The DeFi Collective - October 2025 Report

Luude

Luude- November 13, 2025

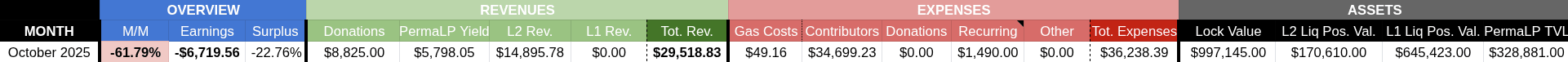

October was a quieter month for the Collective, closing slightly in the red with a shortfall of $6,719.56. This represents a -61.79% change month-on-month, mostly driven by the expected drop in donations following September’s Ethereum Foundation grant and a 50% reduction in L2 revenues, which reverted to baseline after September’s spike following the SYND launch.

Expenses and other revenues remained steady, and there were no major strategic adjustments to treasury composition. The focus remained firmly on sustainability and supporting our ecosystem partners.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

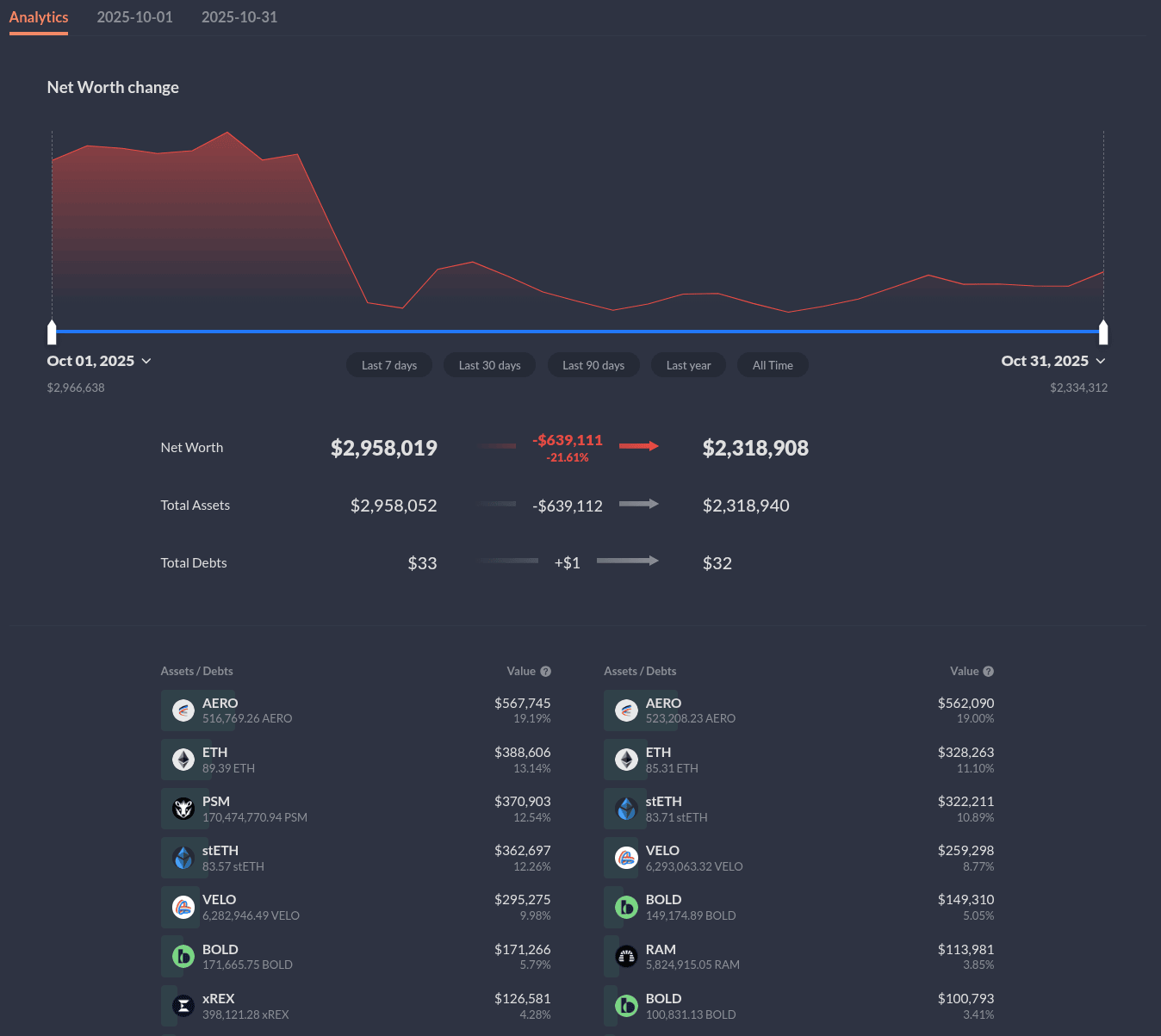

The treasury closed October at $2,318,908 (-22.1% MoM, down from $2,958,019 in September). Most asset values held steady, with the apparent drop primarily attributed to a pricing discrepancy on DeBank, which mispriced the Collective’s PSM holdings at the start of the month.

By month’s end, the treasury allocation stood at 43% locked assets, 7.36% in L2 liquidity positions, 30.13% in L1 liquidity positions, 14.18% in Perma LPs, and 5.33% held in liquid operational balances. Despite the accounting error in external data, the treasury remains well-structured and stable, with capital consistently deployed across productive assets.

Expenses Report

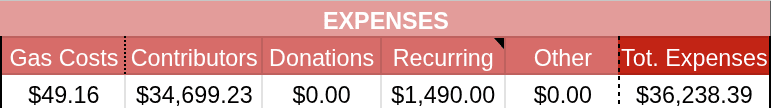

Total expenses for October came in at $36,238.39 (-3.9% MoM). Contributor compensation accounted for $34,699.23, while operational costs held steady at $1,490. Gas costs rose slightly to $49.06, reflecting routine mainnet operations, and there were no one-off expenses this month.

Overall, expenses remain stable within expected ranges, and no material increases are anticipated in the short term.

Earnings Report

Revenues totaled $29,518.83 (-61.79% MoM), resulting in a shortfall of $6,719.56. The decline was largely due to the absence of September’s one-off Ethereum Foundation grant and a normalization of L2 yields after SYND launch on Aerodrome during September.

L2 revenues came in at $14,895.78, representing a return to baseline activity following September’s spike. Donations totaled $8,825.00, down from last month’s $13,269.29, while the Perma LP harvest contributed $5,798.05, marking another month of consistent yield from this program. L1 revenues remained at zero.

While headline revenues were lower, core yield-generating activities continue to operate smoothly. The Collective remains well-capitalized, with stablecoin reserves still providing multiple years of operational runway and flexibility for opportunistic deployment.

Impact Report

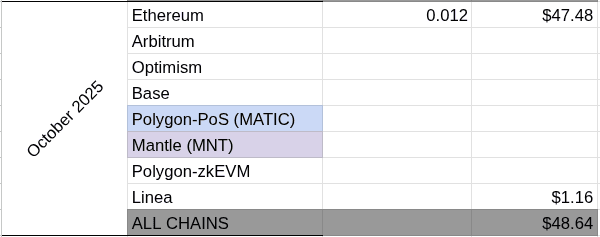

Mainnet

Activity on mainnet remained steady with minimal strategic changes. The only notable move was bridging POOL from PoolTogether on Worldchain back to PoolTogether on mainnet. Routine bridging of BOLD PIL incentives to L2s also continued.

Arbitrum

Operations on Arbitrum remained unchanged. The Collective continued to support the WETH/POOL and PSM/ETH pools. Ramses activity has slowed significantly, reducing overall revenues, though the Collective will remain active as opportunities arise.

Optimism

No strategy adjustments were made this month. Support remained consistent across BOLD/USDC, BOLD/LUSD, and POOL/WETH pools.

Base

Activity on Aerodrome was steady, though September’s elevated yields did not carry over. The treasury continued to support BOLD/POOL, BOLD/LUSD, BOLD/BOTTO, and BOLD/USDC.

Linea

Voting on blue-chip pools continued throughout October, delivering steady and generous returns. Etherex remains a consistent performer, contributing strongly to the overall L2 yield total.

Perma LPs

The Collective’s Perma LP program continued to perform reliably in October, with positions remaining unchanged across POOL/WETH and BOLD/LUSD on Velodrome, BOLD/POOL and BOLD/BOTTO on Aerodrome, and WETH/POOL and PSM/WETH on Ramses.

A harvest of $5,798.05 was completed for the month. Activity within the program remains healthy, and the Collective continues to be pleased with its performance.

Parting Words

The broader market remained choppy in October, but the Collective’s treasury held steady, which is a testament to its careful composition and sustainable yield focus. While revenues dipped from September’s highs, the underlying structure remains resilient, and the treasury continues to perform as designed.

We couldn’t back up last month’s surplus, but the goal remains unchanged. Surplus sustainability is our north star, and the team remains focused on achieving and maintaining it over the coming months.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.