The DeFi Collective - 1st Quarter Summary [Q4 2023]

TokenBrice

TokenBrice- January 18, 2024

![The DeFi Collective - 1st Quarter Summary [Q4 2023]](/images/articles/tdc-q1-summary_hu12109131091462162053.jpg)

The ants are now more than three months old: welcome to the first quarterly report of the DeFi Collective, which covers data from October 5 to December 27, 2023 - our first twelve weeks of activity.

For this report, we’ll examine the treasury-related data aggregated at the quarter level, but more importantly, look at what we’ve achieved in the first quarter and what we’re looking to deliver for the next one.

For more precise information and context on our day-to-day treasury activities, please check the reports published every month:

Quarterly Treasury Report

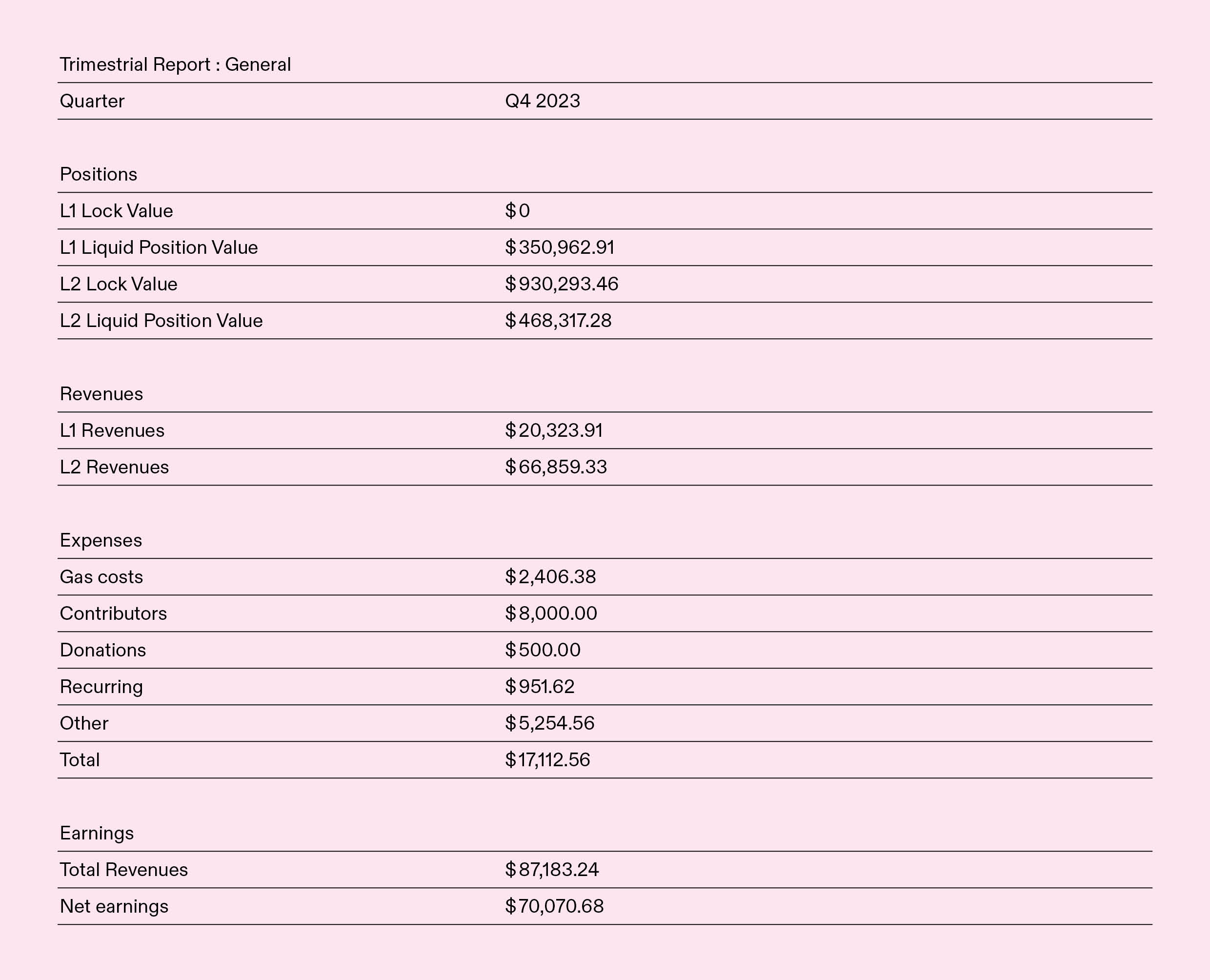

Our first quarter was heavily focused on treasury management, as it is the lifeblood of the Collective, enabling it to self-sustain while also supporting the liquidity of mission-critical tokens simultaneously.

Indeed, our first challenge was demonstrating the Collective’s viability—covering our expenses while preserving a hefty premium to grow the treasury, enabling us to scale our onchain activity. On that front, it’s a tremendous success!

First, with $87 183 of total revenues over the period, the Collective demonstrated that supporting the top-of-the-notch DeFi protocols can be profitable. Now, thanks to expenses kept to the bare minimum, the earnings are also satisfactory, settling at $70 078.

One of our key metrics is the “premium” — the share of the Collective’s revenues that are not needed to cover its expenses and thus can be compounded into our onchain activities. It settles over 80% for this first quarter, giving us a considerable margin for growth of both our onchain and offchain activities.

Our 1st quarter focus [Q4 2023]: set up the basics for the colony

During our first quarter, we’ve set solid foundations not just on the treasury front: it was also the kickoff of several initiatives, such as the LocalApp movement, that will bear fruits in the coming months.

We’ve established an impacting presence in the DeFi industry, growing the Twitter account to over 1000 followers and attracting over 470 DeFi enthusiasts sympathetic to our mission on the Collective Discord — the central hub for our community.

We’ve also organized several spaces to help raise awareness of the project we support, and we are particularly excited to scale this activity upward next quarter. Despite reaching out extensively, most crypto-focused media still sleep on the Collective. As we keep growing, they will eventually have no choice but to cover the most unique and innovative on-chain-off-chain entity whose sole purpose is positively impacting the whole DeFi ecosystem.

Focus for our 2nd quarter [Q1 2024]: scaling up!

With solid foundations set up during the first three months of the Collective’s existence, it’s time to ramp up the efforts on all fronts and cover more ground.

Treasury Management

On the treasury management side, we’ll keep grinding to improve the revenues while providing more support to mission-critical tokens. While our first quarter was pretty LUSD-centric, we’ve started to expand coverage to more tokens in December, and we will keep diversifying. Pooltogether’s POOL is now appreciating the benefits of the ants’ love embrace, as well as CatInTheBox boxETH and DYAD, and we’re eager to add more to the list.

We’re particularly keen on maximally resilient protocols available on layer 2, especially Optimism and Arbitrum, where the Collective currently has the most liquidity-driving capability. So, if you spot any relevant protocols on these two chains, please tip us.

In the first quarter, our presence focused on Mainnet, Optimism, Arbitrum, Polygon-PoS, and Base. Our second quarter will be a great time to expand the chain coverage, as we did already with Mantle, and more are coming (such as Polygon-zkEVM).

We take particular pride in the level of detail of our reporting. We are already one of the entities managing its own onchain assets providing the most outstanding level of detail and transparency on its activities. We will keep pushing forward on this front. Bound by our status as a Swiss non-profit association, we’re eager to lead by example and hopefully inspire others to follow a similar path.

Structuration of the Collective as an Association

Talking of the association, we have more work for this second quarter. As our activities scale up, so must the structure! We’re looking forward to onboarding new association members and considering new board members with relevant experience to help us reach the next step.

Another arc is the internal documentation of the Collective: we are aware that the Policy page still needs more work. Several policy documents are stated for Q1, including the much-needed and awaited “Mission-Critical Protocol Guidelines” and two other documents further explicating the accounting logic and treasury management policies.

If you’d like to join us for the next step of the adventure, the Collective Discord is the place to be. We’ll also release an article highlighting the stories of the first contributors onboarded and providing more information to community members interested in becoming contributors or association members.

Grow our community and presence

To scale up our activities, we must also scale up our community. We know that the Collective’s social media presence and community engagement can be improved, and we’re looking to onboard a contributor dedicated to that mission to ensure it’s delivered consistently.

Indeed, growing the Collective social media and community footprint will help shine a light on its activities and share the spotlight with the mission-critical projects supported, helping them grow in awareness and community presence.

We’re also keen on implementing ways for the community to get more actively involved with the Collective’s onchain activities, potentially harnessing NFTs or other relevant web3-native tools: designing and implementing such a system will be one of the core missions of our upcoming community/marketing contributor.

Increasing the Collective’s ecosystem integration

Few chains are blessed with the presence of the Collective on the network, and very few associated foundation teams are aware of it, let alone appreciative of it: that’s another major field to work on for us this quarter.

Indeed, despite a sizeable presence on Optimism and Arbitrum especially, the Collective has received no support from either side so far. Thus, in this second quarter, it’s time for the ants to go grant hunting, as we believe the Collective’s value proposition is quite evidently synergetic to any layer looking to attract high-quality builders to its ecosystem.

Grant chasing is pretty much a full-time job, with the increasing levels of bureaucracy observed in the various programs: to maximize the Collective’s chances, we’re also looking to onboard a contributor solely dedicated to this mission.

On top of scaling up our own activities, we believe grants can be a decisive factor in positively impacting the projects within the Collective’s scope, especially the most recent and modest ones. Thus, for each grant we are working on, we’re asking for a sizeable share (25-33%) to be allocated to fund mission-critical projects: small teams do not have the resources and the energy to go grant-hunting, so we’re looking to mutualize the efforts on this front too, removing another sizeable pain point for immutable builders, and enabling them to focus solely on building!

Parting Words

Our first quarter was a blast, yet the game has barely begun! We’re particularly stoked for the following months, as it will be a time of rapid expansion while always keeping our eyes on the prize. We want the Collective to be an all-in-one entity alleviating most, if not all of the pain points builders of immutable resilient protocols face, and we’re getting closer to the target with each passing day. We’re looking forward to the day when builders will walk the path of immutability and/or max-resilience not just because it’s ideal at a technical, ethical, and legal level but also because they know the ants will have their back.

We’d like to extend once again our gratitude to the teams of chads who enabled the Collective to exist in the first place by supporting it with brainpower and resources: the Liquity, Maverick, CatInAbox, DYAD, Diva, Retro, and Zero teams. As the Collective grows in size and impact, we believe the broader community will recognize their genuine care for fostering a resilient and transparent DeFi ecosystem.

— TokenBrice, on behalf of the whole team of the DeFi Collective: Nils, Florian, Abmis, Luude, and myself.