The DeFi Collective - 2nd Quarter Summary [Q1 2024]

TokenBrice

TokenBrice- May 2, 2024

![The DeFi Collective - 2nd Quarter Summary [Q1 2024]](/images/articles/tdc-q2-summary_hu118fcc358cbdcc3abf0446a51b610d78_240257_1110x0_resize_lanczos_3.png)

The Collective has been active for more than six months: welcome to our second quarterly report covering the second quarter of the Collective activities from January to March 2024.

For more precise information and context on our day-to-day treasury activities, please check the reports published every month:

We invite you to consult our detailed Reporting Policy for a comprehensive overview of the Collective’s activities, revenue sources, and accounting principles.

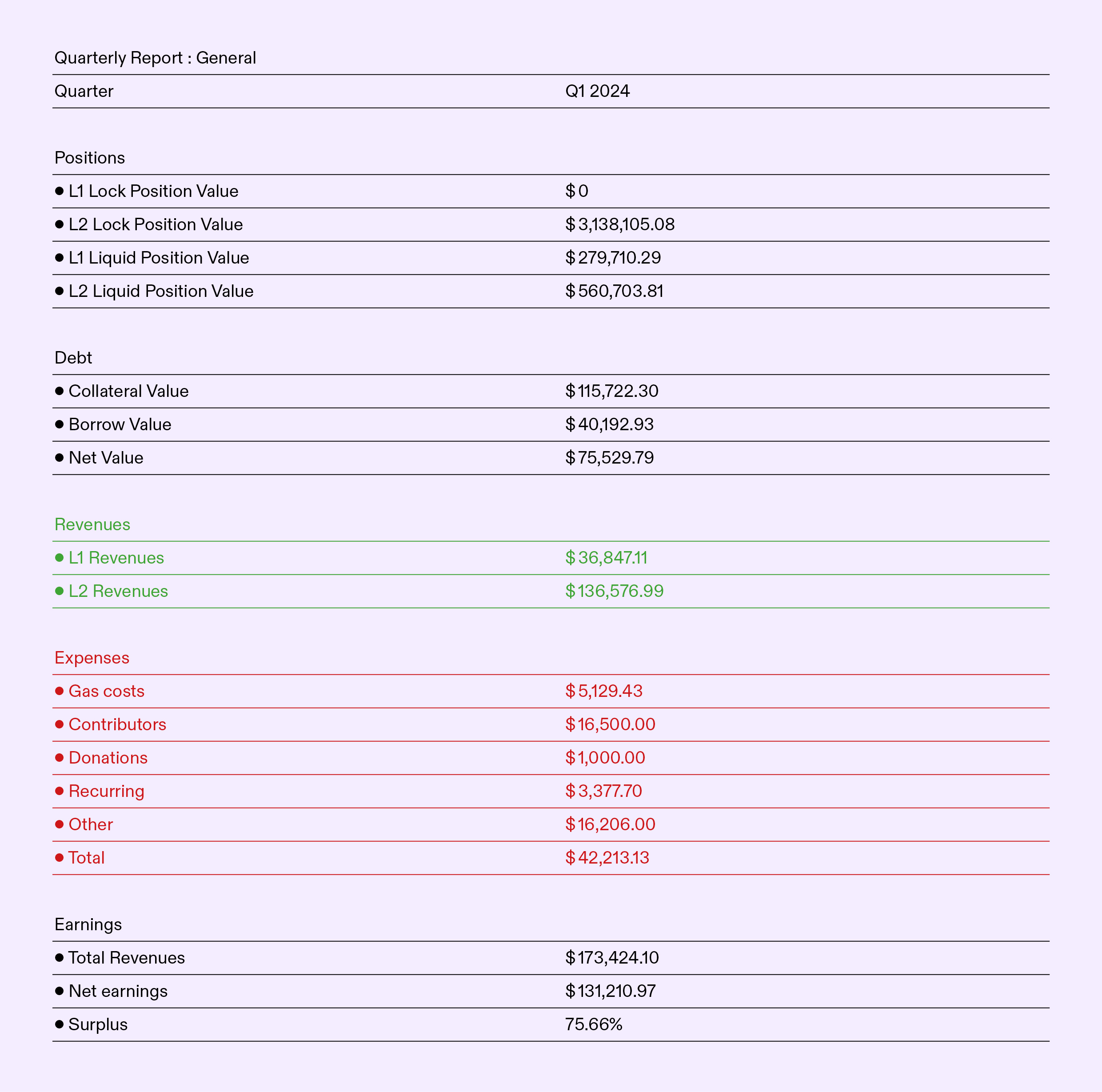

Quarterly Treasury Report

The Collective’s financials are stronger than ever. Quarterly revenue settled at $173,424.10, and earnings were $131,210.97. The growth is impressive compared to the first quarter, as both figures increased by more than 85%.

With the hiring of new contributors and some contracting works, expenses have increased yet remain sustainable: at the current pace, the Collective’s current stablecoin reserves are sufficient to cover more than two and half years of expenses.

The surplus, a key metric we track, represents the share of the revenues that are not needed for expenses and thus can be compounded into the treasury to support public good DeFi protocols further, standing at 75.66%

Main Accomplishments in Q2 of the Collective [Q1 2024]

Streamlined Treasury Management

As we expanded on new EVM L2s (Linea & Mantle) in Q2, we realized that it comes with increased operational costs, such as the weekly management of positions.

While we’re glad to have deployed on Mantle and Linea and will be active on Polygon zkEVM in due time, we’ve also been able to specify a framework to decide when a given L2 makes sense for the Collective:

- [Hard Requirement] Gnosis Safe is available on the network & support for Smoldap’s MultiSafe is available.

- An efficient ve(3,3) DEX is deployed, and open to collaboration with the Collective.

- The L2 foundation / DAO / other associated entities are willing to explore supporting the growth of the activities of the Collective on its network with a grant to supercharge the launch.

While we retain the option to launch on a L2 not fulfilling all these conditions if deemed of strategic interest for the Collective, these three conditions now serve as a baseline to evaluate new L2 deployments.

Structuration of the Collective

One of the main goals for our second quarter was to improve the structure of the collective and, most notably, public documentation in the form of our cornerstone and bounding documents called policies. All critical activities of the association are now explicated in such document, with the release of, in order of publication:

- The Reporting Policy details the accounting logic used for the monthly and quarterly reports.

- The Treasury Management Policy explains our logic regarding the management of assets.

- Last but not least, the DeFi protocol Guidelines frame what “Genuine DeFi” means to the Collective.

The Protocol Guidelines are particularly important, as they explain the evaluation logic of the DeFi protocols performed by the Collective. In addition to their informative value, the guidelines also govern the allocation of funds under the association’s control since only the protocols qualifying in the “Genuine DeFi” or “Monitoring” tier (under certain conditions) are eligible for being supported by the Collective’s assets and expertise.

Team Growth with Crucial Hires

Another focus for Q2, and likely for more, was expanding the team by hiring value-aligned individuals at critical positions. We had identified two main areas where the Collective needed more firepower, and we hired one contributor for each associated role:

- Ecosystem integration: the Collective delivers a public service to the whole DeFi ecosystem by increasing the amount and adoption of maximally resilient protocols; thus, we believe it has serious chances to attract grants, donations, and other forms of support from foundations and other associations. Several attempts were made in Q1, and while unsuccessful, they helped us realize that this activity required sustained and dedicated attention from a contributor dedicated to it. CookingCryptos has been hired in March as our “Grant Hunter” to spearhead the effort in the matter.

- Content & Communications: Growing a community is essential for the Collective’s success, both for its own sake and to increase the support it can provide to genuine DeFi projects. Spicypiz was recently hired as a content strategist to help ramp up the efforts as part of a process that started in March.

Increased Governance Activity

Another focus for last quarter was for the Collective to get involved in relevant governance and better harness the ecosystems it already supports. On that topic, we’d like to highlight two particularly relevant initiatives.

HAI is a new stablecoin launched on the Optimism network, a fork of Reflexer. The Collective submitted one of the first proposals to their governance , suggesting several improvements to the HAI & KITE liquidity strategy and growing its synergies with LUSD. It has passed and has been implemented.

PoolTogether delivers a maximally resilient prize-saving account onchain. It’s part of the genuine DeFi protocols the Collective would like to see flourish. To that end, the Collective self-appointed in December to support POOL’s liquidity on Optimism. The support provided has been increased thanks to the successful passing of PTBR-16 on PoolTogether’s governance, spearheaded by CookingCryptos, which allocated a POOL & PTaUSDC donation to the Collective, allowing it to support POOL’s liquidity on the Base and Arbitrum networks too.

Focus for Q3 of the Collective [Q2 2024]

Streamlining and strengthening the treasury

Our treasury operations are robust and well documented, as evidenced by the publication of the Treasury Management and Reporting policies. The goal for Q2 is to keep strengthening our position to sustain the worst possible bear market without any worries.

Currently, the Collective owns over $450k worth of stablecoins deployed in single-sided deposits (such as supplied on Aave) or in a stablecoin LP – with $42k of expenses per quarter, that means the Collective can sustain more than ten quarters of expenses without any earnings. It’s strong but not sufficient. Our goal for the next quarter is to raise that stablecoin exposure to over $600k, giving the Collective enough reserves to survive a deep and intense bear market of three and a half years. As we keep growing, so will our expenses, so the longer-term target for the stablecoin reserves, by the end of 2024, is >$1M.

- Note 1: the above figure does not include stablecoin deploying in a liquidity pool paired against a volatile asset, such as LUSD/POOL.

- Note 2: the scenario where the Collective earns $0 over a given quarter is extremely unlikely, if not impossible, but we would rather prepare for the worst.

Operationalizing The Guidelines

With the Protocol Guidelines now released, our next step is to put them to work with the publication of the first protocol reviews. It means the formalization of an internal document that specifies all the dimensions of a project, evaluates them, and how to place them on the Genuine DeFi - Monitoring - Onchain CeFi spectrum, which will eventually enable community members and team to get involved in the reviewing process too.

The guidelines are focused on the decentralization criteria, and that’s a good thing! However, we’re starting to think they could be complemented with another evaluation looking at the project’s societal impact, attempting to answer the question: would a massive success of this project be a net gain for society? It’s currently in the early research stage, and we intend to share a first blog post on the matter in Q2.

Structuring the Communications of the Collective

The Collective is already a key player in DeFi, taking part in novel and impactful initiatives beyond liquidity management. However, our communications can sometimes be lackluster and fail to shine the light deserved on our projects. By hiring a dedicated marketing team, starting with Cyril, our Content Strategist freshly onboarded, we intend to implement communication processes ensuring that every initiative is reliably and sustainably covered.

Similarly, our community calls have been infrequent. We intend to resolve that issue in our third quarter by establishing a monthly recurring community call: you’ll be able to listen to the latest about the Collective and ask the board members and contributors your questions with a recurring rendez-vous, stated for every third Thursday of the month at 6 PM unless announced otherwise.

Parting Words

The Collective’s second quarter was marked by sustained growth, both financially and team-wise, which gave it further means to fulfill its critical mission to the DeFi ecosystem. The next quarter is the time for the Collective to go beyond the financial success and demonstrate its critical role as a support system for genuine protocols in all relevant manners. We believe our protocol reviews will be essential in demonstrating the Collective’s commitment and helping genuine DeFi projects emerge.

The Collective is the political party of DeFi, a unique kind of party that walks the talk with its own assets. It operates with a singular purpose: increasing DeFi’s long-term resilience and censorship resistance, using all relevant means. It is an unstoppable snowball designed to carry genuine DeFi protocols in its wake. We’re thrilled to see the initial vision materializing at an increasing speed and looking forward to all we can achieve in Q3.

— TokenBrice, on behalf of the growing team of the DeFi Collective: board members Nils & Florian, and contributors Abmis, Luude, CookingCryptos & Cyril.