The DeFi Collective - September 2025 Report

Luude

Luude- October 13, 2025

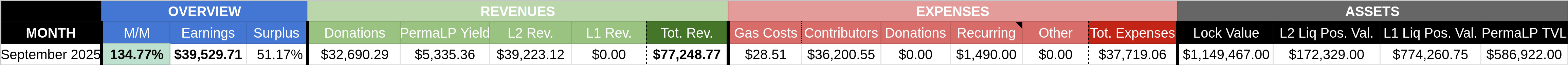

September delivered a significant step forward for the Collective, closing the month well in surplus at $39,529.81 (134.77% above break-even). The result was driven primarily by the second of three Ethereum Foundation donations, a 5.71 ETH ($24,656.29) grant payment for DeFi Scan. Even excluding that contribution, the Collective would have still achieved a surplus month, thanks to a threefold increase in L2 revenues and steady Perma LP performance.

While BOLD PIL donations continued their gradual decline to $8,034.00, the Collective’s broader revenue mix more than compensated. No major positioning changes were made on liquid assets, and the treasury remains strongly diversified and stable as we move closer toward long-term sustainability.

For a full breakdown of revenue streams, accounting methodology, and Collective activities, please refer to the Reporting Policy.

Treasury Report

The treasury closed September at $2,815,639 (-5.4% MoM, down from $2,972,667 in August). Modest drawdowns in the Collective’s major liquidity-driving positions, veAERO, veVELO, xREX, and veRAM, were the main contributors to this small decrease.

By month-end, 40.82% of the treasury was locked, 6.12% was deployed in L2 liquidity positions, 27.50% in L1 liquidity positions, and 20.85% in Perma LPs, with the remaining 4.71% held in liquid operational balances. Despite a slight decline in overall value, the portfolio remains well-positioned, generating consistent income while limiting volatility.

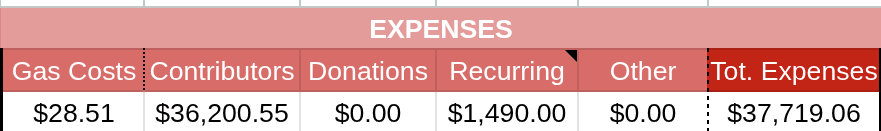

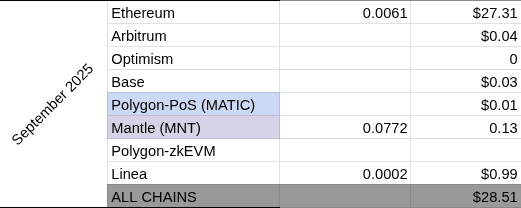

Expenses Report

Total expenses for September came in at $37,719.06 (+8.7% MoM), largely due to a minor uptick in contributor compensation to $36,200.55. All other categories remained at baseline levels.

Expenses are expected to remain within this stable range, with no major increases anticipated heading into Q4.

Earnings Report

September marked a milestone for the Collective with total revenues of $77,248.77 (+134.8% MoM), driving a net surplus of $39,529.81 — the first sustained surplus of 2025.

Donations were the largest contributor, totaling $13,269.29, driven by the Ethereum Foundation grant alongside reduced but steady BOLD PIL inflows. L2 revenues rose sharply to $39,223.12, tripling August’s figure as the treasury team capitalized on Aerodrome’s community launch activity, which increased veARO voting APR significantly throughout the month.

Perma LP harvests added $5,335.36, around 50% lower than August, as last month’s figure included July’s delayed harvest.

With this combination of one-off grant income and increased L2 activity, the Collective has firmly crossed into positive territory while remaining well-capitalized, with stablecoin reserves providing more than four years of operational runway.

Impact Report

Mainnet

Mainnet activity remained minimal, limited to bridging BOLD PIL rewards to Optimism and Base. No other treasury actions were taken.

Arbitrum

Operations remained steady, with activity focused on governance voting in supported Ramses pools. Ongoing support continues for WETH/POOL and PSM/ETH, with no strategy changes.

Optimism

Activity mirrored August, maintaining support for BOLD/USDC, BOLD/LUSD, and POOL/WETH pools. No new strategies were deployed.

Base

Base operations continued as expected, with the treasury team tactically adjusting exposure to veAERO pools to capture higher September activity. Vote and bribe support continues for pairs including BOLD/POOL, BOLD/LUSD, BOLD/BOTTO, and BOLD/USDC.

Linea

Etherex continues to perform exceptionally well, with blue-chip pool voting yields remaining robust. The platform has become a consistent L2 income driver with no signs of slowing down.

Perma LPs

The Collective’s Perma LP strategy continued to deliver stable yields through September. Supported pools include POOL/WETH and BOLD/LUSD on Velodrome, BOLD/POOL and BOLD/BOTTO on Aerodrome, and WETH/POOL and PSM/WETH on Ramses.

A harvest of $5,335.36 was completed, representing a ~50% decline from August (which included July’s delayed yield). The Collective will maintain its standard monthly harvest cadence, compounding a portion of earnings to grow long-term positions while reserving the rest for operational expenses.

Parting Words

The market remained choppy through September, but the Collective’s cautious treasury structure continues to protect the ants from volatility. The treasury is designed to provide long-term sustainable support for our partners, and this month’s results prove the value of patience and a carefully crafted treasury strategy.

After months hovering near break-even, the Collective has finally achieved a true treasury surplus. The goal now shifts from reaching it to maintaining it — ensuring we can continue supporting new partners, scaling DeFi Scan, and expanding our footprint across DeFi.

We’re thrilled to finally be operating in the green. The ants are moving in the right direction.

— Luude, on behalf of the treasury and liquidity management team of the DeFi Collective: TokenBrice and myself.

![The DeFi Collective - 3rd Quarter Summary [Q2 2024]](/images/articles/tdc-q3-summary.png)