The DeFi Collective - 3rd Quarter Summary [Q2 2024]

TokenBrice

TokenBrice- July 24, 2024

![The DeFi Collective - 3rd Quarter Summary [Q2 2024]](/images/articles/tdc-q3-summary_hu14927589643257957885.png)

The Collective was born nine months ago; it’s time for its third quarterly summary. With two new hires, our first alumni, protocol reviews coming soon, and many other developments, there is much to discuss: let’s dive right in.

For more information on our day-to-day treasury activities, we invite you to read the monthly reports published during this quarter:

We invite you to consult our detailed Reporting Policy for a comprehensive overview of the Collective’s activities, revenue sources, and accounting principles.

Quarterly Treasury Report

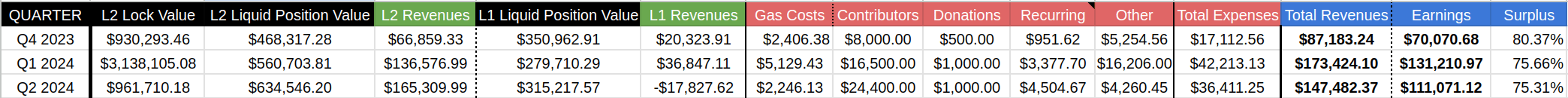

After an impressive revenue and earning growth last quarter, the figures are stabilizing: quarterly revenue settled at $147,482.37 (-14.95% vs. the previous quarter), and earnings at $111,071.12 (-15.35%).

The expenses lowered to $36,411.25 despite our hires, as we had to face exceptional expenses in the previous quarter. Thus, the Surplus remains constant, still above 75%, giving ample margin to the Collective to cover its expenses while compounding most of the earnings to grow the treasury further.

Main Accomplishments in Q3 of the Collective [Q2 2024]

Supporting Possum Labs

The DeFi Collective is proudly supporting Possum Labs , a DeFi platform on Arbitrum that introduces several innovations which are truly sustainable and positive-sum for all parties.

The first one is Portals, enabling depositors to stake a yield-bearing asset and access the yield upfront, denominated in PSM tokens. The PSM token can then be sold to capture the yield. The depositor will then wait for its staked tokens’ energy to recharge so that its deposited funds are available to unstake. Portals automatically buy back PSM with the yield generated by deposits to achieve a balance between buying and selling.

The second one is Possum Core, a new governance system which activates community participation in budget decisions, and encourages long-term thinking while maintaining flexibility. Possum Core also has special features, such as immutability and soft lock mechanism.

Streamlining and Strengthening the Treasury

While we have made significant progress, we must acknowledge that we fell short of our ambitious objective of having > $600k in pure stablecoin exposure presented in the previous quarterly summary. Still, ~$40k was added to our reserve last quarter, bringing them north of $490k, allowing the Collective to sustain three full years of expenses in an unlikely scenario that no income would be produced.

Thus, despite missing the target, we’re getting closer to fulfilling the last quarter’s objective of having enough reserves to sustain three and a half years with no revenues: onward and upward, with ever-increasing resilience!

Operationalizing The Guidelines

Thanks to a productive retreat at which the Collective’s contributors and members finally met in person for the first time, we’ve made significant progress in operationalizing the guidelines. An exhaustive checklist and associated scoring method for review protocols are now established, and we are ready for the next step—the protocol reviews.

Structuring the Communications of the Collective

One of the key objectives of the last quarter was to improve our communication processes. To that end, two new contributors were hired: Spicypiz, our content strategist, who is working closely with Stengarl, our community manager. Spicypiz emerged out of more than ten candidates from a demanding hiring process.

At the same time, Stengarl was already involved in the Collective’s community and had already been awarded the “Ant of the Month” title, so hiring him as our community-focused contributor was a logical next step.

Together, they are establishing a strategy and corresponding workflows to ensure the Collective communicates effectively and consistently on its channels and outside on topics related to its core themes and objectives.

First Retreat & First Alumni

Along with our first association retreat right before ETH Belgrade, the conference was the first to see a talk fully dedicated to the Collective and its mission: the recording is available here

Finally, and sadly, our first contributor offboarding also occurred last quarter. Abmis, the first contributor to the Collective, moved on to a full-time business development role with Velodrome. While his expertise and dedication are already missed, we’re all thrilled to see him rising in the DeFi industry and joining a team to grow a genuine DeFi protocol. From the get-go, we’ve realized the Collective is a great stepping stone for savvy DeFi enjoyers looking to make a career out of it, and we’re happy to play the part. Be ready for the Collective’s alumnus, for they will be many, across all genuine DeFi protocols, and influential.

Focus for Q4 of the Collective [Q3 2024]

Publish the First Protocol Reviews

With the guidelines now operationalized, the next step is publishing the first protocol reviews. This requires developing and publishing a dedicated section for reviews, which is one of our main focuses for this upcoming quarter.

We’ve already started working on the first reviews internally, and we expect to be able to produce roughly one per week at cruising speed. Thus, our ambitious objective for the next quarter is to publish ten reviews by the end of it.

The first ones released will include protocols that the Collective already supports, such as PoolTogether, Liquity, and Possum, along with protocols we’re avid users of and deeply familiar with, such as Velo/Aerodrome.

Lift the Colony

With Spicypiz and Stengarl onboarded, the marketing & community team now has all the firepower it needs to deliver on one of the Collective’s early ambitions: being able to help raise awareness and attention drawn to the genuine DeFi protocols we support. Our core objective for the next quarter, with processes being established toward that end, is that news coming from genuine protocols is consistently relayed and given the attention it deserves. At the same time, releases and new developments will be covered and explained more extensively, and dedicated content will be produced.

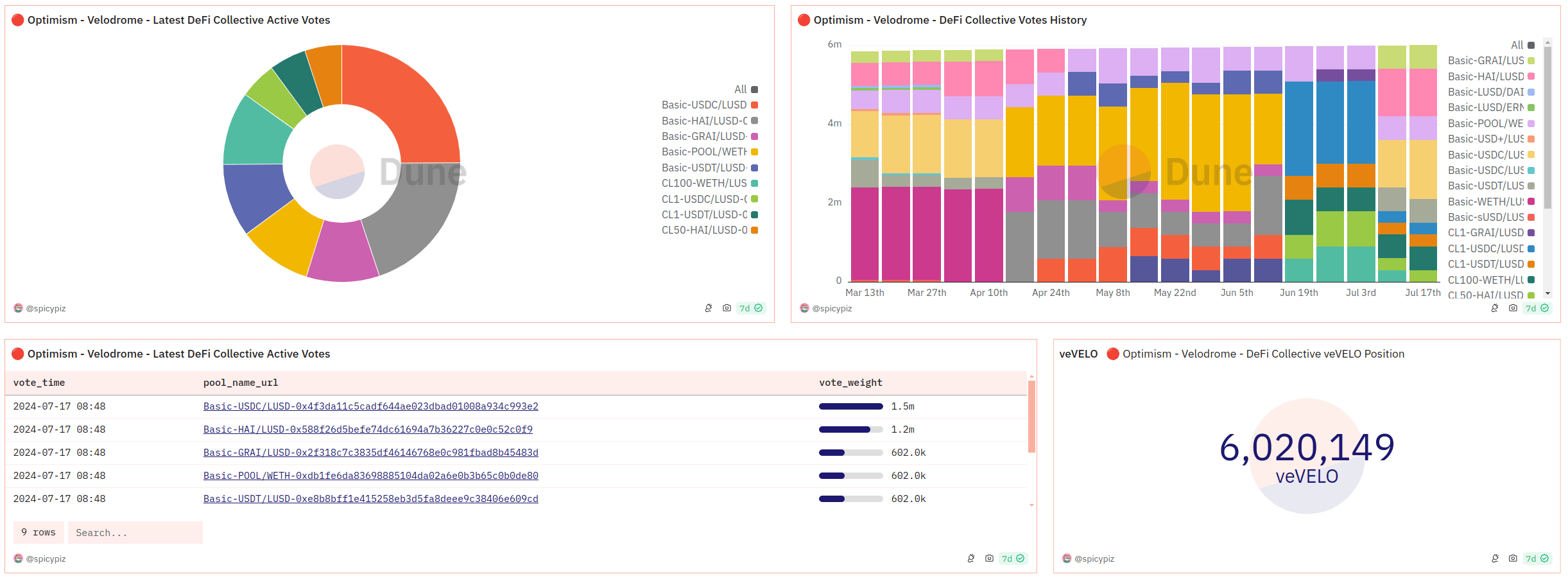

Another critical work stream is to provide more contextualized information on the liquidity-driving activities of the Collective, allowing anyone to grasp its impact quickly and how it harnesses its various liquidity-driving positions such as veAERO, veRAM, or veVELO. After some discussions and iterations regarding the most suitable format for this project, the appropriate form has been found, and work is already underway. Spicypiz, our content strategist, doubled down as a Dune Analytics wizard and is building network-specific dashboards that provide all relevant information.

The first one is already live and will help you better understand and track the Collective’s impact on Optimism with its usage of Velodrome. Others will follow to track our activity on Base with Aerodrome, Arbitrum with Ramses, and any other relevant DEX/L2.

Keep Growing Stable & ETH Reserves

Regarding treasury management, our focus for next quarter will be to keep growing the stablecoin reserves, but even more importantly, the ants’ ETH stash:

- Stablecoin reserves: current = $490k, target >$600k

- ETH reserves: current ~= 75 ETH, target = 100 ETH

Indeed, now that solid stablecoin reserves are secured, growing our ETH exposure is equally crucial for the long-term viability of the Collective. Besides, the Collective will need ETH collateral to mint BOLD to seed pools to support its growth on L2, such as Optimism or Base.

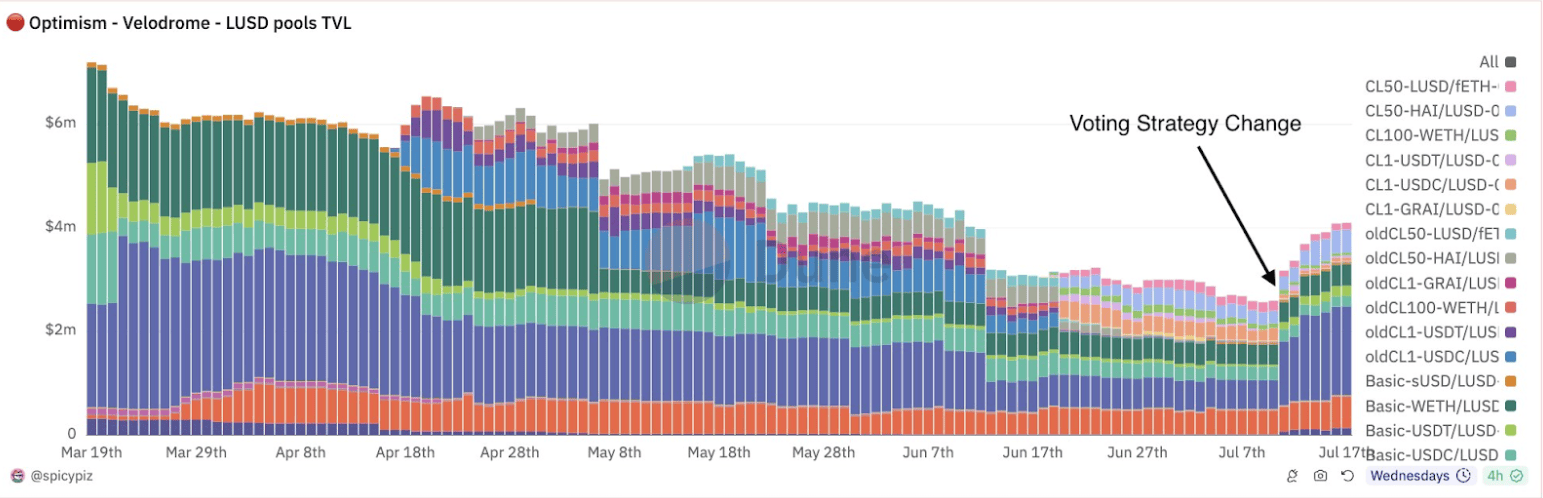

One of the highlights of liquidity operations this quarter was our increased usage of Concentrated Liquidity pools, thanks to the release of Slipstream on Velodrome and Aerodrome. While they do deliver increased liquidity efficiency, they also have limits, as Spicypiz noted in his dedicated article. Thus, while the Collective will keep harnessing CL pools, the frequent management they require makes it hard to conciliate with our weekly Safe signing sessions.

We’ve started experimenting in July with a hybrid strategy for stablecoin pools, harnessing both sAMM & CL pools:

- Most of the firepower is allocated to the sAMM pool on a given pair, with the Collective voting on it, posting vote incentives, and supplying it to establish a solid liquidity baseline.

- Some voting power is still directed to the corresponding CL pool to attract a reasonably small but maximally efficient TVL supplied entirely by other liquidity providers.

This strategy has been highly effective since its inception. In fact, LUSD pools on Optimism have seen a great increase thanks to basic pools and market conditions.

If this new strategy proves efficient, we will update our treasury management policy accordingly.

Internal Compliance

Finally, we’ve also defined some internal goals for the next quarter to improve the Collective’s legal processes and ensure continued compliance.

Parting Words

Despite a slight setback in revenue growth, the Collective is more resilient and better apt than ever to deliver on its missions: supporting the development of genuine DeFi protocols and promoting the value of genuine DeFi across the broader ecosystem.

The upcoming quarter will be crucial to strengthening the Collective’s position further so that it can be apt to face a sizable challenge in the following one, with the launch of Liquity v2 in November: the whole colony will be ready and operational to ensure this significant launch gets the attention, liquidity, and mindshare it deserves.

Ants are preparing for BOLD, what about you anon?