The DeFi Collective - November 2024 Report

Luude

Luude- December 20, 2024

Welcome to the Collectives November impact and treasury report. Fresh off the highs of the Collectives 1st birthday in October, November saw the ants continue the great work with the long-awaited launch of DeFiScan, which has been a huge success so far, with at the time of writing, 8 protocols lifting the curtain on their inner workings to be graded in front of the entire DeFi community.

In addition, November saw the markets surge to new highs, pushing the Collective’s liquid assets under management to all-time highs. This is a testament to the hard work and strategic treasury management decisions over the past few months. Although this is all great news, November did see month on month revenues and surplus fall, but not to worry ants we will be increasing the surplus again and doubling down on sustainability.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

So, without further ado, let’s dive in and see what the ants achieved in November.

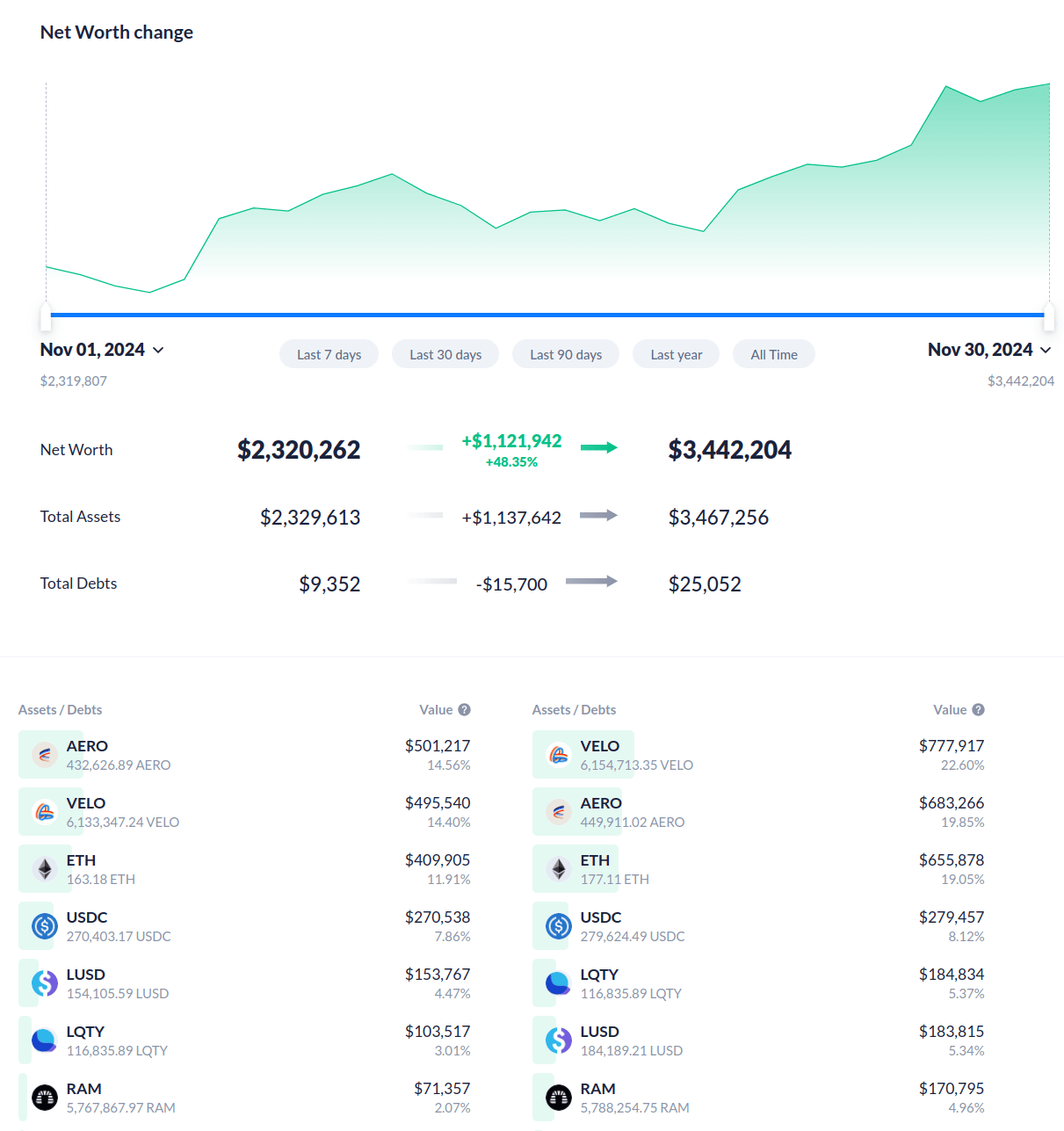

Treasury Report

The face value of assets controlled by the Collective (excluding grants) increased by 48.35% in November, increasing from $2,320,262 on November 1 to $3,442,204 by November 30. This comprises $1,595,424.66 locked assets, $716,660.91 L2 liquid positions, and $962,748.19 liquid positions on mainnet. In addition to this, the Collective’s new perma-LP initiative grew from $4078.00 in October to $10,732.00 by the end of November. As mentioned above, the treasury management team’s decisions to aggressively grow the Collective’s VELO, AERO, and ETH positions over 2024 has paid off, with these balances contributing incredible growth to the overall treasury throughout November, which allows the Collective to position itself in a very advantageous position going forward.

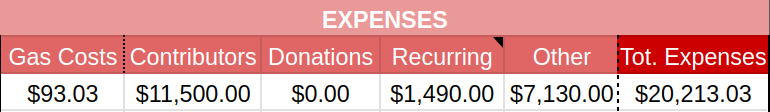

Expenses Report

Baseline expenses remained relatively steady throughout the month, with a slight increase in contributor expenses, which is expected to increase slightly over the coming months as the Collective expands to scale DeFiScan and take on other initiatives. November did see an increase in ‘other’ expenses, which are mostly related to the launch of DeFiScan and initiatives around that. DeFiScan expenses are also expected to increase over the coming months as the Collective spread the message and scale the platform to cover every protocol in DeFi.

Gas expenses continue to fall month-on-month, with activity on mainnet slowing as funds are held in auto-compounding vaults awaiting the launch of BOLD, along with Safe launching their gas sponsor feature on L2s. This excellent feature from Safe allows each signer to have 5 sponsored transactions per day on applicable L2s. This has allowed the treasury management team to almost cut L2 gas expenses completely, along with streamlining operations and speeding up processes. Thank you Safe team!

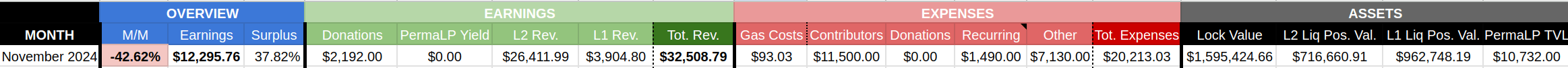

Revenues Report

Revenues are down -42.62% compared to October, finishing the month at $32,508.79. This sharp decrease in revenues is something we are aware of and will work to rectify in the coming months, however, it is not as bad as it seems on paper. October was an outlier month with an increase of 38.81% compared to September, driven mostly by the $20,000 in donations the Collective received from the 1st anniversary NFT mint. Additionally, expenses increased during November and the Collective hold a large amount of mainnet assets in auto-compounding vaults which delays the reporting of revenues received from these assets.

Revenues recorded on mainnet and L2’s remained steady in comparison to September. The treasury management team will aim to increase these slightly over the coming months to compensate for the expected increase in expenses and to ensure a healthy surplus is maintained.

Impact Report

Mainnet

November saw a shakeup in the Collectives mainnet strategy, with support ceasing for DYAD. This was primarily due to the decreasing revenues the DYAD support was generating. Along with the release of DeFiScan and the stage 0 ranking of DYAD. Due to this, it is hard for the ants to justify such generous support for a stage 0 protocol and liquidity has been removed and placed elsewhere on mainnet. The ants are still big fans of DYAD and what they are trying to achieve, and will maintain a close eye on their progress to move from stage 0 to stage 1, which will allow for support to continue again in the future.

Remaining treasury operations on mainnet remained steady, with large ETH and stablecoin positions parked in various money markets awaiting deployment.

Arbitrum

The Arbitrum strategy remains consistent, with support continuing for PoolTogether and Possum. The ants doubled down on the perma-LP initiative outlined in Octobers impact and treasury report, growing the wETH/PSM LP by more than 200% during the month. This strategy is expected to continue, along with utilising the large veRAM position to grow revenues with the goal of increasing the operating surplus.

Optimism

Treasury activities on Optimism remained steady in October, with ongoing liquidity support for USDC/LUSD, and POOL/ETH pairs. The ants have continued to leverage their substantial veVELO position to provide voting support for various other mission-critical pools.

The treasury management team expects this strategy to continue, along with using a small portion of the large veVELO poition to increase revenues while trading volumes are high to increase the Collective’s operating surplus.

Base

Operations remain steady on Base, with support continuing for LUSD/USDC and LUSD/POOL pools.

As always, operation lock-AERO continues, with the collectives position growing another 4.00% during October. The ants have grown this position over 209% in the past year which has proven to be one of the best strategic decisions that could have been made and sets the Collective up to provide robust support to mission critical protocols on Base going forward.

Polygon-PoS

Activity on Retro restarted, albeit extremely slowly. We will continue with a vote-only approach going forward and use what revenues are generated to contribute to growing the treasury.

Mantle

As mentioned in Octobers report, Cleopatra on Mantle has had some intermitted issues for Safe users. These continued throughout November with only 1 possible vote and harvest rotation occurring.

Linea

The vote-only strategy continues on Nile, with modest results recorded. This strategy will be maintained going forward to contribute to treasury growth.

Blast

The ants received a veFNX airdrop which has enabled us to begin treasury operations on Blast. Much like the other smaller chains, a vote-only strategy has begun to assist with treasury growth.

These operations are still in their early stages and we are yet to see a pattern form to gauge what results to expect.

Perma LPs

As briefly mentioned above, the Collectives perma-LP initiative continued during November with another 3,105,523 PSM and 0.6 ETH being added to the permanent wETH/PSM LP. This doubled the LP size during the month and will continue going forward, with PSM received from Posum Core being paired with ETH from treasury operations and added to the LP.

Some further perma-LP initiatives are expected in December, with PoolTogether LPs being added to this initiative.

Parting Words

Everything is better when the numbers are going up and November was a prime example of this as the assets controlled by the Collective inch towards all-time high and activity picking up onchain. We are also extremely proud to see the launch of DeFi Scan and the great feedback it has received so far. We wont be stopping here though, with a renewed focus on sustainability and scaling DeFiScan the Collective is poised for a strong finish to 2024 and a great start to 2025.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.

![The DeFi Collective - 3rd Quarter Summary [Q2 2024]](/images/articles/tdc-q3-summary.png)