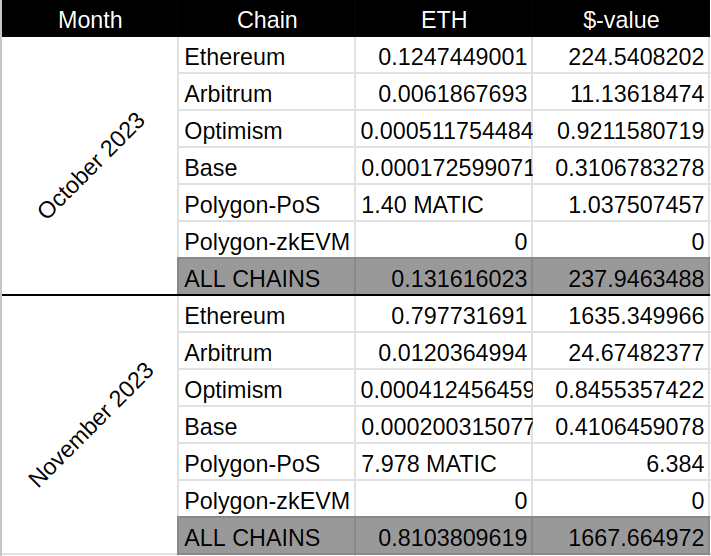

The Collective is active on six chains, with most assets deployed on mainnet, Arbitrum, and Optimism. In November, its exposure to Base increased to support liquidity on mission-critical assets, as highlighted in the impact section below.

Revenues Report

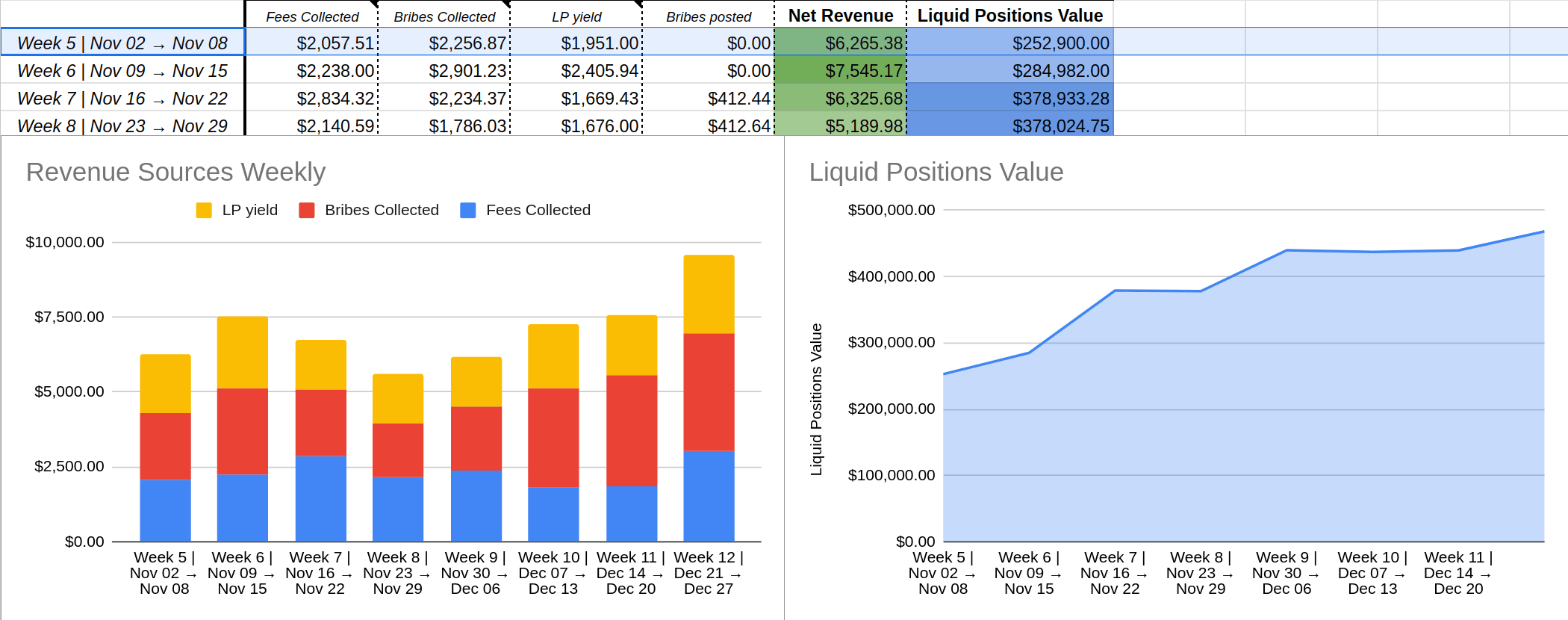

Thanks to the continued deployment of assets on both L2 and mainnet, the Collective’s revenue significantly increased in November, reaching $32,968.76 (a 76.8% increase compared to October’s $18,648.53). Several factors contributed to that uptrend, including increased revenues derived from the mainnet activities, the deployment of assets on Base, and the optimization of pre-existing positions on Optimism and Arbitrum.

Indeed, thanks to its productive liquidity-driving positions, the Collective was able to generate $25,326.21 while supporting liquidity on mission-critical assets on L2. These revenues are derived from locked positions amounting to $576K and liquidity-providing positions amounting to $378K by the end of the month.

On Mainnet, the monthly revenue increased to $7,642.55 thanks to the productive positions on Liquis & Aura, worth $392K by the end of November.

Thus, despite the increase in expenses, the Collective earnings (revenues - all expenses) are up 19.75% monthly, reaching $22,046.54.

Impacts Report

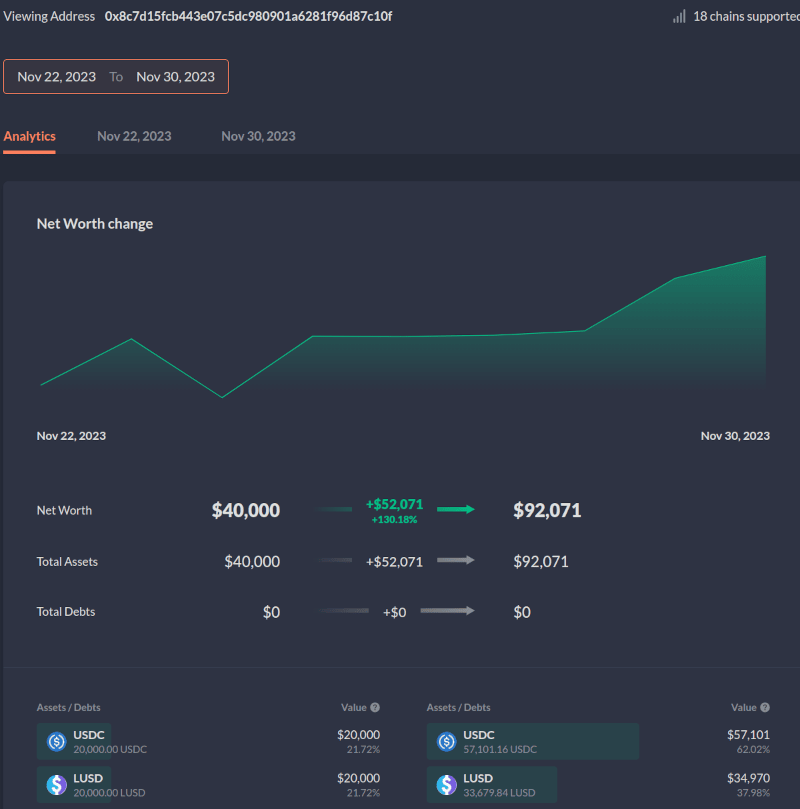

In November, the focus was put on growing the Collective’s presence and impact for supported projects on the Base network: a LUSD/USDCb pool was created and supported with vote incentives, votes, and liquidity providing, helping it reach a TVL of $92k by Nov 30:

The ants’ support goes beyond liquidity–driving and can be all-encompassing! Indeed, the ants also directly contributed to the proper support and technical integration of LUSD on the Base chain with various additional initiatives, including:

- With the submission of all the relevant data so LUSD is processed correctly on BaseScan

- The creation of the LUSD/USDC pool and the deployment of its gauge

- Abmis’ submission of a pull request to have LUSD added to the Base official bridge UI.

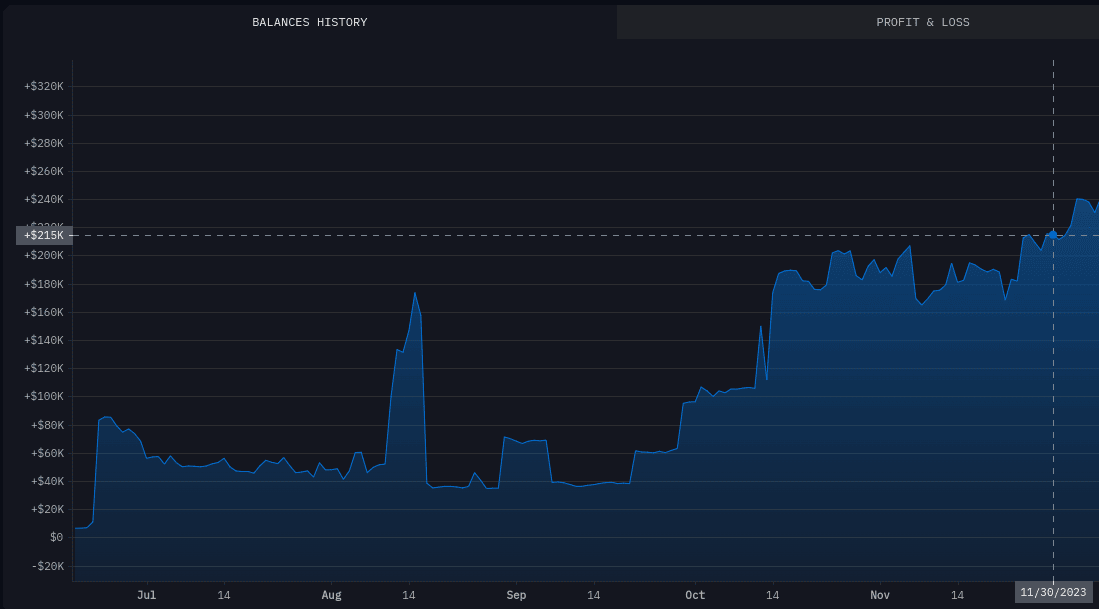

On Arbitrum, further support was extended to the Ramses LQTY/ETH pool with gauge voting, vote incentives, and direct liquidity supply, helping it reach a TVL north of $200K:

The liquidity on both LUSD & LQTY tokens was further bolstered and diversified thanks to Camelot Exchange deploying incentives on related pairs, which the Collective promptly supplied. It led to a spectacular growth of the available liquidity for LUSD on Arbitrum: we raise our cups once more to the Camelot Sirs.

On Optimism, on top of the usual activities described in last month’s report, the Collective supplied the LUSD/GRAI pool and started to allocate some voting power to the POOL/ETH pool to help improve the liquidity situation of Pooltogether’s POOL token on the network.

On Polygon-PoS, the Collective’s veRETRO position supported blue-chip asset pairs since no other tokens fit our demanding framework. These include wMATIC/USDC, wBTC/wETH, wMATIC/wETH, wETH/USDC & some RETRO-related pairs. The revenues produced were used to compound the veRETRO position further to grow the Collective’s liquidity-driving capability on the network.

On mainnet, the Collective also directly contributed to the GHO’s re-pegging efforts with its assets by supplying Maverick’s GHO/USDC pool.

Parting Words

November was the second month of operations for the Collective and the first challenging one with complete and increased expenses. We’re thrilled to have successfully overcome it by managing to increase the earnings further while, as always, increasing the support provided to mission-critical tokens and projects. Over the next period (December), we’re looking to diversify further the tokens the Collective directly supports.

The vision of a self-sustaining support structure for DeFi’s public good is increasingly becoming an observable onchain reality: we’re proud and excited to demonstrate its viability by scaling it further.

Note: The conservative four-week delta instated with the first report proved tricky and likely unnecessarily long, so we’ve decided to lower it to two weeks, starting with the following reports. You can thus expect the subsequent reports to be published in the middle of the month, covering the previous month. We’ll see you in mid-January for December’s report then.

— TokenBrice, on behalf of the treasury and liquidity management team of the DeFi Collective: Abmis, Luude, and myself.