The DeFi Collective - September 2024 Report

Luude

Luude- October 8, 2024

Welcome to the Collectives’ September impact and treasury report. After August’s stellar performance, September revenues trended back towards the baseline of recent months with the spike of L1 revenues, driven by KEROSENE’s performance reversing however, L2 revenues picked back up to be on par with previous months.

As always, for more information on the Collective activities, where the revenues come from, and the accounting logic, please refer to the Reporting Policy.

So, without further ado, let’s dive in and see what the ants achieved in September.

Treasury Report

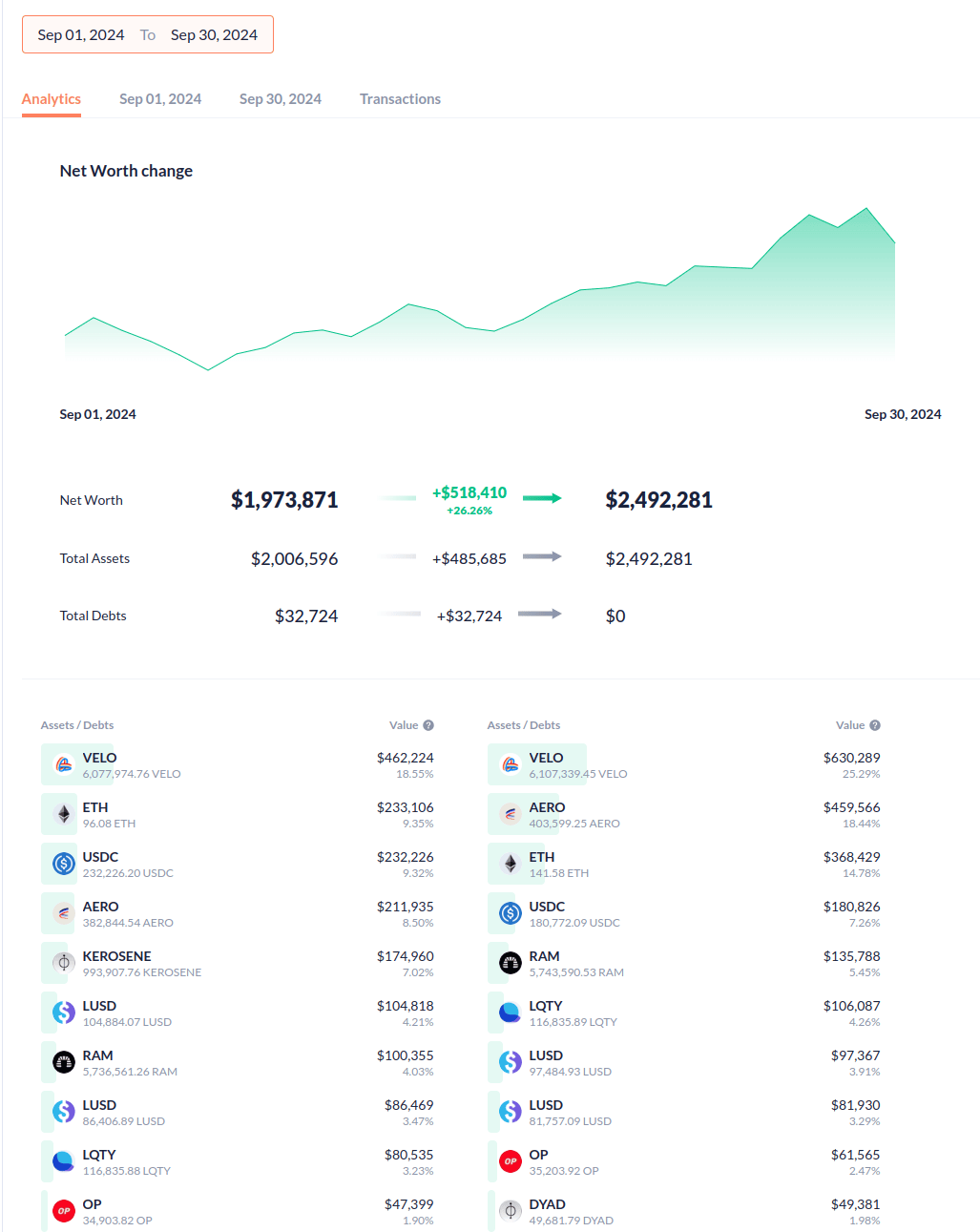

The face value of assets controlled by the Collective (excluding grants) increased by 26.26% in September, rising from $1,973,871 on September 1 to $2,492,281 by September 30. This increase was primarily due to the increase in the Collective’s main liquidity-driving positions veVELO and veAERO. Along with this, the Collective also managed to add 45 ETH to its treasury balance, primarily due to the rebalancing of other positions. With an ever-increasing balance of stablecoins, ETH, and liquidity-driving positions, the Collective is building firepower for future initiatives that can survive all market types.

Expenses Report

Expenses saw another increase in September however this increase is due to an important addition to the colony with Sagaciousyves coming on board as an official contributor whose important role will be outlined in further detail below. Beyond an increase in contributor’s expenses, all other expenses were relatively steady compared to previous months.

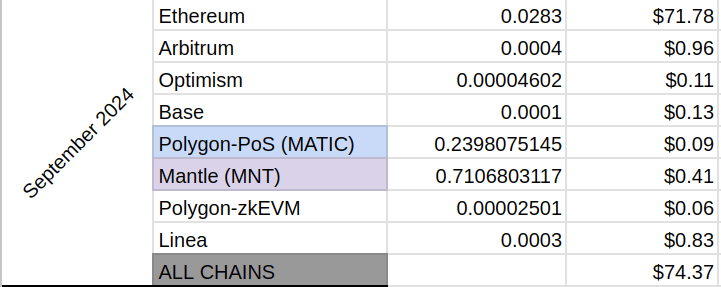

Gas expenses fell almost -50% compared to August due to a decrease in mainnet activity. As shown in the image below, Ethereum has scaled, and mainnet gas expenses account for virtually all of the Collectives gas costs resulting in mainnet activity dictating the gas expenses per month.

Revenues Report

Revenues are down -48.07% compared to August, finishing the month at $40,815.63. Although a -48% decrease in revenues is never ideal, this large month-over-month decline is also impacted by the spike in August revenues. When compared back to previous months during 2024, revenues have fallen back towards baseline levels. The good news is that the treasury management team anticipated that August’s revenues may not continue and used them to bolster strategic assets which will be used in the upcoming months to support mission-critical protocols. While we wait for these mission-critical initiatives to begin, mainnet revenues are expected to remain low as a large amount of treasury assets are lent on immutable money markets earning compounded APYs, which will have their revenues added to a future months’ treasury report.

Impact Report

Mainnet

Although September’s mainnet revenues were down in comparison to August, the impact was still maintained. Support for DYAD/USDC continues, with the ants providing liquidity over a wide range to ensure that there is available liquidity for DYAD as it experiences some peg volatility.

In addition to this, September saw one of the treasury team’s yearly targets met, with over 100 ETH accumulated throughout the year. This fantastic achievement puts the Collective in a great position to support Liquity v2 on launch and begin to plan out our BOLD support strategies.

Looking forward, the strategy will remain constant, with support for DYAD remaining and ETH accumulation ongoing.

Arbitrum

September consisted of a small shuffle in strategy on Arbitrum with USDC/LUSD and PSM/LUSD liquidity being removed, which will be better utilised elsewhere. Support for Possum continued, with the ants PSM being staked to Possum Core.

On Ramses, the ants continue to direct a portion of our voting power towards blue chip assets, with the primary goal of revenue generation, which is used elsewhere to support aligned protocols.

Optimism

Treasury activities on Optimism remained steady in September, with ongoing liquidity support for HAI/LUSD, USDC/LUSD, and POOL/ETH pairs. The ants have continued to leverage their substantial veVELO position to provide voting support for various other mission-critical pools.

The treasury management team plans to consolidate operations on Velodrome, with support concentrating on a select few pools to grow liquidity and prepare for upcoming strategies.

Base

Operations remain steady on Base, with vote and bribe support continuing for LUSD/USDC and LUSD/POOL pools.

As always, operation lock-AERO continues, with the collectives position growing another 8.00% during September. This has proven to be a wise strategy so far and it is expected to continue indefinitely.

Polygon-PoS

Activity on Retro has ground to a halt, the treasury management team continues to vote for blue chip pools, however, this hasn’t been yielding any results over recent weeks.

We will update you if there is a Retro revival in future reports.

Mantle

September saw the ants remove the remaining LUSD/USDC liquidity from Mantle, with this to be used more effectively elsewhere. Voting support will continue for bluechip assets with the revenues used to support operations elsewhere.

Linea

Similarly to Mantle, the remaining LUSD/USDC liquidity was removed from Linea with a vote-only strategy undertaken on bluechip assets.

Parting Words

Although revenues were down in September, the treasury management team is happy with how things are looking as we progress into the later months of 2024. With the ETH target milestone reached before BOLD launching, we are strategically setting ourselves up to provide an outsized impact from day 1, with some exciting initiatives in the works.

Elsewhere in the colony, as briefly mentioned above, the Collective onboarded its latest contributor, Sagaciousyves who will be focusing their attention on protocol decentralisation reviews. These protocol reviews are an extremely important aspect of the Collectives’ mission and will give DeFi users an overview of how to accurately assess protocols in terms of resilience, decentralisation, and importance. There are some exciting things cooking in this space and we cant wait to share them with you all.

October will mark the 1st anniversary of the Collective and what a year it has been! Stay tuned for some special commemorative events and the release of the yearly report, along with the release of the much anticipated first protocol review.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.