The DeFi Collective - October 2024 Report

Luude

Luude- November 14, 2024

Welcome to the Collectives October impact and treasury report. October was a big month for the Collective, celebrating its 1st anniversary. What a year this has been. This was celebrated with a limited edition NFT mint with all proceeds being donated to the Collective to continue further efforts going forward. On the treasury front, October was a steady month which saw a continuation of baseline revenues held across supported L2s and mainnet.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

So, without further ado, let’s dive in and see what the ants achieved in October.

Treasury Report

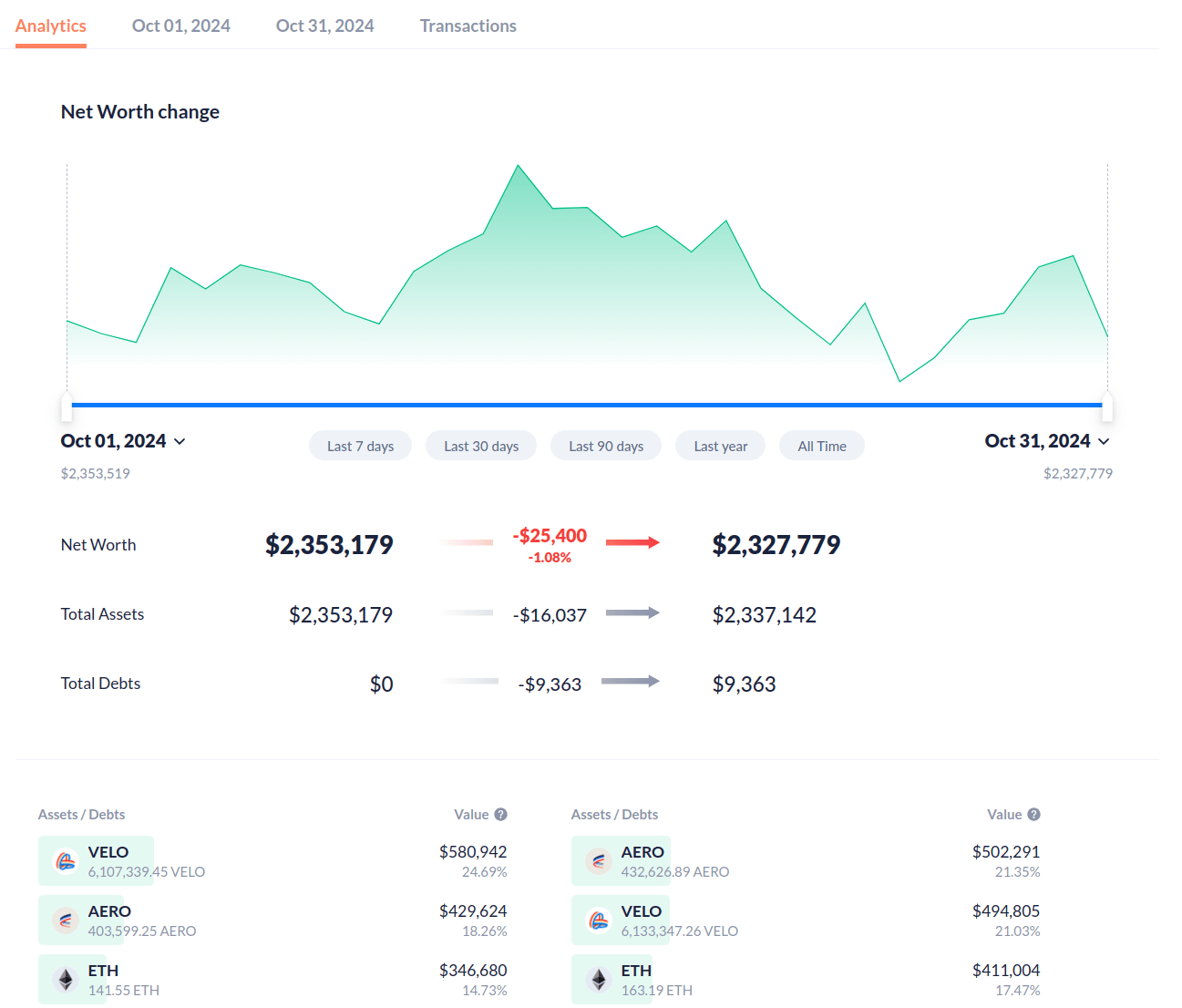

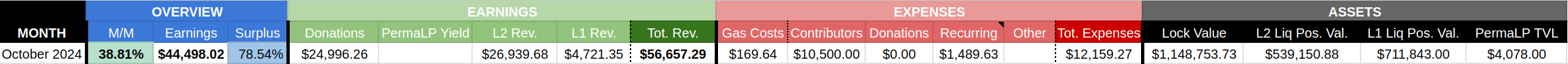

The face value of assets controlled by the Collective (excluding grants) decreased by -1.08% in October, falling from $2,353,179 on October 1 to $2,327,779 by October 31. This is made up of $1,148,753 locked assets, $539,150 L2 liquid positions, and $711,843 liquid positions on mainnet. Although the value of assets controlled by the Collective remained flat over October, if we look a little deeper this was primarily due to the Collective’s large veVELO position falling in value slightly, with almost all other assets rising in value and when compared to September’s treasury balance, October saw a significant MoM increase in treasury value.

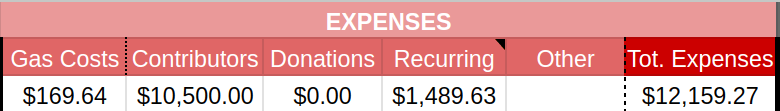

Expenses Report

Expenses remained relatively steady compared to September, with a slight increase expected going forward with some long-term contributors receiving a small amount of additional compensation per month as a thank-you for their hard work and support to the Collectives mission over the past 12 months. Although there will be a slight increase in contributor expenses going forward, the Collective’s total monthly expenses remain significantly below the revenue generated per month, leaving the ants in a good position to continue compounding into mission-critical support going forward.

Gas expenses were up slightly in October, primarily due to an uptick in activity on Mainnet which saw a migration of the DYAD/USDC position from Uniswap to Curve. L2 gas expenses remain extremely low, with this expected to drop to near $0 per month going forward after the release of sponsored transactions on Safe wallets.

Revenues Report

Revenues are up 38.81% compared to September, finishing the month at $44,498.02. The increase in revenues was thanks to the generosity of the DeFi Collective community, which donated a whopping 10 ETH to support the Collective while minting one of the limited edition 1st anniversary NFTs. These donations will be used to support mission-critical protocols going forward and continue the work the Collective has been undertaking over the past 12 months.

In terms of revenues on mainnet and layer-2, these remained relatively steady, with mainnet revenues appearing to fall at first however this is misleading due to the majority of the mainnet positions being deposited in auto-compounding vaults. Layer-2 revenues were slightly down in comparison to September, this is largely due to a slight change in bribe support on Optimism and Base.

Impact Report

Mainnet

On paper, October saw mainnet revenues fall another -50%, although this isn’t all that meets the eye, with the treasury management team allocating over 100 ETH into an auto-compounding lending vault as we await the launch of BOLD.

Support for DYAD continued, with the Collectives DYAD/USDC position being transferred from Uniswap to Curve.

Looking forward, the strategy will remain constant, with support for DYAD remaining and ETH accumulation ongoing.

Arbitrum

The Arbitrum strategy remains consistent, with support continuing for PoolTogether with a large wETH/POOL LP on Ramses and the ants PSM being staked to Possum Core. In addition to this, we have a new perma-LP initiative that will allow the Collective to build a permanent wETH/PSM LP position on Ramses that is funded by yield from the PSM staked in Possum Core. Further details on the perma-LP initiative will be discussed below.

Optimism

Treasury activities on Optimism remained steady in October, with ongoing liquidity support for USDC/LUSD, and POOL/ETH pairs. The ants have continued to leverage their substantial veVELO position to provide voting support for various other mission-critical pools.

Vote support has been reduced to core pools that the Collective will support going forward. These pools include LUSD/USDC, wETH/LUSD, LUSD/USDT and POOL/wETH. This strategy is expected to remain consistent over the coming months.

Base

Operations remain steady on Base, with support continuing for LUSD/USDC and LUSD/POOL pools.

As always, operation lock-AERO continues, with the collectives position growing another 4.65% during October.

Polygon-PoS

Activity on Retro has ground to a halt, the treasury management team continues to vote for blue chip pools, however, this hasn’t been yielding any results over recent weeks.

We will update you if there is a Retro revival in future reports.

Mantle

Mantle operations significantly slowed during October, with the WalletConnect implementation on the Cleopatra dApp not allowing a Safe to be connected. This has resulted in only 1 possible harvest during October and likely the end of the Collectives’ operations on Cleopatra.

We will update you if there is a revival in future reports.

Linea

A vote-only strategy has been in operation throughout October, with the focus being on blue-chip assets. This doesn’t yield eye-watering results but will continue over the foreseeable future.

Perma LPs

As briefly mentioned above, October saw the Collective undertake a new permanent LP initiative, starting with support from Possum’s PSM token on Arbitrum. This will entail yield generated from the Collectives PSM staked in Possum Core being paired with wETH from treasury operations and permanently LP’d on Ramses.

This initiative will expand over the future for various other supported protocols where all liquidity will be held within a dedicated perma LP multi-sig, separate from the main treasury wallet. This initiative allows the protocols supported by the ants to know there will be an ever-increasing liquidity position growing that will always be there. We expect BOLD to be the second protocol harnessing perma LP thanks its liquidity initiatives.

PermaLP are accumulated on permalp.deficollective.eth, and their value and yield will be accounted for separately. The first deployment happened this month, where 3.5M PSM received from Core were received, matched with 0.6 ETH and supplied on Ramses, bringing the Perma LP Total to $4,078.00. The yield from the perma LP will be harvested monthly, starting in November.

Ongoing Perma LP Streams:

- PSM, with up to 0.5 wETH/month to be matched with PSM received from Core, and supplied to Ram_vAMM_PSM/wETH

- BOLD, with up to $20 000/month to be matched with BOLD received from the liquidity initiatives, and supplied to BOLD stable pools on Optimism, Base, and Arbitrum. [Once BOLD is live]

Parting Words

October was an exciting month for the ants, where we celebrated our 1 year anniversary which saw 10 ETH donated to the Collective, and also the announcement of the long-awaited launch of DeFiScan where the Collective will shine a much-needed light on the decentralization status of DeFi protocols.

In addition to this, the first yearly financial report was published, showcasing the fully onchain and profitable nature of the Collective’s operations. This is something that we are very proud of and are looking forward to continuing over the coming years, whilst supporting DeFi’s most decentralized and critical protocols.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.